[ad_1]

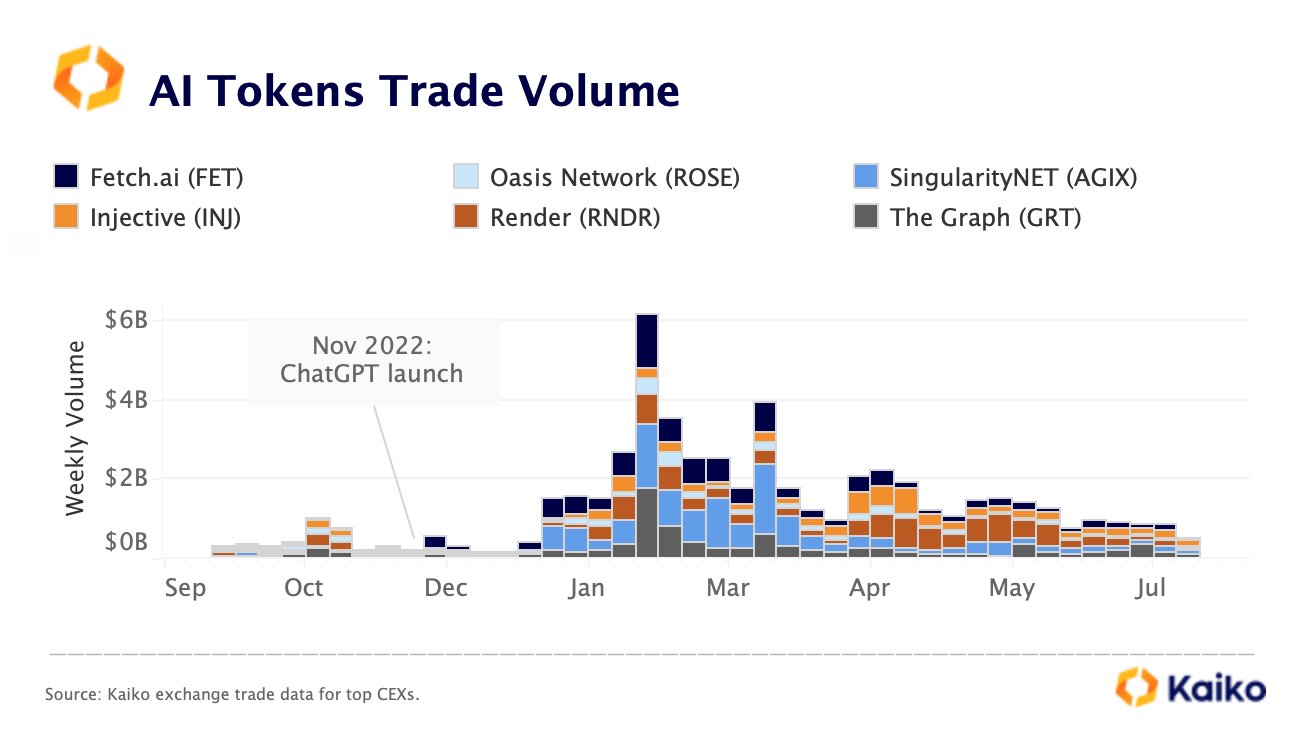

A market information agency says that synthetic intelligence (AI)-focused crypto initiatives are experiencing a decline in buying and selling quantity after buzzing earlier this 12 months.

In line with crypto intelligence agency Kaiko, AI-related tokens resembling Oasis Community (ROSE), Render (RNDR), and The Graph (GRT), have not too long ago lost their momentum.

“AI-related tokens have been shedding momentum, hitting lowest weekly commerce quantity since January.”

In January, rumors have been swirling that tech large Microsoft can be investing a staggering $10 billion into Open AI, a US-based AI analysis laboratory that created ChatGPT, a viral AI chatbot.

On the time, AI-focused crypto initiatives, together with SingularityNET (AGIX), Fetch.ai (FET), and Ocean Protocol (OCEAN), vastly benefited from the excitement surrounding the rumor, rising 136%, 91%, and 37%, respectively.

In line with Riyad Carey, a analysis analyst at Kaiko, Worldcoin (WLD), a crypto venture co-founded by OpenAI founder Sam Altman, had a “distinctive” launch earlier this week that’s convincing individuals to make use of its eye-scanning know-how.

“Worldcoin’s WLD launch is likely one of the extra distinctive I can keep in mind: Almost 90% of circulating provide was loaned to market makers. Only one% of complete provide was launched. Itemizing was (as anticipated) very environment friendly, although there was some suspected wash buying and selling…

The launch means that the workforce felt it needed to assign an interesting greenback worth to their token. Convincing individuals to scan their eyes for 25 models of a token that doesn’t but exist will be difficult; if the token’s value is, say, $0.10, it’s much more difficult.

The 25 WLD tokens are at present value just a little greater than $50 and can seemingly keep in that vary for the following three months. To date, this appears to be engaging individuals to enroll and scan.”

Worldcoin is at present underneath investigation in each the UK and France over privateness considerations.

Kaiko then shifts its focus to XRP, the digital asset used to function Ripple Labs’ funds system, which not too long ago had a landmark ruling in its favor towards the U.S. Securities and Alternate Fee (SEC).

In line with the info gathering platform, the token’s futures volume-to-open curiosity ratio signals sustained speculative curiosity for the digital asset.

“XRP perpetual futures volume-to-open curiosity ratio stays above common on most exchanges, signaling sustained speculative curiosity.”

Transferring on to the highest two crypto belongings by market cap, Bitcoin (BTC), and Ethereum (ETH), Kaiko finds that they’ve seen an enormous decline in volatility over the past three months.

“Each BTC and ETH have seen a decline in 90-day realized volatility this 12 months. At present, their volatility ranges are hovering round two-year lows.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Price Action

Observe us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal danger, and any loses it’s possible you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney

[ad_2]

Source link