[ad_1]

I simply returned from an invigorating week in scorching and humid Miami, Florida, the place I used to be privileged to current on the Mining Disrupt convention. This annual occasion attracts the who’s who of the digital asset mining trade, together with high gamers, enthusiastic traders and Bitcoin advocates alike.

In my capability as Government Chairman of HIVE Digital Applied sciences, I used to be excited to make clear our firm’s involvement within the nice digital transformation and enlargement into the realm of synthetic intelligence (AI) and Web3 functions. You’ll be able to examine HIVE’s plans here.

Undeterred Optimism Amid the Ongoing Bitcoin Bear Market

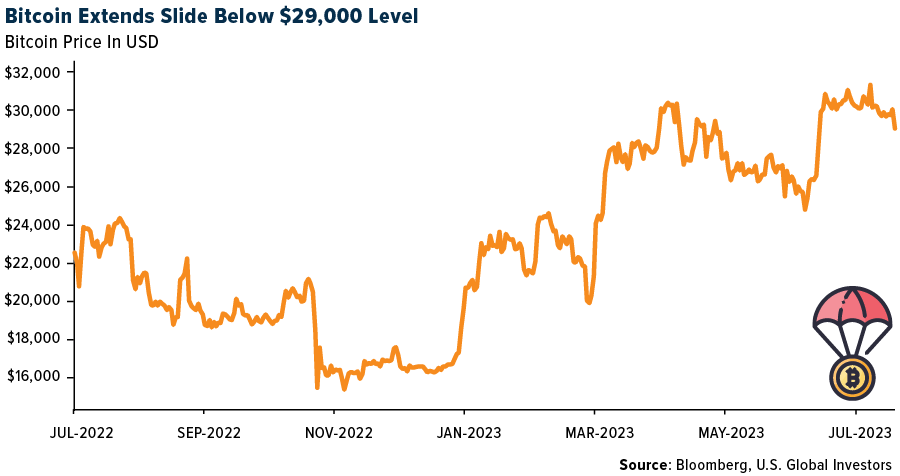

My fellow presenters and attendees have been all extremely bullish on Bitcoin, regardless of the continued bear market that has seen the digital asset retreat from its all-time excessive of practically $69,000 in November 2021.

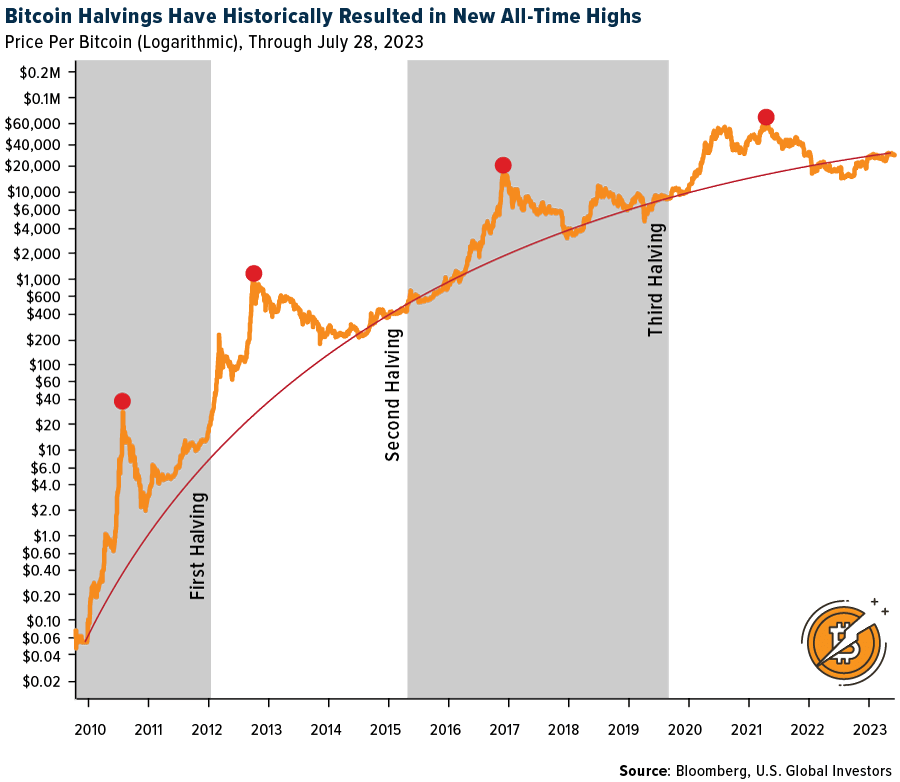

The convention coincided with Bitcoin crossing a major milestone: the profitable mining of the 800,000th block. This landmark occasion teases the upcoming fourth Bitcoin halving occasion, projected to occur when block 840,000 is mined in less than nine months from now. The halving course of, which happens roughly each 4 years, cuts the rewards for Bitcoin miners in half, thereby limiting new provide and creating shortage.

Traditionally, each new cycle has resulted in a recent file excessive worth for Bitcoin. This phenomenon is attributed to the belief amongst traders that the asset’s provide is capped at 21 million cash, an element that might spur the value to go to new highs.

Bitcoin in Want of Regulatory Readability

Many presenters and panelists on the convention centered their message on the necessity for regulatory readability within the mining area. Among the many most esteemed audio system was Dennis Porter, co-founder and CEO of the Satoshi Action Fund, whose mission is to teach legislators and policymakers throughout the U.S. on Bitcoin’s different advantages.

Throughout his presentation, Dennis drew fascinating parallels between Bitcoin and the hashish trade, each of which have needed to foyer for state-level acceptance and laws, whilst they proceed to face federal-level restrictions. He touted his group’s success in getting Montana and Arkansas to go the Right to Mine law, which protects Bitcoin miners and prohibits power producers from imposing discriminatory charges on them. The Fund was additionally instrumental in shifting the Texas legislature to kill a proposed anti-mining invoice.

Democratic presidential candidate Robert F. Kennedy Jr. additionally participated at Mining Disrupt by way of Zoom, representing considered one of 4 present candidates who expressly assist Bitcoin-friendly insurance policies, the others being entrepreneur Vivek Ramaswamy, Florida governor Ron DeSantis and Miami mayor Francis Suarez, who opts to take his mayoral wage in Bitcoin.

Kennedy, who lately disclosed buying two bitcoins for every of his seven kids, reaffirmed his intention to again the U.S. greenback with Bitcoin and exempt the asset from capital beneficial properties taxes if elected president, saying that such exemptions ought to primarily profit small traders and companies.

A Legislative Milestone for Digital Property?

In the meantime, in Washington, a bipartisan invoice that goals to offer a regulatory framework for cryptocurrencies was advanced by a key congressional committee this week. This laws, endorsed by the Home Monetary Providers Committee, was in response to final 12 months’s sudden collapses of a number of crypto companies, together with Celsius and Voyager. It defines a cryptocurrency’s standing as both a safety or a commodity, expands the Commodity Futures Buying and selling Fee’s (CFTC) oversight of the trade and clarifies the Securities and Alternate Fee’s (SEC) jurisdiction.

Regardless of some opposition, the invoice acquired assist from committee Republicans and a few Democrats, marking a significant legislative second for the digital asset sector.

Make no mistake, the invoice has been met with opposition, primarily from Rep. Maxine Waters, the main Democrat on the Monetary Providers Committee, who believes the invoice would trigger confusion and cut back protections for shoppers and traders. Comparable considerations have been raised within the Democratic-led Senate.

Nevertheless, many within the crypto trade stay optimistic, asserting that with bipartisan assist, the invoice might stand an opportunity within the Senate. The talk continues over whether or not these property ought to be handled as securities or commodities, highlighting the necessity for regulatory readability on this evolving sector.

Spot Bitcoin ETFs and Their Potential Approval

I additionally wish to spotlight the potential of a spot Bitcoin ETF being authorised within the U.S. On the Mining Disrupt convention, there was guarded optimism that this may increasingly occur quickly, following repeated rejections up to now. I imagine a spot ETF could be a major catalyst for Bitcoin, probably streamlining entry for each institutional and retail traders and driving up demand and worth.

Functions for such an ETF from a number of companies, together with BlackRock, Constancy, Invesco, VanEck and WisdomTree, have been printed within the Federal Register, shifting them one step additional within the SEC’s approval course of. The official journal of the U.S. authorities now has a window to simply accept, reject, lengthen or open these functions for public feedback.

With the Bitcoin community inching nearer to the following halving occasion and the simultaneous evolution of the ecosystem and regulatory panorama, the world is conserving a watchful eye on the digital asset’s progress. Right here’s to the fascinating journey forward!

Index Abstract

- The main market indices completed up/down/combined/flat this week. The Dow Jones Industrial Common gained/misplaced x%. The S&P 500 Inventory Index rose/fell x%, whereas the Nasdaq Composite climbed/fell x%. The Russell 2000 small capitalization index gained/misplaced x% this week.

- The Cling Seng Composite gained/misplaced x% this week; whereas Taiwan was up/down x% and the KOSPI rose/fell x%.

- The ten-year Treasury bond yield rose/fell x foundation factors to x%.

Airways and Delivery

Strengths

- The very best performing airline inventory for the week was xxxx, up xx.x%. For the week, TSA throughput was up 13% year-over-year on capability up 10% year-over-year. July load components are one share level greater year-over-year versus two share factors in June. Airline internet visitors elevated 12% year-over-year for the week ending July 17.

- Financial institution of America’s tracker of the newest high-frequency freight indicators exhibits that ocean spot charges improved in July, particularly the Transpacific, pushed by a profitable July 15 worth improve. Container spot charges are up 5% month-over-month, placing them 22% above January 2019 ranges.

- Ryanair’s first quarter 2024 revenue after tax is €663mn, 7% forward of consensus. The beat relative to consensus was primarily pushed by greater common fares within the quarter, up 42% year-over-year. The web money place reached near €1bn.

Weaknesses

- The worst performing airline inventory for the week was xxxx, down xx.x%. Home leisure fares have been trending down over the previous few months, though different airways have been much less involved about that development. Airways with a bigger part of long-haul worldwide visitors proceed to see sturdy demand, however there have been warning indicators of pricing declines. ARC Corp., for instance, reported home fares declined 6.5% within the June quarter, with every month successively decrease. This information solely displays company gross sales and misses internet gross sales, however the development is essential as a result of it’s prone to proceed by at the least mid-fourth quarter 2023.

- Product tanker charges have declined materially on a time-charter-equivalent (TCE) foundation to $31,000/$26,000 per day for LR2/MR vessels from $53,000/$37,000 per day at Scorpio Tanker’s 2QTD Replace. The decrease charges are pushed by weaker Asia petrochemical feedstock demand, a protracted upkeep cycle, and a slower ramp in China.

- On July 24, Volaris reported second quarter 2023 outcomes, with adjusted EBITDAR of $212 million, for an EBITDAR margin of 27% and EBITDA of 172 million. In the meantime, EBIT got here in at 51 million, 30% beneath Bloomberg consensus on lower-than-expected unit revenues. The corporate reported unit income (TRASM) at -4% year-over-year, principally according to historic seasonality. Unit prices (CASM) fell by 13% year-over-year, primarily pushed by CASM gasoline, with CASM ex-fuel coming in up 14% year-over-year.

Alternatives

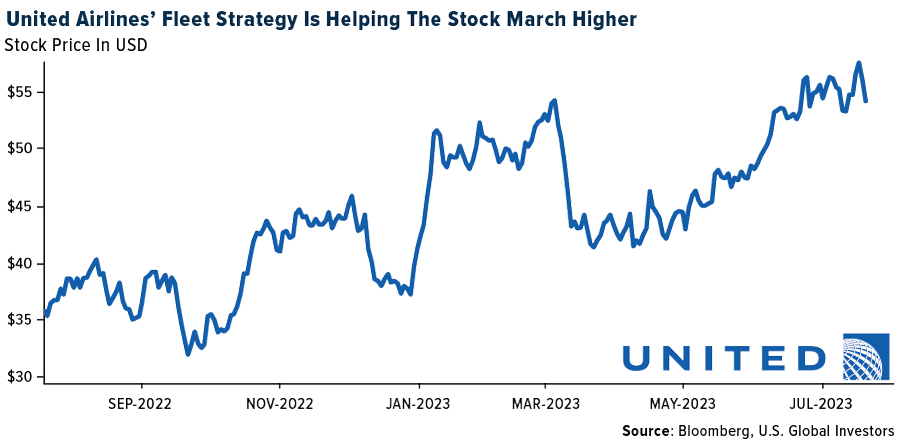

- United Airways famous a big a part of its technique revolves across the bigger single aisle narrowbody MAX 10 and A321 plane, which aren’t included within the service’s fleet at this time. Since 2019, United has elevated gauge by 20%, which is “greater than every other U.S. airline and eight factors greater than the trade,” and administration expects growing gauge going ahead will assist drive prices down sooner or later. Along with “superior economics,” these new plane are anticipated to serve the rise in premium leisure demand. All in, United has a big order e-book for narrowbodies, which is able to both enable for progress or retirement, relying on trade circumstances, and administration feels greatest positioned going ahead as the most important worldwide community amongst U.S. carriers.

- Based on ISI, tanker EPS and dividend estimates stay sturdy, with 75% of its protection universe offering yields of at the least 7.5% for the following 12 months. But, ISI’s total protection trades at a reduction to NAV, with some valuations matching these from occasions or extended losses and liquidity threat. Earnings season ought to once more present large beneficial properties and dividends and remind traders of the sturdy multi-year set-up, and winter will once more be on the horizon, notably for a continent that has misplaced its largest fossil gasoline provider.

- The Worldwide Air Transport Affiliation (IATA) is projecting APAC to witness the best pickup in exercise throughout summer time journey season because the area is the final one to re-open (versus North America and Europe). Particularly, ahead bookings tracked by IATA point out the area will witness the best progress throughout Might-September 2023.

Threats

- American Airways introduced a brand new pilot contract that matches the lately introduced United Airways settlement in precept. American’s newly introduced contract raised its supply for pilots by greater than $1 billion, growing the four-year contract worth to $9 billion, and can “match United pay charges, backpay and different advantages similar to sick time and life insurance coverage,” AAL’s CEO Robert Isom acknowledged to pilots. Administration made clear through the second quarter convention name that they’re dedicated to match United’s wages and that they may return to the negotiating desk if adjustments aren’t authorised on a well timed foundation.

- Based on ISI, the group’s preliminary view is that the general labor price inflation from the latest UPS Teamsters deal would approximate high-single-digit impression of prices (7-8%) in 12 months one and a mid-single-digit improve (4-5%) within the final 4 years of the contract. ISI had been factoring in nearer to 4% for 12 months one and three% going ahead, thus there may be the potential for price per package deal inflation to exceed the estimates by a number of hundred foundation factors by ISI’s forecast horizon.

- Alaska reported a June-quarter beat however guided to a lower-than-expected September quarter unit income (“RASM”) and margin outlook. The more severe-than-expected September quarter RASM information implies a steeper deceleration than what is anticipated by its legacy friends which have publicity to stronger worldwide markets, exacerbating investor considerations on home pricing that’s coming off peak ranges skilled in 2022.

Luxurious Items and Worldwide Markets

Power and Pure Assets

Strengths

- The very best performing commodity for the week was nickel, rising 4.XX%, maybe on information that the European Union is including Russian nickel to its import ban this 12 months. Fertilizer equities have been up once more this previous week, supported by a mixture of upper crop costs, upticks in nitrogen/phosphate, and stronger international power costs. Nitrogen and phosphate markets continued to strengthen this previous week, particularly in Western markets: Brazil resulting from seasonal energy and the U.S. resulting from ongoing tightness exiting the spring season.

- Electra Battery Supplies Company stated its battery grade cobalt provide settlement with LG Power Resolution, a world producer of lithium-ion

batteries, has been prolonged and expanded from phrases initially

introduced in September 2022. Electra will now provide LG Power Resolution with

19,000 tons of battery grade cobalt over a five-year interval from 2025. The

materials can be equipped from the one cobalt sulfate refinery in North

America, in Ontario. - World metal output rose 2.1% month-over-month, principally pushed by Chinese language manufacturing, up 4.5% month-over-month. Ex-China output was down 1% month-over-month. Turkey rose one other 5% month-over-month, persevering with the post-earthquake restoration however Ukraine fell 23% month-over-month after the January-Might enchancment. World utilization elevated to 76.5% in June.

Weaknesses

- The worst performing commodity for the week was lumber, dropping 5.XX%, on information that U.S. housing begins corrected sharply in June from a powerful print in Might. World copper inventories stay low, however they’ve been rising in latest weeks and at the moment are up 11% from this 12 months’s trough, led by rising shares in China. Bonded stock continues to fall, however onshore shares have been rising. China has been producing file volumes of refined copper this 12 months, with very sturdy copper focus imports.

- S&P World Platts believes additional upside for ethane worth is unlikely and that costs ought to reasonable again to a mean of $0.25 per gallon within the second half of the 12 months. Ethylene stream cracker feedstock demand stays restricted given prevailing weak petrochemical margins, with Ineos’ unplanned Chocolate Bayou, TX cracker outage in mid-July additional lowering demand. Moreover, ethane export demand for June was down greater than 20% from Might. With the present infrastructure points within the means of being resolved, the spike in ethane costs is anticipated to be non permanent.

- Based on UBS, copper demand in 2022 and the primary half of 2023 has been lackluster however secure with power transition demand offsetting weak point from the slowdown in development/combined home consumption in China and weak point in Europe/U.S. development/manufacturing. UBS stays involved about additional weak point in demand in Europe within the second half of 2023 however expects a bottoming out in conventional demand drivers in Europe/U.S. in 2024.

Alternatives

- Lithium ought to be tight by the tip of the last decade. The swoon (and restoration) in costs year-to-date has doubtless given the market pause and volatility continues to hamper capital formation. Whereas the demand facet continues to tick together with regional and seasonal volatility (notably from Asia) it’s the provide facet that is still comparatively opaque.

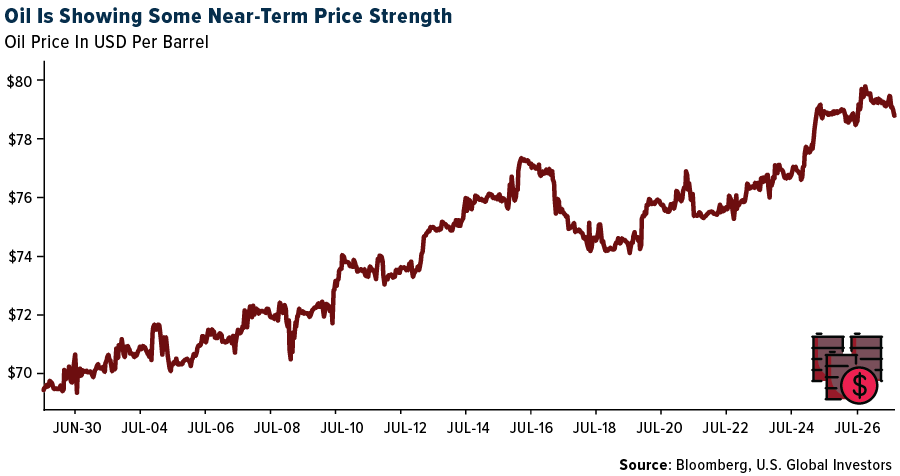

- Oil rose to $82.93 per barrel this week. The oil worth restoration accelerated, supported by information of upcoming Chinese language stimulus. The Chinese language politburo met yesterday and signaled plans to regulate property insurance policies and enhance home demand. This greater than offset weaker PMIs than anticipated in each the U.S. and Europe.

- U.S. uncooked metal mill functionality utilization rose within the week, the American Iron and Metal Institute reported. Uncooked metal manufacturing was at 76.6%, up from 75.5% the earlier week. Manufacturing through the week totaled 1.741 million tons, up 1.5% from the week ended July 15 when manufacturing was 1.716 million tons. Manufacturing elevated 1.2% from the corresponding week a 12 months in the past, when functionality utilization was at 78.1% and manufacturing totaled 1.721 million tons.

Threats

- JPMorgan has a number of indicators in its dashboard suggesting warning; cathode premiums are low (spot demand not as sturdy because it was), the copper/aluminum ratio is again to its excessive of 4x (substitution threat), costs are properly above marginal price, Chinese language copper imports are flat year-over-year, and international manufacturing to April has risen a stable 4.5%.

- On the subject of Belarus attempting to construct a brand new port in Russia for potash, the important thing takeaway is that it seems to be like no progress has been made in 18 months as BPC discovered current Russian port operations. Nevertheless, BPC exports out of Russia have been flat at round 650-700,000 tons monthly for months and Russian exports from Uralkali/EuroChem stepped down in June.

- Metal imported from Mexico to the U.S. has elevated materially up to now two years relative to pre-pandemic ranges — up 43% in 2022 relative to 2018 and 92% relative to 2015. Actually, whereas previous to 2018, Mexico had a damaging metal commerce steadiness with the U.S., since 2018, it has develop into a web exporter of metal in commerce with its northern neighbor. Amongst market contributors, this has raised considerations that the U.S. may impose tariffs on imports of metal from Mexico.

Bitcoin and Digital Property

Strengths

- Of the cryptocurrencies tracked by CoinMarketCap, the very best performer for the week was XDC Community, rising 42.23%.

- Binance will roll out full companies on its new platform for Japan in August. The agency purchased Sakura Alternate Bitcoin final November and stated this Might that it was making a platform to totally adjust to native guidelines, in accordance with Bloomberg.

- 8000 Stan Lee digital collectibles offered out “practically instantaneously” on Monday, illustrating sturdy demand for some digital property nonetheless exist regardless of the gradual restoration of the NFT market, writes Bloomberg.

Weaknesses

- Of the cryptocurrencies tracked by CoinMarketCap, the worst performer for the week was Gala, down 14.30%.

- Crypto miner shares dropped this week as Bitcoin slid beneath $29,000. Shares like Cipher Mining, Stronghold Digital, Hut 8, and Marathon fell alongside Bitcoin, in accordance with Bloomberg.

- One of the head-scratching phenomena enjoying out within the digital-asset world is the shrinking of the secure coin market whereas most cryptocurrencies are posting outsized beneficial properties this 12 months, in accordance with Bloomberg.

Alternatives

- Worldcoin, the token of the crypto venture co-founded by OpenAI CEO Sam Altman, rallied on its first day of buying and selling on Monday as traders piled into the hype surrounding synthetic intelligence, writes Bloomberg.

- TD Cowen has initiated protection and rated MicroStrategy “outperform” because the group cites each Bitcoin publicity and upside on enterprise intelligence software program. The inventory has rallied about 209% this 12 months by Tuesday’s shut, writes Bloomberg.

- Digital Foreign money Group is nearing a deal to promote its media firm CoinDesk to an investor group. The group is led by the founding father of Tilly Capital and Enterprise capital agency Capital6, in accordance with an article printed by Bloomberg.

Threats

- FTX co-founder Sam Bankman-Fried was summoned to federal courtroom within the Southern District of New York this Wednesday, in accordance with a courtroom submitting. Bankman-Fried was summoned to deal with the adequacy and continuation of present bail circumstances, writes Bloomberg.

- Sequoia Capital pared again the scale of two main enterprise funds, together with its cryptocurrency fund, as a part of a dramatic downsizing the storied enterprise agency is endeavor amid a broad startup downturn, writes Bloomberg.

- Binance has withdrawn its utility for a license from German monetary regulator BaFin. The transfer follows a retrenchment from markets together with Austria, Belgium, and the Netherlands and as its U.S arm is sued by regulators for working an unregistered alternate, writes Bloomberg.

Gold Market

U.S. World Traders, Inc. is an funding adviser registered with the Securities and Alternate Fee (“SEC”). This doesn’t imply that we’re sponsored, beneficial, or authorised by the SEC, or that our talents or {qualifications} the least bit have been handed upon by the SEC or any officer of the SEC.

This commentary shouldn’t be thought of a solicitation or providing of any funding product. Sure supplies on this commentary could include dated data. The data supplied was present on the time of publication. Some hyperlinks above could also be directed to third-party web sites. U.S. World Traders doesn’t endorse all data equipped by these web sites and isn’t accountable for their content material. All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions will not be applicable to each investor.

Holdings could change each day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article have been held by a number of accounts managed by U.S. World Traders as of (06/30/2023):

American Airways

United Airways

Alaska Air

Tesla

Kering

Volkswagen

BMW

Mercedes

Louis Vuitton

Remy Cointreau SA

BMW Group

Apple

Electra Battery Supplies

K92 Mining

Agnico Eagle

*The above-mentioned indices aren’t complete returns. These returns mirror easy appreciation solely and don’t mirror dividend reinvestment.

The Dow Jones Industrial Common is a price-weighted common of 30 blue chip shares which might be usually leaders of their trade. The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 frequent inventory costs in U.S. corporations. The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq Nationwide Market and SmallCap shares. The Russell 2000 Index® is a U.S. fairness index measuring the efficiency of the two,000 smallest corporations within the Russell 3000®, a well known small-cap index.

The Cling Seng Composite Index is a market capitalization-weighted index that contains the highest 200 corporations listed on Inventory Alternate of Hong Kong, primarily based on common market cap for the 12 months. The Taiwan Inventory Alternate Index is a capitalization-weighted index of all listed frequent shares traded on the Taiwan Inventory Alternate. The Korea Inventory Worth Index is a capitalization-weighted index of all frequent shares and most well-liked shares on the Korean Inventory Exchanges.

The Philadelphia Inventory Alternate Gold and Silver Index (XAU) is a capitalization-weighted index that features the main corporations concerned within the mining of gold and silver. The U.S. Commerce Weighted Greenback Index offers a common indication of the worldwide worth of the U.S. greenback. The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose fairness weights are capped 25 % and index constituents are derived from a subset inventory pool of S&P/TSX Composite Index shares. The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded corporations concerned primarily within the mining for gold and silver. The S&P/TSX Enterprise Composite Index is a broad market indicator for the Canadian enterprise capital market. The index is market capitalization weighted and, at its inception, included 531 corporations. A quarterly revision course of is used to take away corporations that comprise lower than 0.05% of the load of the index, and add corporations whose weight, when included, can be higher than 0.05% of the index.

The S&P 500 Power Index is a capitalization-weighted index that tracks the businesses within the power sector as a subset of the S&P 500. The S&P 500 Supplies Index is a capitalization-weighted index that tracks the businesses within the materials sector as a subset of the S&P 500. The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base stage of 10 for the 1941-43 base interval. The S&P 500 Industrials Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the industrial sector as a subset of the S&P 500. The S&P 500 Client Discretionary Index is a capitalization-weighted index that tracks the businesses within the shopper discretionary sector as a subset of the S&P 500. The S&P 500 Info Expertise Index is a capitalization-weighted index that tracks the businesses within the data expertise sector as a subset of the S&P 500. The S&P 500 Client Staples Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the shopper staples sector as a subset of the S&P 500. The S&P 500 Utilities Index is a capitalization-weighted index that tracks the businesses within the utilities sector as a subset of the S&P 500. The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the businesses within the healthcare sector as a subset of the S&P 500. The S&P 500 Telecom Index is a Supplies Index is a capitalization-weighted index that tracks the businesses within the telecom sector as a subset of the S&P 500.

The Client Worth Index (CPI) is likely one of the most well known worth measures for monitoring the value of a market basket of products and companies bought by people. The weights of parts are primarily based on shopper spending patterns. The Buying Supervisor’s Index is an indicator of the financial well being of the manufacturing sector. The PMI index is predicated on 5 main indicators: new orders, stock ranges, manufacturing, provider deliveries and the employment setting. Gross home product (GDP) is the financial worth of all of the completed items and companies produced inside a rustic’s borders in a particular time interval, although GDP is normally calculated on an annual foundation. It contains all non-public and public consumption, authorities outlays, investments and exports much less imports that happen inside an outlined territory.

The S&P World Luxurious Index is comprised of 80 of the most important publicly traded corporations engaged within the manufacturing or distribution of luxurious items or the supply of luxurious companies that meet particular investibility necessities.

Frank Holmes has been appointed non-executive chairman of the Board of Administrators of HIVE Digital Applied sciences. Each Mr. Holmes and U.S. World Traders personal shares of HIVE. Efficient 8/31/2018, Frank Holmes serves because the interim government chairman of HIVE.

[ad_2]

Source link