[ad_1]

Crypto miner Riot Platforms has recorded a weekly achieve of just about 50%. The surge in RIOT share costs comes after Vanguard Group, one of many world’s largest asset managers, disclosed it acquired a ten.2% stake within the firm.

At press time, the buying and selling value of RIOT stays near $17.80, an annual excessive for the corporate. The latest good points have pushed its market capitalization to over $3 billion. In the meantime, Vanguard Group has considerably elevated its publicity to Bitcoin mining corporations, together with Riot competitor Marathon.

Vanguard Navigates Investments in Bitcoin Mining

Vanguard’s filings with the US Securities and Trade Fee revealed that it had expanded its funding in Riot Blockchain to 17.932 million shares. The stake is valued at over $300 million based mostly on Riot’s present share value.

Moreover, Vanguard disclosed one other submitting indicating possession of 17.5 million shares in Marathon Digital, a competitor to Riot. It has added one other $300 million to Vanguard’s stake.

Beforehand, the asset supervisor held 10.968 million shares in Marathon Digital, whereas its funding in Riot included 15.2 million shares.

By way of these investments, Vanguard now holds 10.24% of Riot and 10.31% of Marathon, based mostly on figures by Fintel. These figures replicate a considerable enhance from their earlier holdings earlier this yr, with Vanguard’s funding in Marathon rising by almost 60% and its funding in Riot growing by 18%.

The choice to extend investments in Bitcoin mining corporations showcases Vanguard’s confidence within the potential of those trade leaders, significantly in anticipation of the Bitcoin halving scheduled for April 2024.

Nevertheless, it’s value noting that Vanguard has exercised warning within the total crypto market prior to now.

In a statement launched in Might 2022, the corporate emphasised its dedication to conventional funding rules whereas acknowledging the deserves of supporting cryptocurrency expertise. It had mentioned that Vanguard’s method goals to guard purchasers’ property whereas guaranteeing a dependable funding expertise.

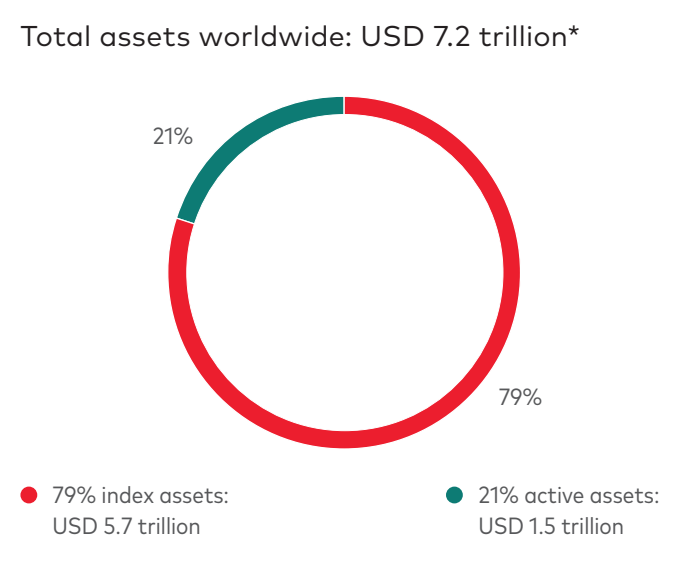

In the meantime, Vanguard’s complete property underneath administration (AUM) have skilled important development. It surpassed $7.2 trillion in 2022, an eightfold enhance since 2005.

Efficiency of Riot Bitcoin Mining Friends

Riot’s mining friends, together with Marathon Digital, HUT8, Hive, and Canaan, have confronted challenges in latest occasions. Marathon Digital reported a 21% decline in Bitcoin mined in June in comparison with Might.

HUT8 Mining Corp. disclosed that it generated 120 Bitcoin in June, leading to a mean manufacturing fee of roughly 4 Bitcoins each day. In the meantime, HIVE Blockchain Applied sciences announced that it produced 259 Bitcoins in June, averaging 8.6 BTC each day.

Cipher, one other mining large, produced round 360 BTC in June, representing a 27% lower in comparison with the earlier month. Moreover, Canaan reported a 5% decline in income for the primary quarter of 2023 in comparison with the final quarter, as per its Q1 2023 report.

All this comes along with a drop in income. Glassnode information point out a big discount in miner income derived from transaction charges. It reportedly reached a four-month low as of July 9, implying a lower in earnings.

Affect of SEC Actions

The latest actions taken by the U.S. Securities and Trade Fee (SEC) in opposition to main crypto gamers like Binance and Coinbase have adversely impacted crypto shares.

This regulatory scrutiny has now prolonged to the secondary market and miners. Bloomberg reported in Might that Marathon Digital Holdings acquired one other subpoena from the company associated to a possible violation of securities legal guidelines.

Nevertheless, regardless of these challenges, Vanguard’s elevated stake in miners signifies a optimistic outlook.

These main fund managers don’t appear overly involved about potential SEC actions.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material.

[ad_2]

Source link