[ad_1]

The Bitcoin worth has been experiencing a pointy rally since final Thursday, when BlackRock filed its utility for a Bitcoin spot ETF. Since hitting its native low of $24,819 proper alongside the Tether FUD, the BTC worth has risen by over 16% for the reason that BlackRock information broke.

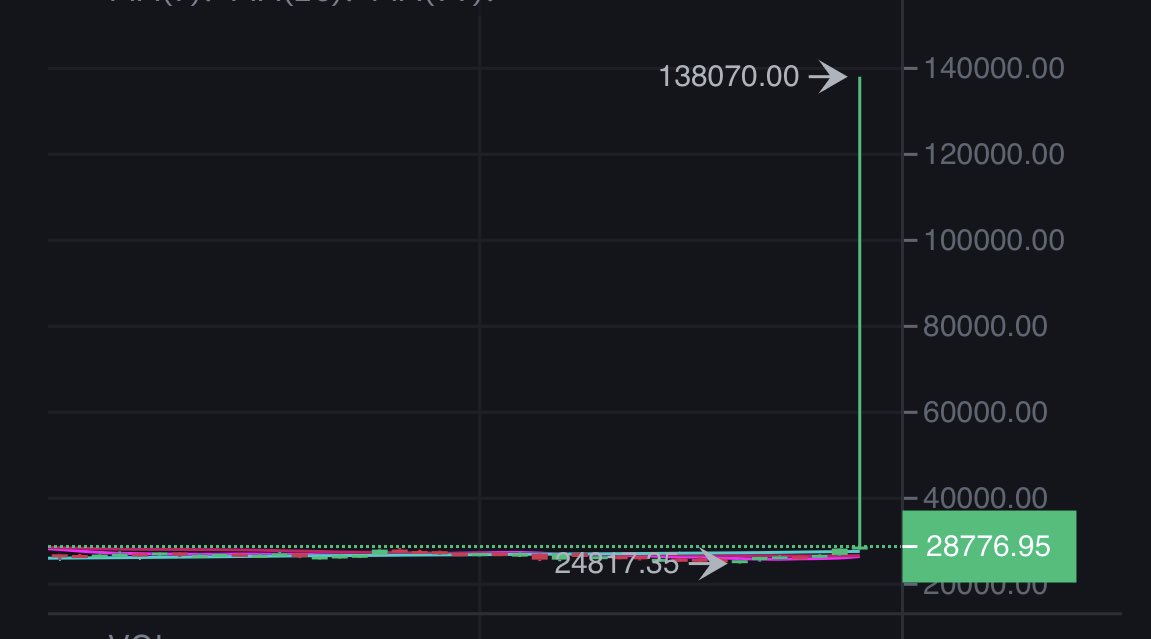

Bitcoin Hits $138,070 On Binance US

Nonetheless, that is on no account a proof for the next information: Some Binance US customers are reporting that the Bitcoin worth has hit a whopping worth of over $138,000 on the change. The favored Twitter account @MikeBurgersburg wrote: “Lololololol- Bitcoin hit $138,070 on Binance US somewhat bit in the past. Every part okay over there, CZ?”.

The anomaly was additionally shared by Twitter consumer @OperationAjax, who posted the screenshot under, writing: “I feel somebody broke the moneymaker on @BinanceUS lol. Somebody put them on “UltraWASH Mode” and despatched #BTC/ Tether to $140,000/BTC.”

At press time, neither Binance US nor Binance CEO Changpeng Zhao have commented on the anomaly within the Bitcoin worth. Due to this fact, it could actually solely be speculated what occurred. The most probably clarification is an inside information glitch.

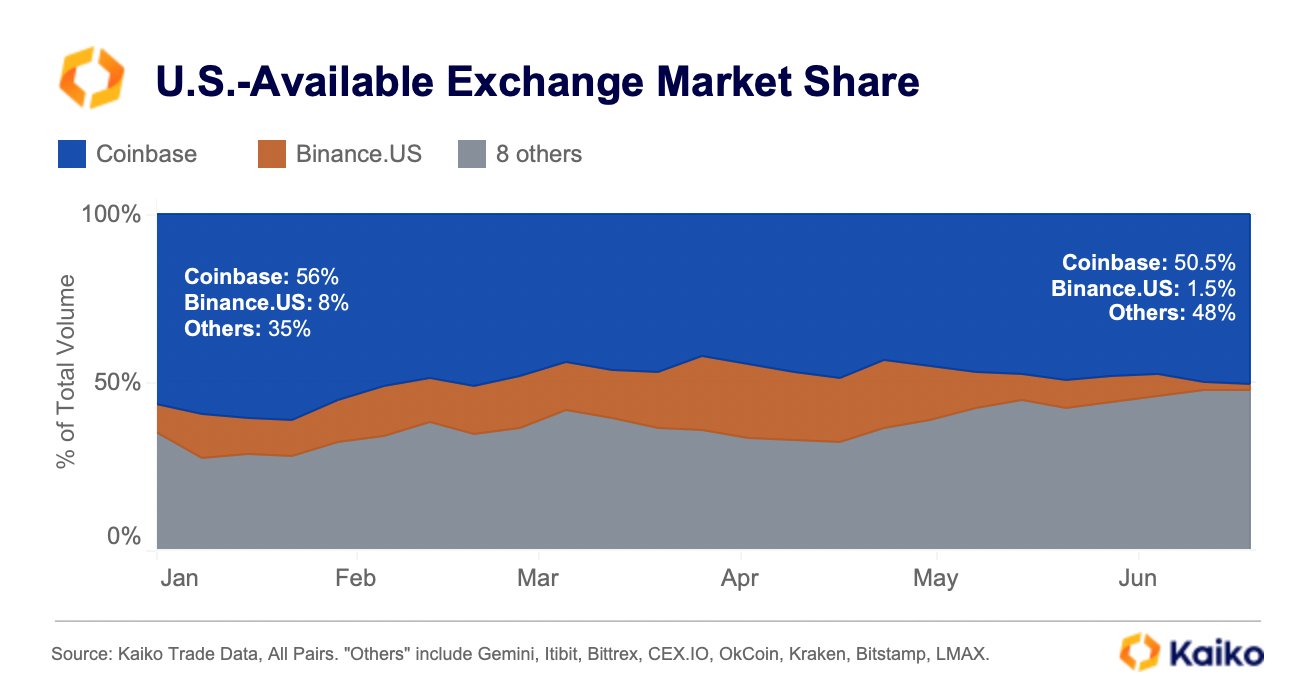

However, different causes are additionally conceivable, equivalent to inadequate liquidity on the change, which led to the exceptional worth. As market information supplier Kaiko reported yesterday, Binance US buying and selling volumes have plummeted for the reason that starting of the 12 months.

“The U.S. crypto change market is extra fraught than ever,” Kaiko wrote through Twitter, sharing the chart under, which reveals that Binance US’s share of the American market has plummeted from 8% firstly of the 12 months to 1.5% at present.

Nonetheless, in opposition to the idea of inadequate liquidity speaks the truth that the worth is at present not displayed on Binance US. On this respect, an information error appears extra possible.

Stress On Binance Might Enhance Additional

In the meantime, stress on Binance within the US might proceed to mount, despite the fact that the US Securities and Change Fee (SEC) and Binance US reached a tentative settlement final Friday, 16 June, over the specter of an asset freeze.

As NewsBTC reported, the proposed measures embody proscribing Binance officers’ entry to personal keys and disclosing enterprise bills. The settlement nonetheless must be authorised by the related federal decide.

In any other case, Travis Kling, former fairness portfolio supervisor and senior funding adviser at Ikigai Asset Administration, commented through Twitter that there’s at present quite a lot of chatter concerning the Blackrock Bitcoin ETF, “and rightfully so.” Nonetheless, Kling sees Binance as an impediment to the ETF, not directly implying that Operation Choke Level 2.0 isn’t over but:

One factor I’ll say- there isn’t any probability, and I imply zero, that this ETF is authorised with Binance in its present place of market dominance. If this ETF is authorised, Binance is both gone solely or their position in worth discovery is massively diminished. If Binance holds on to its present degree of affect, no probability this ETF is authorised.

At press time, the Bitcoin worth was at $28,859, breaking the downtrend that persevered since mid-April this 12 months.

Featured picture from iStock, chart from TradingView.com

[ad_2]

Source link