[ad_1]

- Institutional inflows, like BlackRock’s Bitcoin ETF, have propelled BTC’s rise above $100K.

- Regulatory shifts and Putin’s support for BTC add momentum to its ongoing market surge.

Bitcoin [BTC] has crossed the $100,000 mark, achieving a major milestone for the crypto market. The price surge has drawn attention to factors such as institutional interest, regulatory developments, and global support for digital assets.

Below, we explore the main reasons behind this rise.

Bitcoin market data reflects strong momentum

As of press time, Bitcoin was trading at $102,570 with a 24-hour trading volume of $141.34 billion. Over the last 24 hours, its price has risen by 6.19%, while a 6.78% gain has been recorded over the past week.

Bitcoin’s market capitalization now stands at $2.01 trillion, based on a circulating supply of 20 million BTC.

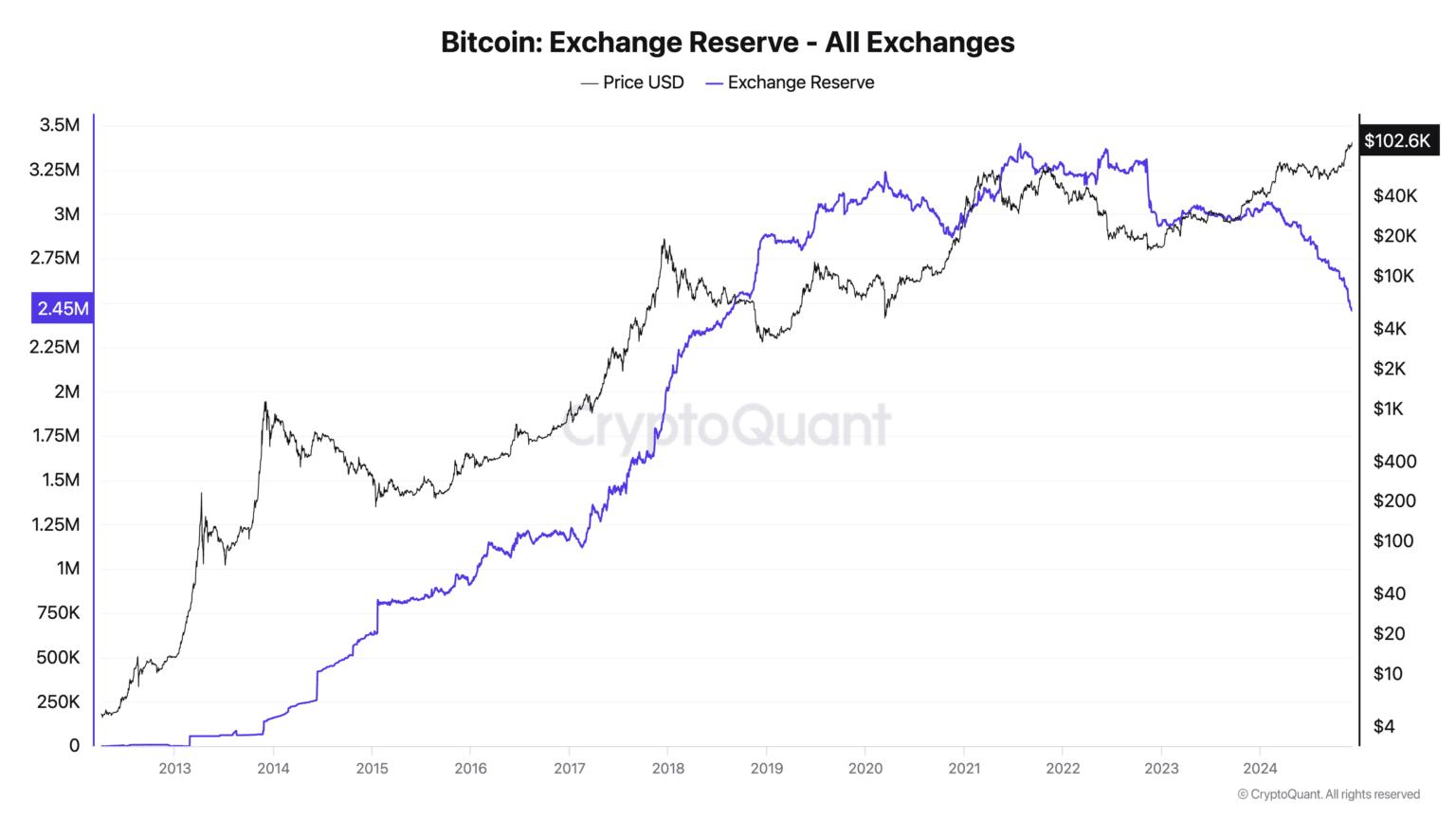

Bitcoin’s trading range over the last day spanned between $94,870 and $103,679, marking a new all-time high of $103,679. BTC exchange reserves have also been falling, indicating reduced selling activity.

This suggests that investors are choosing to hold their assets.

Institutional inflows bolster Bitcoin rally

Institutional interest has played a significant role in Bitcoin’s rise past $100,000. A major contributor has been BlackRock’s iShares Bitcoin Trust ETF (IBIT), which recently crossed $50 billion in assets under management.

Notably, IBIT achieved this milestone within just 228 days, far faster than traditional ETFs, some of which have taken years to reach similar levels.

The rapid growth of IBIT illustrates the increasing demand for Bitcoin among institutional investors. BlackRock has also integrated Bitcoin exposure into its traditional funds, further demonstrating its faith in the cryptocurrency’s potential.

As more institutions adopt BTC as a key financial asset, the market continues to show strength.

Regulatory shifts drive positive sentiment

Regulatory changes have further fueled Bitcoin’s momentum. On 4th December, Donald Trump announced Paul Atkins, known for his crypto-friendly stance, as the new SEC chair, replacing Gary Gensler.

This move has created optimism within the crypto industry, as it raises expectations for clearer and more supportive regulations in the U.S.

Additionally, Russian President Vladimir Putin expressed strong support for BTC during the Russia Calling Investment Forum. Putin noted,

“These tools will develop one way or another because everyone will strive to reduce costs and increase reliability.”

His remarks highlight the global recognition of Bitcoin as a transformative financial technology, contributing to the ongoing rally.

Surge in futures market activity

The derivatives market has also experienced significant growth alongside Bitcoin’s price surge. Open interest in Bitcoin futures has climbed to $64.70 billion, indicating heightened activity among both institutional and retail traders, according to an AMBCrypto report.

The rise in open interest suggests continued confidence in BTC, even as profit-taking may occur in the short term.

This uptick in futures trading activity reinforces BTC’s position as a sought-after asset in both spot and derivatives markets.

[ad_2]

Source link