[ad_1]

- Spot Bitcoin ETFs have accumulated over $22 billion in inflows, reflecting strong market demand.

- Retail investors now hold 80% of total assets in Bitcoin ETFs, driving significant interest.

Since their introduction, spot Bitcoin [BTC] exchange-traded funds (ETFs) have experienced a remarkable surge in popularity, amassing cumulative inflows that have eclipsed $22 billion.

Among the frontrunners, BlackRock’s IBIT stands out with an impressive $23 billion in inflows, while Grayscale’s GBTC has faced notable outflows totaling $20 billion.

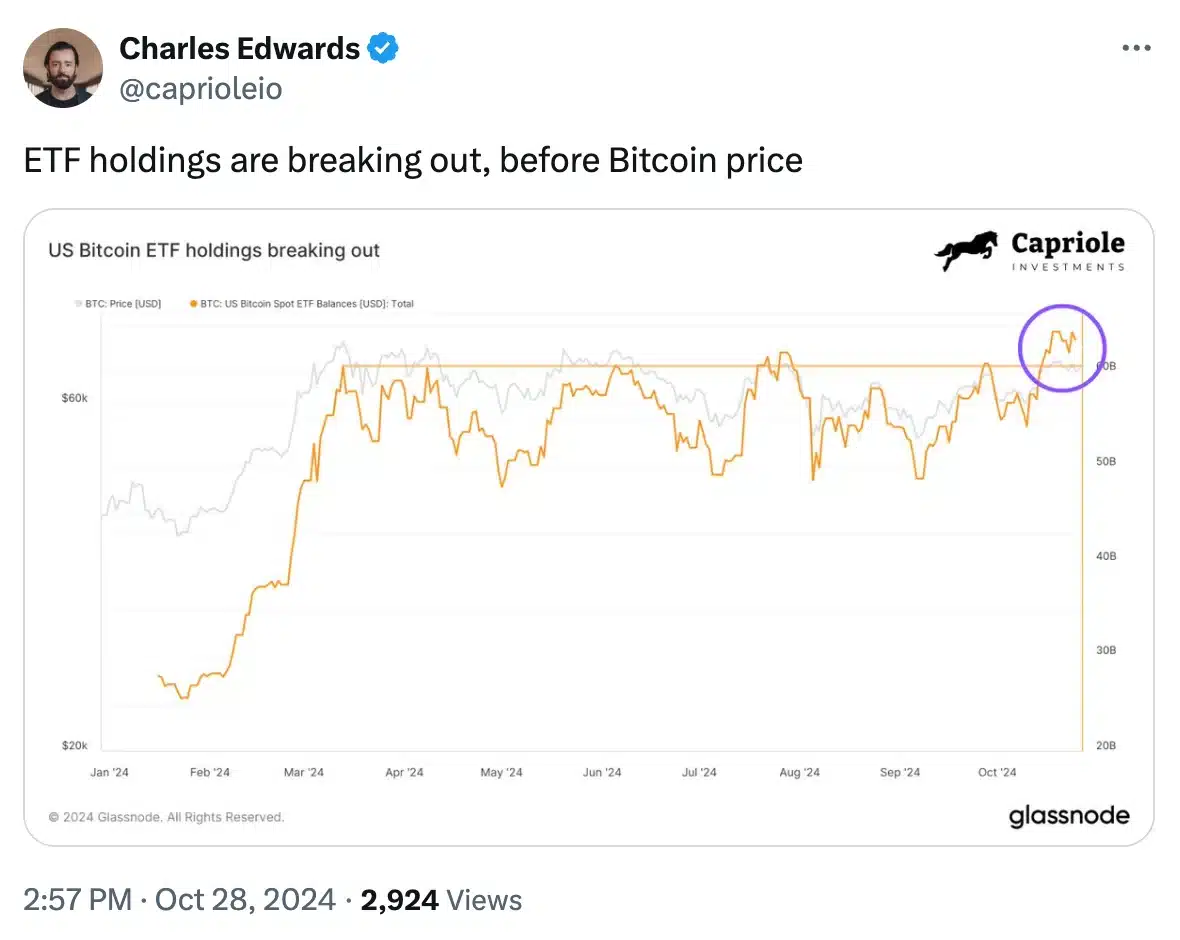

As expected, the recent momentum in BTC ETFs continued with nearly $1 billion in net inflows recorded last week, marking the highest demand seen in the past six months.

Execs weigh in…

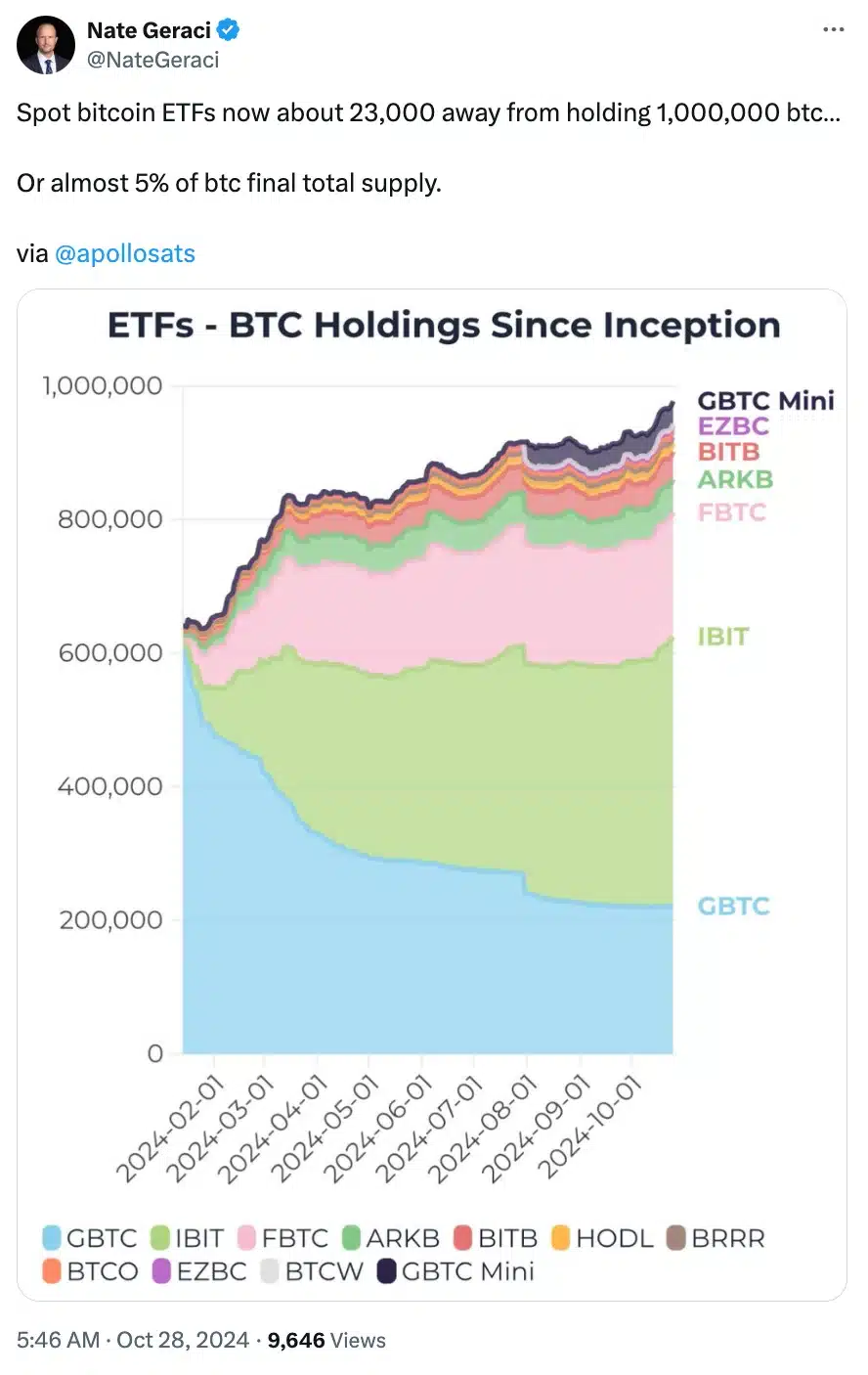

In light of the significant success of spot Bitcoin ETFs, Nate Geraci, President of ETF Store, took to X to share his insights, and stated,

Joining the conversation, Charles Edwards, Founder of Capriole Investments and The Ref, remarked,

Are retail investors driving the Bitcoin ETF market?

Despite spot BTC ETFs creating pathways for institutional investors, recent insights from crypto exchange Binance reveal that retail investors are significantly fueling the growing demand.

According to their report, retail participants now hold a staggering 80% of the total assets in these ETFs, underscoring their crucial role in the market’s upward momentum.

This trend highlights a remarkable shift in investment dynamics, where individual investors are not only active but are driving substantial interest in Bitcoin through these financial instruments.

The report noted,

“Spot Bitcoin (“BTC”) Exchange-traded funds (“ETFs”) have accumulated over 938.7K BTC (~US$63.3B), and when including other similar funds, this figure comprises 5.2% of Bitcoin’s total supply.”

What’s more to it?

The report further highlighted a significant uptick in activity within crypto ETFs, with net inflows exceeding 312,500 BTC (approximately $18.9 billion) and positive inflows recorded in 24 of the last 40 weeks. On average, these ETFs are removing about 1,100 BTC daily from circulation, reflecting a proactive buying approach.

This reduction in supply, combined with rising demand, could drive Bitcoin prices higher, indicating a growing acceptance of Bitcoin investments through ETFs and a notable shift in market dynamics.

Bitcoin ETFs vs Gold, Ethereum ETFs

That being said, the report also shows that spot BTC ETFs have significantly outperformed early Gold ETFs, recording net inflows of around $18.9 billion within a year, compared to just $1.5 billion for Gold ETFs. This surge has drawn over 1,200 institutional investors to Bitcoin ETFs, a notable rise from the 95 institutions in Gold’s first year.

In contrast, Ethereum [ETH] ETFs have struggled, experiencing outflows of approximately 43,700 ETH (around $103.1 million) and negative flows in eight of the last eleven weeks.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Hence, Bitcoin ETFs have a more substantial impact on market dynamics when adjusted for spot trading volume, reflecting stronger demand from institutions.

These trends align with a rise in BTC’s price to $68,266.17, following a 1.87% increase in the past 24 hours and a 4.38% monthly gain, according to CoinMarketCap.

[ad_2]

Source link