[ad_1]

Coinspeaker

$1 Billion of Bitcoin Options Expire as BTC Price Holds Above $60,000

It’s been a tough week for Bitcoin

BTC

$62 188

24h volatility:

1.5%

Market cap:

$1.23 T

Vol. 24h:

$26.23 B

and crypto investors across the world amid heightened volatility following the escalating Israel-Iran conflict earlier this week. As of today, October 4, a total of 17,500 Bitcoin options will expire with a put-call ratio of 0.75, with a notional value of $1.07 billion and a max pain point of $63,000.

With the US elections just six weeks from now, Bitcoin is likely to see some volatility in the closely contested battle between Kamala Harris and Donald Trump. Popular platform Greeks.live reported that all major maturity implied volatilities (IVs) are at average levels compared to last year. Also, these IVs will remain supported through the upcoming US elections. The next two weeks will provide a favorable window for positioning ahead of the fourth quarter.

Popular crypto analyst Ali Martinez reported that there’s been a notable increase in Bitcoin’s Taker Buy/Sell Ratio on the OKX exchange. According to Martinez, this spike signals a surge in aggressive buying, which could indicate potential upward momentum for Bitcoin in the near future.

There was a spike in the #Bitcoin Taker Buy/Sell Ratio on @okx! This indicates a surge in aggressive buying — a sign of upward momentum ahead! pic.twitter.com/QgZ9qkhSls

— Ali (@ali_charts) October 4, 2024

With more than a 6% dip on the weekly chart, Bitcoin investors wait on the sidelines for clear signals to emerge for the next price action. Quinn Thompson, the chief investment officer at Lekker Capital, said that investors should make the most of the opportunity by buying the BTC dips.

He added that the current price of around $61,000 is a no-brainer while adding that the “macro backdrop” of the BTC price action has changed significantly in comparison to the past drops.

BTC Price Surge Ahead as Demand Remains Strong

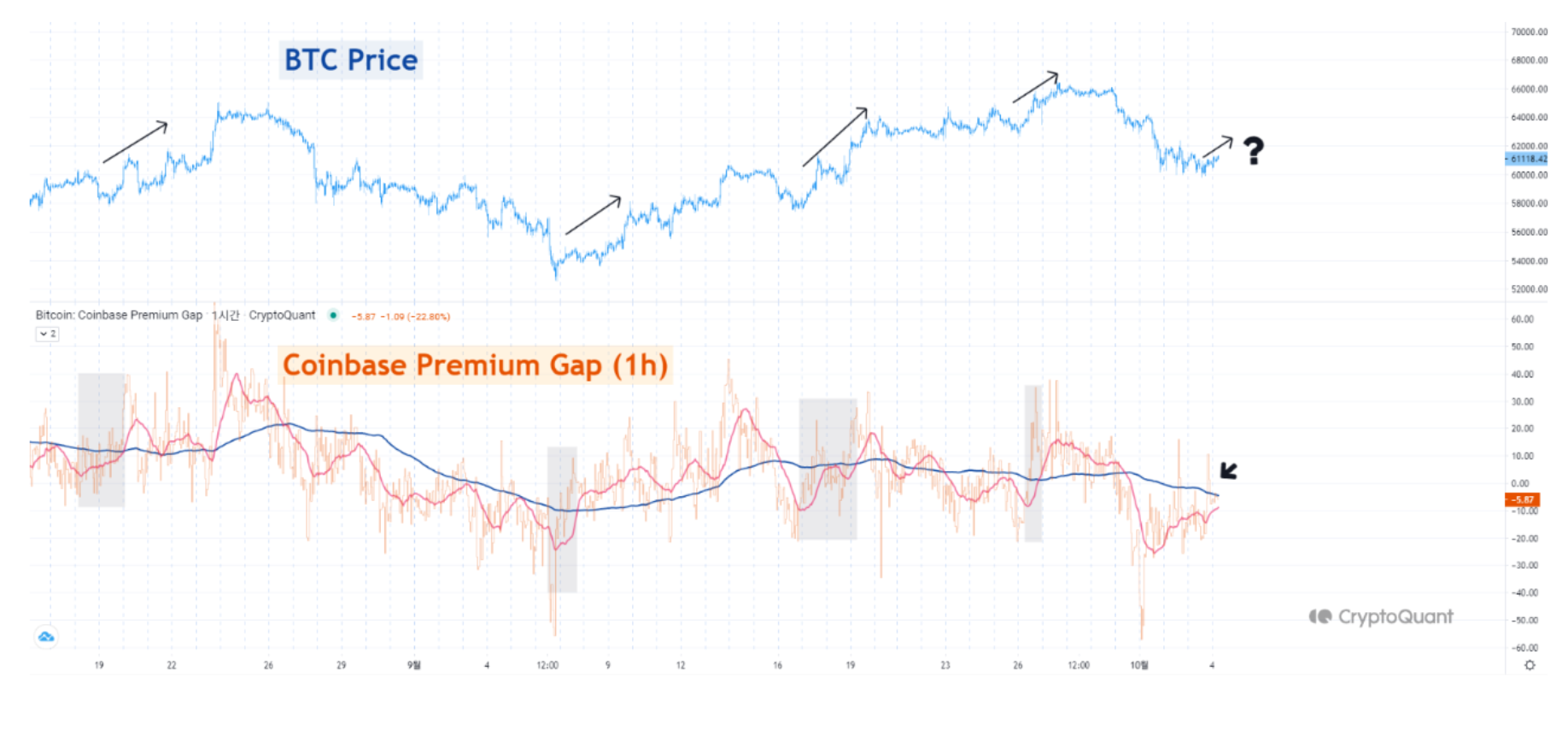

On-chain blockchain analytics platform Cryptoquant recently reported that there’s enough possibility of a short-term BTC price increase ending the recent downward selling pressure.

Behind the scenes, demand remains strong, as highlighted by the widely-watched Coinbase premium metric. This metric tracks the price difference between the BTC/USD pair on Coinbase, the largest U.S. exchange, and the BTC/USDT equivalent on Binance.

According to CryptoQuant contributor Yonsei_dent, moving averages of the premium’s size are closely linked to specific Bitcoin price trends. He explained:

“We analyzed the Coinbase Premium Index on a 1-hour time frame to observe short-term momentum, utilizing the 24-hour (daily) and 168-hour (weekly) moving averages for added context. Historically, when the daily moving average forms a golden cross by crossing above the weekly moving average with strong momentum, we observed significant price movements shortly after that.”

-

Courtesy: CryptoQuant

Such a golden cross scenario occurred even during the last month thereby pushing up the BTC price to $66,000.

$1 Billion of Bitcoin Options Expire as BTC Price Holds Above $60,000

[ad_2]

Source link