[ad_1]

- Interest in Bitcoin accumulation remained high despite the recent correction.

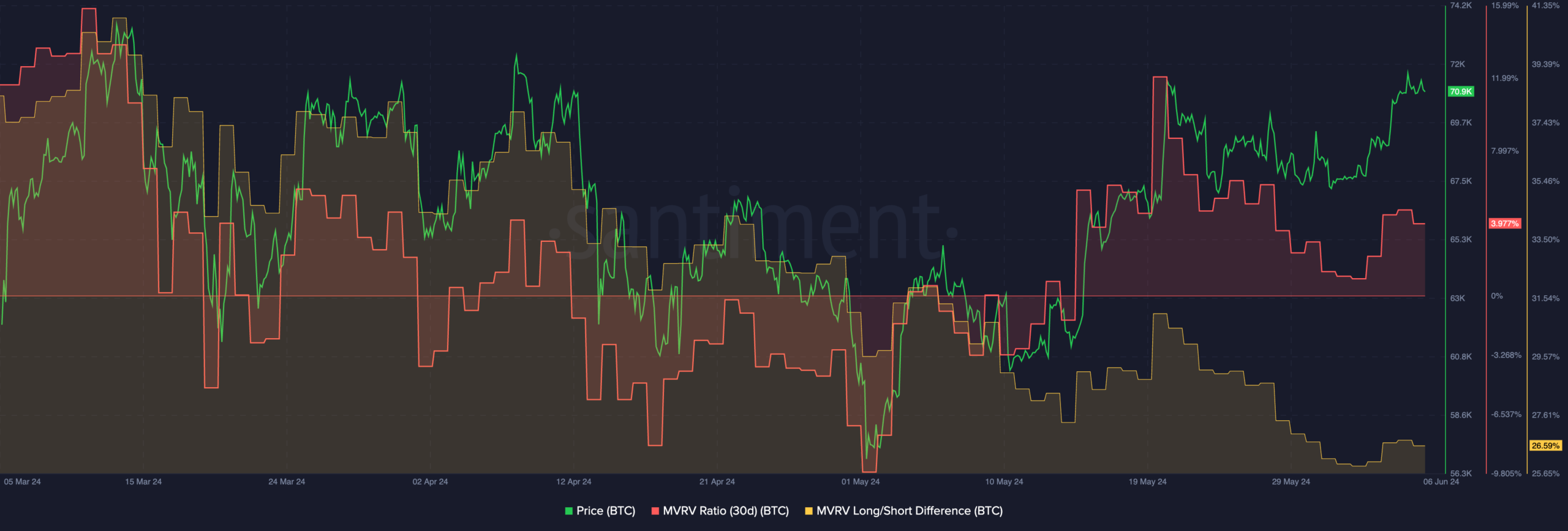

- The profitability of BTC was high even though prices fell.

Bitcoin [BTC] witnessed a significant correction over the last few days. Despite the price decline, buyers continued to show optimism.

Resurgence in interest

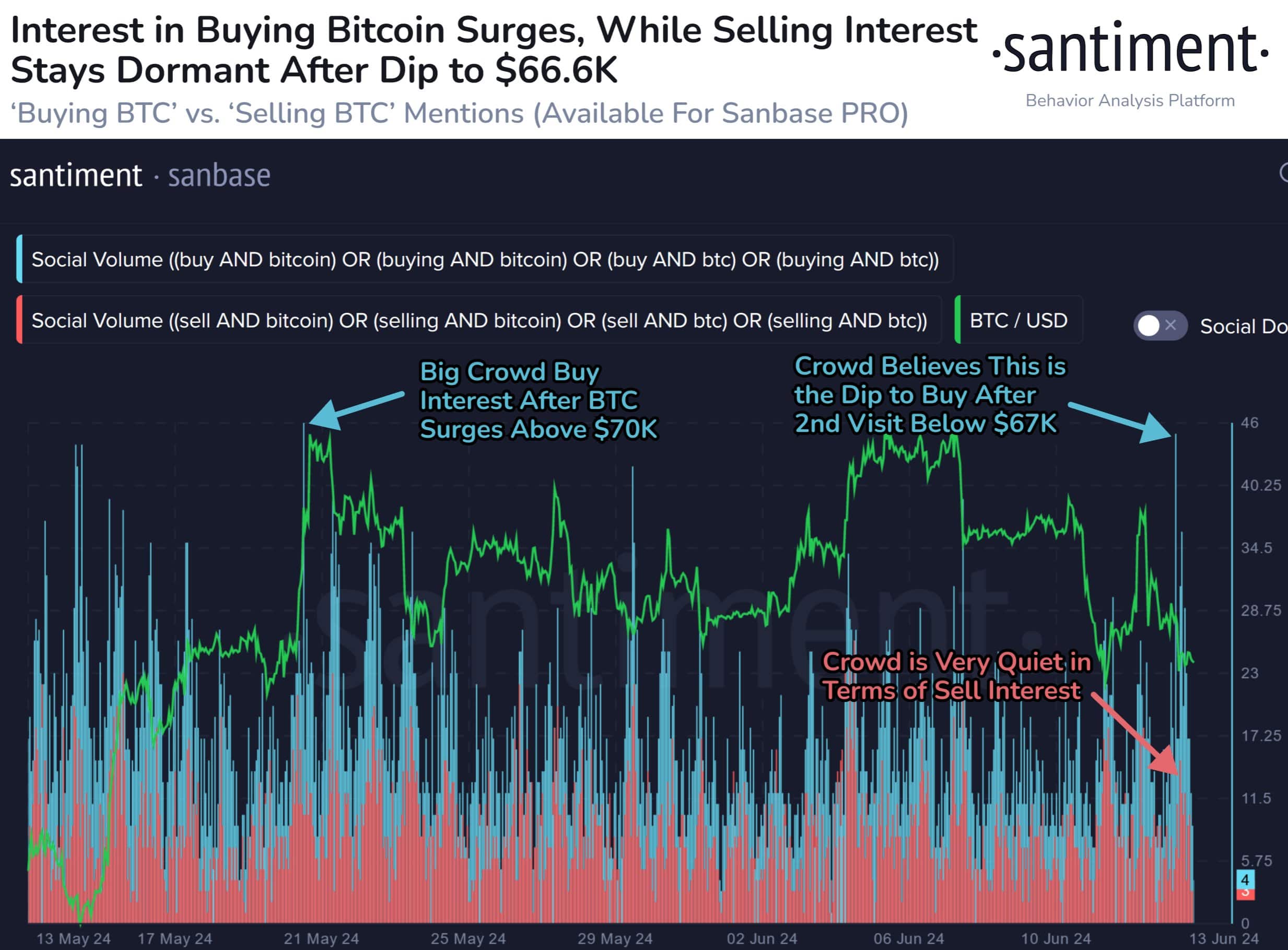

According to Santiment’s data, a recent dip in Bitcoin’s price below $67,000 on 13th June, triggered a surge in buying activity, marking the second-largest spike in investor interest for Bitcoin in the last two months.

The first scenario when this happened, involved a sudden price increase in May 2024. This type of surge can entice traders to jump in, anticipating further price hikes and potential profits.

They may be driven by the belief that they are missing out on a lucrative opportunity if they don’t participate in the rally.

Conversely, a price drop, like the one witnessed on June 13th, can also trigger a buying frenzy. In this scenario, some traders might believe the price decline is unwarranted and represents a buying opportunity.

They anticipate a quick recovery and a chance to capitalize on a temporary dip.

Bitcoin traders step back

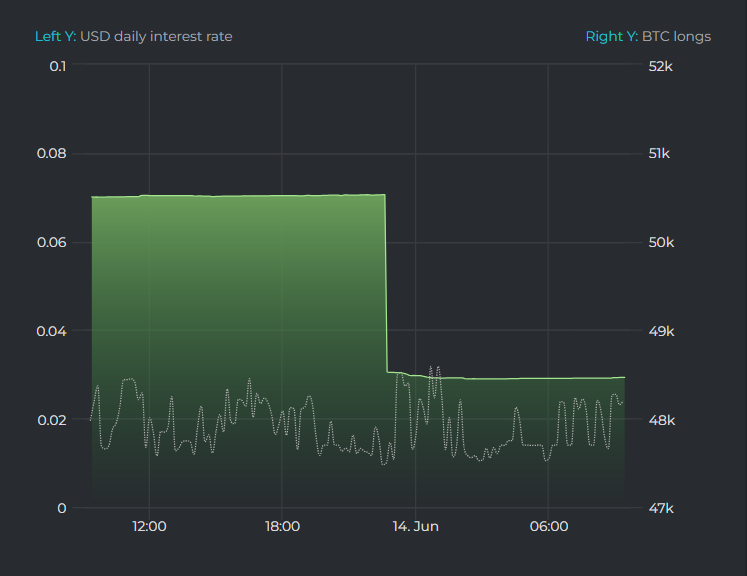

On the flipside, traders were becoming more and more cautious. Data from Datamish revealed a significant movement by Bitfinex whales between 22:35 and 22:41 UTC+8 on June 13th.

During this brief window, these large-scale investors reportedly reduced their long positions by roughly 2,000 BTC, bringing their current holdings down to 48,464 BTC.

This coincides with a broader trend of long position liquidation on Bitfinex since June 11th, totaling approximately 76.4 BTC.

This sell-off by whales suggests that despite the surge in retail buying, some larger investors are adopting a more cautious approach, potentially anticipating further price fluctuations or seeking to lock in profits.

Read Bitcoin (BTC) Price Prediction 2024-2025

At press time, BTC was trading at $66,918.83, its price had declined by 0.18% in the last 24 hours. The volume at which it was being traded at had fallen by 24.99% as well.

The MVRV ratio for BTC remained high indicating most holders were profitable at the time of writing.

[ad_2]

Source link