[ad_1]

Nvidia NVDA inventory has surged almost 200% over the previous 12 months. Forward of its third-quarter earnings report, right here’s Morningstar’s tackle what to search for in Nvidia’s earnings and the outlook for its inventory.

Key Morningstar Metrics for Nvidia

Nvidia Earnings Date

Tuesday, Nov. 21, after the shut of buying and selling.

What to Look ahead to In Nvidia’s Q3 Earnings

We stay centered on synthetic intelligence and Nvidia’s knowledge middle (DC) enterprise. Nothing else issues.

- In Might, Nvidia offered buyers with an incredibly upbeat forecast for the July quarter. They shattered these expectations and guided for a major improve within the October quarter. We anticipate Nvidia to beat this steerage, and we’ll see by how a lot.

- We nonetheless imagine hyperscalers are dashing to purchase as many Nvidia graphics processor items, or GPUs, as they’ll with a purpose to prepare giant language fashions like ChatGPT, each for themselves and for his or her cloud prospects.

All eyes will likely be on the steerage for the January 2024 quarter.

- Demand nonetheless seems to be nicely forward of provide, so the steerage might suggest how nice that distinction at the moment is, together with whether or not is Nvidia nonetheless constrained by provide in constructing knowledge middle GPUs.

- Nvidia indicated that the most recent spherical of China restrictions is not going to have a significant affect on its enterprise. It’s attainable that it is because China frontloaded its GPU orders earlier this 12 months in anticipation of those restrictions. It’s additionally attainable that any misplaced income from China will likely be made up for by super income progress in developed markets. Steerage for the January quarter may be indicative right here.

Truthful Worth Estimate for Nvidia Inventory

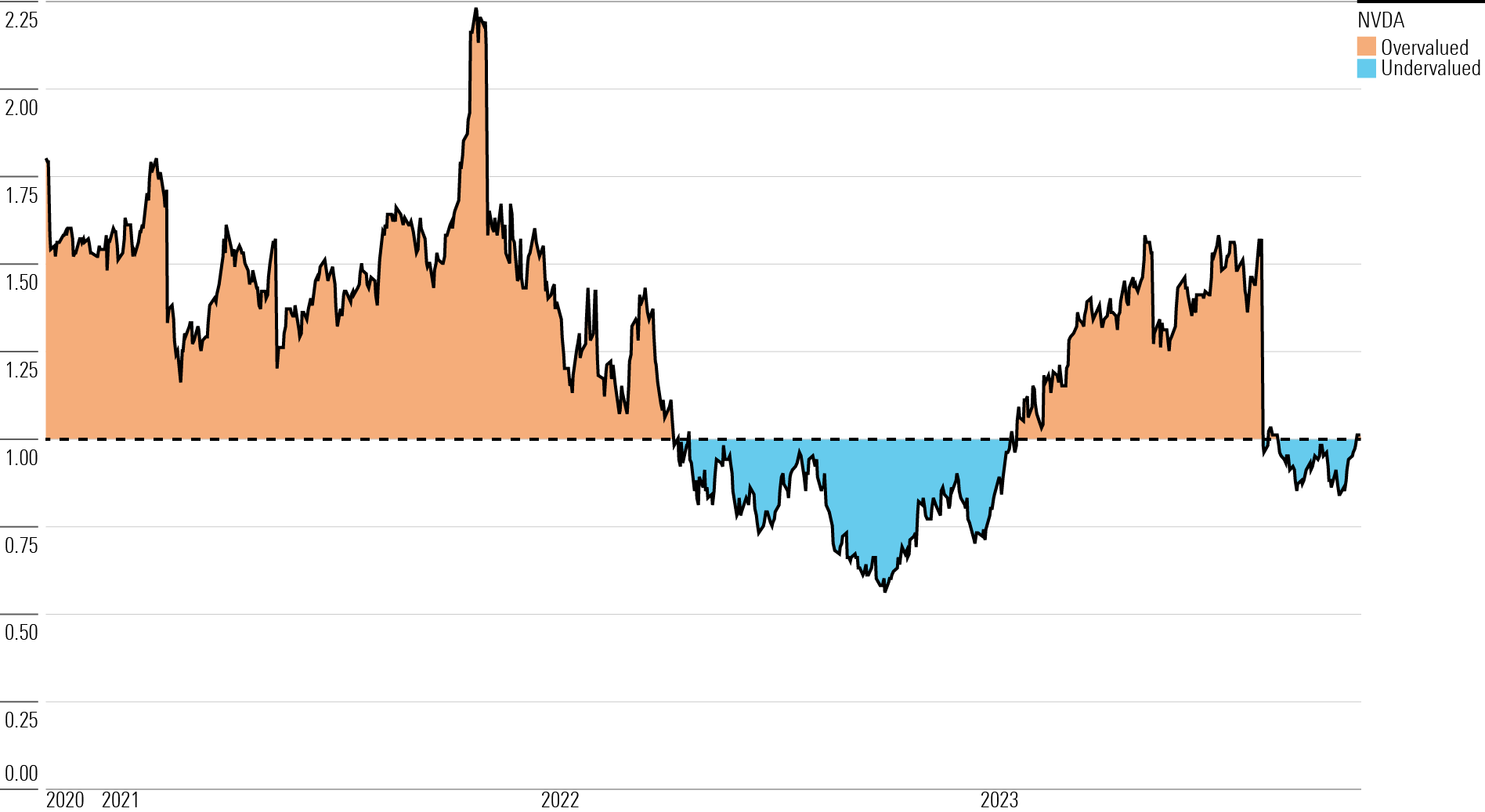

With its 3-star score, we imagine Nvidia’s inventory is pretty valued in contrast with our long-term truthful worth estimate.

Our truthful worth estimate is $480 per share, which suggests an fairness worth of over $1.1 trillion. Our truthful worth estimate implies a fiscal 2024 (ending January 2024) worth/adjusted earnings a number of of 45 instances and a fiscal 2025 ahead worth/adjusted earnings a number of of 31 instances.

Each our truthful worth estimate and Nvidia’s inventory worth will likely be pushed by the agency’s prospects in DC and AI GPUs, for higher or worse. We anticipate an enormous enlargement within the AI processor market within the decade forward. We see room for each super income progress at Nvidia and competing options at both exterior chipmakers (like Superior Micro Gadgets AMD or Intel INTC) or in-house options developed by hyperscalers (akin to chips from Alphabet GOOGL, Amazon AMZN, or others).

Nvidia’s DC enterprise has already achieved exponential progress, rising from $3 billion in fiscal 2020 to $15 billion in fiscal 2023. The corporate ought to see a good larger inflection level in fiscal 2024, as we anticipate DC income to greater than double to $41 billion. In gaming (which was previously Nvidia’s largest enterprise) we mannequin $9.8 billion in income in fiscal 2024, almost $11 billion of income in fiscal 2025, and 10% common annual income progress thereafter. We now have excessive hopes for Nvidia’s automotive enterprise, as better processing energy will likely be required in energetic security techniques and autonomous driving.

Read more about Nvidia’s fair value estimate.

Financial Moat Score

We assign Nvidia a large financial moat, because of intangible belongings round its GPUs and, more and more, switching prices round its proprietary software program, akin to its Cuda platform for AI instruments, which allows builders to make use of Nvidia’s GPUs to construct AI fashions.

Nvidia was an early chief and designer of GPUs, which had been initially developed to dump graphic processing duties on PCs and gaming consoles. The agency has emerged because the clear market share chief in discrete GPUs (over 80% share, per Mercury Analysis). We attribute Nvidia’s management to intangible belongings related to GPU design, in addition to the related software program, frameworks, and instruments builders must work with these GPUs.

We don’t foresee any firms turning into further related gamers within the GPU market alongside Nvidia and AMD. Even Intel, the chip {industry} behemoth, has struggled for a few years with constructing a high-end GPU that may be adopted by gaming lovers. Its subsequent effort for a discrete GPU is slated to launch in 2025.

In our view, GPU parallel processing functionality is on the coronary heart of Nvidia’s dominance in its numerous finish markets. PC graphics had been the preliminary key software, permitting for extra strong and immersive gaming. Cryptocurrency mining additionally entails many mathematical calculations that may run in parallel, so GPUs have an edge right here as nicely. Up to now decade, GPUs had been discovered to extra effectively run the matrix multiplication algorithms wanted to energy AI fashions. Nvidia made shrewd strikes to construct and increase the Cuda software program platform, creating and internet hosting a wide range of libraries, compilers, frameworks, and growth instruments that allowed AI professionals to construct their fashions. Cuda is proprietary to Nvidia and solely runs on its GPUs, and we imagine this {hardware} plus software program integration has created excessive buyer switching prices in AI, contributing to Nvidia’s huge moat.

Read more about Nvidia’s moat rating.

Threat and Uncertainty

We assign Nvidia a Morningstar Uncertainty Score of Very Excessive. In our view, the agency’s valuation will likely be tied to its means to develop inside DC and AI. Nvidia is an {industry} chief in GPUs utilized in AI mannequin coaching, and it’s carved out a very good portion of the demand for chips utilized in AI inference workloads.

We see a bunch of tech leaders vying for Nvidia’s main AI place. We predict it’s inevitable that main hyperscale distributors, akin to Amazon’s AWS, Microsoft MSFT, Alphabet, and Meta Platforms META, will search to scale back their reliance on Nvidia and diversify their semiconductor and software program provider base, together with the event of in-house options. Our score relies on the uncertainty round this market. Nvidia dominates AI right now, and the sky is the restrict for its profitability if it might probably keep this lead over the subsequent decade. Nonetheless, any semblance of the profitable growth of options may meaningfully restrict the corporate’s upside.

Read more about Nvidia’s risk and uncertainty.

NVDA Bulls Say

- Nvidia’s GPUs provide industry-leading parallel processing, which was traditionally wanted in PC gaming functions however has expanded into crypto mining, AI, and maybe future functions.

- Nvidia’s GPUs and Cuda software program platform have established it because the dominant vendor for AI mannequin coaching, a use case that ought to rise exponentially within the years forward.

- The agency has a first-mover benefit within the autonomous driving market, which may result in the widespread adoption of its Drive PX self-driving platform.

NVDA Bears Say

- Nvidia is a number one AI chip vendor right now, however different highly effective chipmakers and tech titans are centered on in-house chip growth.

- Though Cuda is at the moment a frontrunner in AI coaching software program and instruments, main cloud distributors would possible favor to see better competitors on this house and should shift to various open-source instruments in the event that they had been to come up.

- Nvidia’s gaming GPU enterprise has typically seen boom-or-bust cycles based mostly on PC demand and, extra just lately, cryptocurrency mining.

This text was compiled by Adrian Teague

[ad_2]

Source link