[ad_1]

Early final summer time, Adam Yedidia took Sam Bankman-Fried to 1 aspect after a recreation of paddle tennis. Within the shadow of a hut within the grounds of the Bahamian penthouse they and others shared, he requested the crypto tycoon: “Are we OK?”

Yedidia informed a New York court docket this month that he was apprehensive FTX, the crypto change that Bankman-Fried had co-founded and at the moment led, was in monetary hassle. He recounted his outdated buddy’s reply: “We had been bulletproof final yr, however we’re not bulletproof this yr.”

FTX collapsed just a few months later, sending shockwaves by way of the cryptocurrency business. US prosecutors hope this chat, which they’ve taken to calling the “bulletproof dialog”, will assist to point out Bankman-Fried knew about, and hid, an $8bn money shortfall for months a minimum of earlier than it was uncovered.

Till November final yr, FTX gave the impression to be probably the most profitable fintech corporations in historical past. The crypto change, the place prospects might commerce numerous cryptocurrencies, was valued at $40bn after simply three years in existence, making its 30-year-old co-founder and chief government a billionaire.

Bankman-Fried oversaw each the change and Alameda Analysis, a personal buying and selling agency, with a tiny group of shut associates of their late 20s and early 30s. Most of them lived collectively within the $30mn Bahamas penthouse, with an orchid-shaped pool on its terrace and sweeping ocean views.

This penthouse clique has had a wierd reunion in court docket over the previous three weeks. Most of them haven’t been in the identical room because the chaotic occasions of final autumn, when a leak of economic information precipitated a stampede to withdraw cash from FTX. However there was inadequate cash to fulfill the requests — solely an $8bn gap the place buyer deposits ought to have been.

US prosecutors allege the shortfall arose as a result of FTX had transferred or lent billions of {dollars} of its prospects’ cash to Alameda, which spent it on crypto investments, enterprise capital, political donations, movie star advertising and actual property. They declare Bankman-Fried defrauded his lenders, buyers and prospects.

Bankman-Fried acknowledges that cash flowed from FTX to Alameda, however has pleaded not responsible to fraud, claiming the catastrophe was a results of poor bookkeeping and danger administration that left FTX dangerously uncovered to a crypto market crash.

The previous crypto kingpin, his trademark curly hair shorn by a fellow inmate at a New York jail, has spent the primary 12 days of the trial sitting hunched and emotionless on the defence desk as his longtime pals took the stand in opposition to him.

Caroline Ellison, Bankman-Fried’s former girlfriend and Alameda’s former chief government officer, together with FTX co-founder Gary Wang and director of engineering Nishad Singh have all pleaded responsible to fraud and different offences.

Bankman-Fried faces life in jail if he’s convicted. However the trial has wider significance for the largely unregulated world of cryptoasset buying and selling. It represents an important check for efforts by US legislation enforcement to exert their authority over buying and selling companies domiciled offshore. Damian Williams, the US lawyer for New York’s Southern District, has sat in court docket a number of occasions to observe his deputies perform the high-stakes prosecution.

Hilary Allen, a professor of legislation on the American College, says that whereas the business has typically “weaponised technobabble” to assert it falls exterior nationwide regulation, this case is meant to point out that there “truly is somebody you possibly can maintain accountable”.

The trial will resume on October 26 after a week-long intermission. Authorized observers more and more anticipate Bankman-Fried himself to take the stand. The query is whether or not crypto’s most fascinating advocate can presumably clarify away the proof and the damning testimony of his oldest pals.

Previous pals flip

The 12-person jury and its six back-up jurors consists of two conductors on New York’s Metro North commuter railway and a former Salomon Brothers funding banker. They’ve sat by way of displays of inner spreadsheets, chat messages and tweets together with hours of testimony because the prosecution set out the majority of its case.

All 12 should comply with convict or acquit. If a number of dissents, the last word result’s a mistrial, forcing the federal government to determine whether or not to deliver the entire case once more.

The important thing subject is whether or not Bankman-Fried had felony intent. Prosecutors have centered on conversations and paperwork that they hope will persuade the jury that the FTX founder was conscious of, orchestrated and lied in regards to the diversion of funds to Alameda for years.

Yedidia, one of many lower-profile roommates on the Bahamas penthouse, was a shock alternative as the primary prosecution witness. One among Bankman-Fried’s finest pals at MIT and a senior coder at FTX, he testified beneath an immunity order that precludes him from being charged primarily based on his proof, offering it’s truthful. That affords defence attorneys much less scope to assault his credibility than for Ellison, Wang and Singh — all of whom are co-operating with prosecutors within the hope of lighter sentences.

He mentioned he knew that buyer deposits went to Alameda however assumed the buying and selling agency simply held the cash for safekeeping as a result of it had a neater time getting financial institution accounts than FTX. By way of technical work on the change’s settlement system, in June 2022, he realized that Alameda owed about $8bn in FTX prospects’ hard-currency deposits to the change.

“It appeared like some huge cash,” Yedidia mentioned, his concern resulting in the “bulletproof dialog”. He additionally requested how lengthy it could be “till we’re bulletproof once more?” Bankman-Fried mentioned it may very well be six months to a few years. Within the occasion, the corporate didn’t even final 4 months.

Since FTX’s demise, Yedidia mentioned he has develop into a highschool maths instructor. The return to regular life is not going to be really easy for the opposite three key witnesses.

Co-founder Gary Wang, notorious at FTX for barely talking to his colleagues, was extremely talkative on the witness stand, testifying that secret, distinctive privileges for Alameda had been baked into FTX’s code way back to its launch in 2019. In the end, the buying and selling agency was exempt from FTX’s regular automated liquidation system and ready “to withdraw limitless quantities of cash”.

Initially, he recalled Bankman-Fried saying Alameda might borrow from FTX so long as it was “lower than what FTX’s whole buying and selling income was on the time”. If Alameda borrowed extra, Wang mentioned, the one supply of additional funds at the moment was to dip into prospects’ cash. However by late 2019 or early 2020, Wang mentioned he observed Alameda had performed simply that.

Wang mentioned Bankman-Fried then informed him to include the worth of Alameda’s holdings of FTT, a cryptocurrency that FTX had itself created, into his calculation. If Alameda had sufficient crypto belongings to pay again its borrowing from FTX, Bankman-Fried reasoned that was OK. “I trusted his judgment,” Wang informed the court docket.

Because the crypto growth picked up in 2020 and 2021, and FTT’s worth rose from about $3 to greater than $70, Alameda’s FTT stash gave it monumental headroom for borrowing from FTX whereas nonetheless being theoretically solvent and in a position to pay again its loans on demand.

However critics say the usage of risky crypto tokens meant Alameda’s monetary power was illusory. Allen, of the American College, describes the token as “the fulcrum” that allowed the alleged fraud to be perpetrated. One of many authorities’s knowledgeable witnesses known as up an image of a $100 invoice for example the distinction between fiat foreign money and crypto tokens

Ellison, who testified after Wang, defined how utilizing FTT as collateral additionally gave Alameda entry to billions in borrowing of money and crypto belongings from exterior lenders, as much as a peak equal to $15bn by late 2021. She informed the court docket it was “considerably deceptive” to incorporate FTT on the agency’s stability sheet because it couldn’t be bought in giant quantities with out undermining its worth.

The reversal of crypto markets within the spring of 2022 threatened to show what prosecutors declare was Bankman-Fried’s magical enthusiastic about FTT. By mid-June, Ellison feared that falling costs had left Alameda technically bancrupt. Bankman-Fried thought the numbers should be flawed. He known as Wang, his trusted fixer.

Wang recalculated and noticed an error that made Alameda’s state of affairs look worse than it was. He recorded its true internet stability on FTX in a spreadsheet, labelling it “Gary’s quantity”. Together with the roughly $8bn in prospects’ money and its different positions, Alameda owed FTX $11bn.

The inside circle then sat all the way down to a gathering. Yedidia recalled watching Wang, Bankman-Fried, Ellison and Singh submitting right into a convention room within the Bahamas workplace, the place Wang mentioned Bankman-Fried reviewed the spreadsheet displaying the $11bn debt. That sum was greater than all of the income FTX had ever made and all of the fairness it had raised from exterior buyers mixed.

The group needed to take into account what to do subsequent. Alameda’s exterior lenders needed billions in loans repaid, however that cash was both locked up in illiquid investments or had been spent. Wang described how Bankman-Fried informed Ellison she might pay again the exterior collectors. “He turned to Caroline and mentioned: Alameda can go forward and return the borrows.”

For prosecutors, that is maybe probably the most essential second. Understanding that Alameda should be dipping into FTX buyer funds so as to repay exterior collectors, Bankman-Fried ordered it to hold on. Ellison mentioned she and Bankman-Fried then labored collectively on seven completely different stability sheets so as to conceal the outsized borrowing from FTX.

The defence response

Bankman-Fried was arrested within the Bahamas penthouse in January and later appeared, handcuffed, on the tarmac of Nassau airport earlier than being extradited to the US. However earlier than he was detained, he gave a flurry of media interviews that offered prosecutors with a sketch of his doubtless defence.

He blamed “large administration failures” and “huge oversights” in bookkeeping and danger administration for the leakage of funds to Alameda, which left FTX itself unable to pay again prospects. He has mentioned he had solely “absolutely realised” the change’s place in late autumn of 2022 and by no means knowingly lied.

Bankman-Fried appeared to allude to this assembly in a Monetary Instances interview in December. “I do bear in mind that there have been some discussions round Alameda’s positions,” he mentioned on the time. “I don’t bear in mind numbers from these. I don’t bear in mind numbers being mentioned, I’m undecided they weren’t. I believe Alameda did some recounting then, or some checking in on the well being of its place.”

If he does take the stand, prosecutors will attempt to display that the gaps in Bankman-Fried’s reminiscence are each selective and misleading. The trial could but hinge on what was mentioned inside that convention room — and the truth that the three different individuals current will contradict him makes his testimony a tough process.

Nevertheless, not all components of the prosecution narrative line up neatly. Singh mentioned he left the essential June assembly nonetheless considering issues had been OK and didn’t realise buyer funds had been being raided till September. Underneath cross-examination, he mentioned that after the June assembly he “suspected there was wrongdoing . . . [but] took cues from individuals round me and didn’t pursue it additional”.

In Singh’s telling, the penny dropped in September 2022 amid a debate about whether or not Alameda must be shut down. Ellison mentioned it could be unimaginable as a result of the buying and selling agency couldn’t repay its money owed to FTX. The identical night Singh mentioned he confronted Bankman-Fried, pacing backwards and forwards on the penthouse balcony. Pressed on Alameda’s lack of ability to pay again what it owed, in impact, to FTX’s prospects, Bankman-Fried mentioned: “Proper. That. We’re slightly brief on deliverables.”

He informed Singh he hoped the change might develop its method out of hassle, incomes sufficient to re-fill the hole, or elevate cash from new fairness buyers. Between September and November he tried to faucet buyers, together with Saudi wealth funds, with out apparently telling them why he wanted the cash.

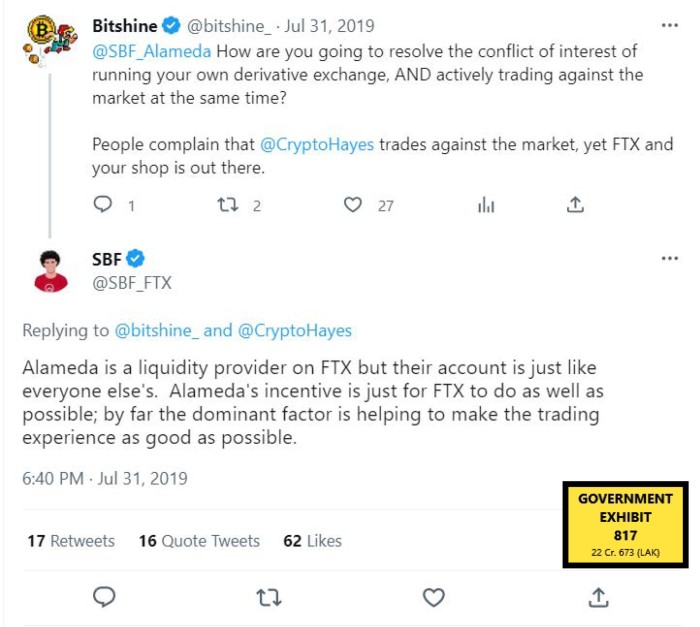

Bankman-Fried’s public picture and character have additionally featured closely within the case. Prosecutors have already made full use of his prolific tweets and interviews, from FTX’s earliest days to its closing week, and known as on witnesses to clarify how they’re false.

They’ve additionally sought to forged doubt over the loveable oddball picture he appreciated to mission. Witnesses mentioned Bankman-Fried not often slept on a beanbag, regardless of making a lot of it in media profiles, and that he selected to maintain driving a modest Toyota Corolla automobile as a result of he knew it was “higher for his picture”.

For the prosecution, assistant US lawyer Thane Rehn mentioned Bankman-Fried’s persona and enterprise empire was “constructed on lies” and that “in actuality, he was taking [the] cash and spending it on himself”. However Mark Cohen, the lead defence lawyer, argued the federal government portrayal of his shopper as a grasping felony mastermind verged on caricature. “He was a math nerd who didn’t drink or social gathering,” Cohen mentioned in his opening arguments.

Cohen additionally tried, in his opening argument, to prime the jury to doubt the penthouse witnesses. “Ask yourselves [ . . .] are they pointing to out-of-context or ambiguous statements that now they’re saying led to black-and-white conclusions?”

Removed from being a “cartoon villain” in his Bahamas lair, Bankman-Fried was a hard-working entrepreneur who eschewed private luxuries however made errors in his rush to develop the corporate. Cohen mentioned Alameda’s privileges “had been performed for cheap functions on the time” and much from secret. “Taking one thing out of context and in hindsight calling it improper shouldn’t be proof past cheap doubt,” he added.

Nevertheless, Cohen’s typically halting cross-examination of the important thing prosecution witnesses has up to now did not considerably dent their credibility.

“When the co-operating witnesses multiply, the factors simply don’t land as effectively,” says Sarah Paul, a former prosecutor and companion at Evershed Sutherland, including that it was onerous to cross-examine Ellison as a result of she could have come throughout to jurors as a sympathetic witness.

With the federal government case largely intact on the finish of the trial’s first act, it seems that Bankman-Fried is the one witness who can provide a counter-narrative to the prosecution’s portrayal of greed, secrets and techniques and lies.

Paul provides that if he does take the stand it may very well be a counsel of desperation, given how overwhelming the prosecution’s case seems to be.

“It might be his final hope,” she says. “Perhaps he is ready to persuade a minimum of one juror that he didn’t have felony intent.”

Pictures by Bloomberg, Reuters, AFP/Getty Photographs and AP

[ad_2]

Source link