Bitcoin and the broader crypto market have come below main promoting strain amid information of the FTX creditor liquidation.

On Monday, September 11, the world’s largest cryptocurrency Bitcoin (BTC) confronted a serious worth correction with its worth taking a dip below $25K. Nevertheless, the BTC worth has recovered since and is at present buying and selling at $25,807 ranges.

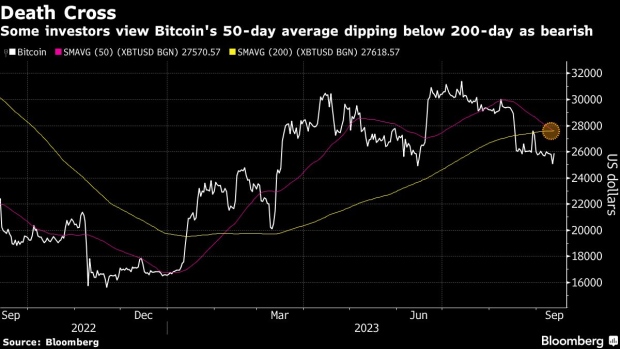

On the technical charts, the BTC worth has shaped a demise cross sample with its 50-day short-term transferring common having breached its 200-day short-term transferring common. This means sturdy bearish formations on the technical charts with additional risk of worth correction.

-

Picture: Bloomberg

- Alternatively, the liquidity within the crypto market has been on a gradual decline throughout this steady promoting strain. On the identical time, the on-chain and the off-chain volumes are additionally about to achieve the historic lows.

FTX Creditor Liquidation

Together with Bitcoin, the altcoins have confronted a extreme worth crash with Ethereum falling all the way in which to $1,540 ranges falling below essential help ranges. Equally, Ethereum competitor Solana has been dealing with large promoting strain and has been buying and selling at $18.00.

FTX’s directors have efficiently reclaimed roughly $7 billion value of belongings, $3.4 billion of that are in cryptocurrency. A courtroom listening to scheduled for Wednesday will consider a proposal to provoke token gross sales as a method to repay collectors, as outlined in latest submissions.

An accompanying presentation reveals that FTX possesses roughly $1.2 billion in SOL, the native token of the Solana community, alongside holdings of $560 million in Bitcoin, the most important cryptocurrency, and $192 million in Ether, the second-ranked cryptocurrency. This has left the market feeling unsure and anxious in regards to the impending FTX creditor liquidation.

FTX is within the strategy of contemplating the appointment of the asset administration division of Galaxy Digital Holdings Ltd., owned by billionaire Michael Novogratz, to help in managing the numerous pool of tokens held by the distressed trade. In accordance with a submitting made in August, the weekly restrict for cryptocurrency divestments varies, spanning from $50 million to a possible most of $200 million.

Various cryptocurrencies, also known as altcoins, are experiencing a interval of underperformance, with Solana’s SOL main the decline with a drop of over 8%. Different notable altcoins, together with Toncoin’s TON and layer 2 Arbitrum’s ARB, have additionally skilled important declines of an identical magnitude. Moreover, Ripple’s XRP has confronted a 5% loss in worth throughout this era.

Bhushan is a FinTech fanatic and holds a great aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in the direction of the brand new rising Blockchain Know-how and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired information. In free time he reads thriller fictions novels and typically discover his culinary expertise.

Subscribe to our telegram channel.

Join

![Bitcoin [BTC], Gold, S&P 500 and a case of the widening correlation](https://www.blocpress.com/wp-content/uploads/2023/03/chart-1905225_1920-1000x600-120x86.jpg)