[ad_1]

Most crypto mining shares together with MARA inventory, RIOT inventory, CIFR inventory and HUT inventory had been struggling this week. Regardless of the latest upsurge within the crypto market, no indicators of restoration are proven in mining shares.

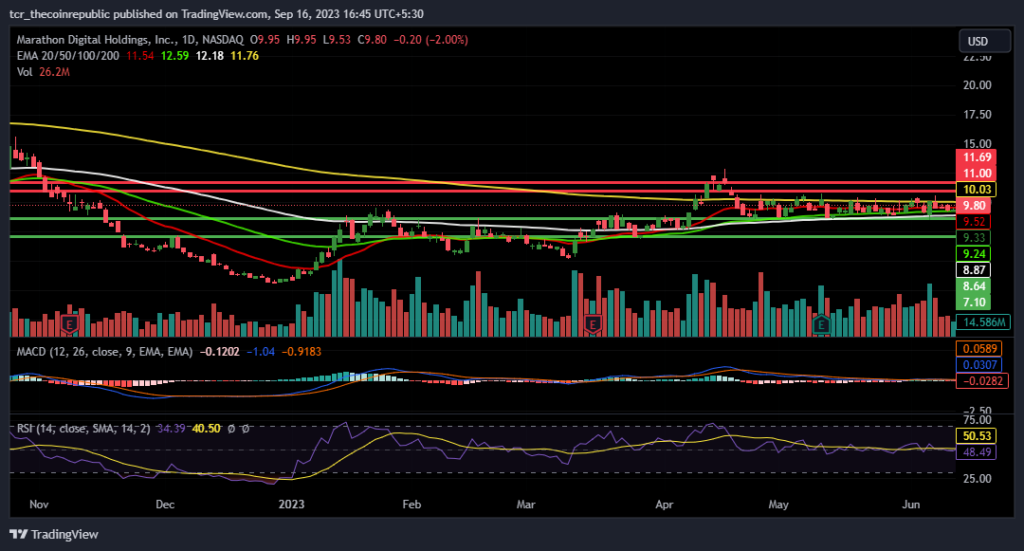

MARA Inventory Technical Worth Evaluation

Within the weekly time-frame, MARA inventory misplaced 17.30% of its buying and selling value. It’s noticed that Maraton Digital Holdings, Inc. inventory value is heading in the direction of its 52 weeks low.

MARA inventory peaked at $19.88 and its lowest buying and selling value prior to now 52 weeks time-frame is $3.11. Marathon Digital Holdings, Inc. has a market capitalization of $1.713 Billion. A surge of 328.68% is seen available in the market cap in 2023 in comparison with that in 2023.

A major decline of 28.13% is seen within the buying and selling value of MARA inventory value. On the time of publication, Marathon Digital stock was buying and selling 57.14% under its annual value goal of $15.40.

On September 15, 2023, MARA inventory declined by 2.00%, buying and selling within the vary between $9.53 and $9.95. The typical buying and selling quantity of MARA shares is 28.538 Million.

The MACD line is shifting parallel to the sign line reflecting rising bearish presence. The RSI line and RSI- primarily based MA line are shifting close to RSI Decrease Band.

Technical Ranges

Help Ranges: $8.64 & $7.10

Resistance Degree: $11.00 & $11.69

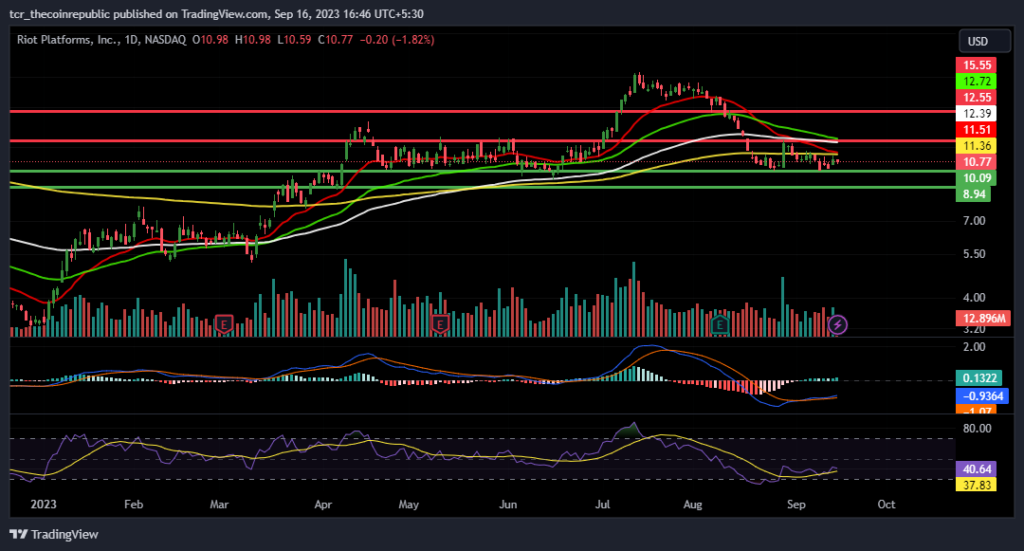

RIOT Inventory Technical Evaluation

RIOT inventory misplaced 4.69% of its buying and selling value within the weekly time-frame and declined greater than 19.75%. Regardless of quick time period losses, Riot Platforms, Inc. added 208.60% to its buying and selling value in YTD time-frame.

The annual value goal of RIOT inventory is $19.22 which is round 78.84% better than its present buying and selling value. Riot Platform, Inc. has a market capitalization of $1.996 Billion.

The MACD line is shifting parallel to the sign line within the destructive zone and important bulls accumulation is above the histogram which signifies surge in value however, RIOT inventory costs are falling always.

The RSI line is near the RSI-based MA line above 30, reflecting neutrality. RIOT share’s common buying and selling quantity is 15.729 Million. Based on TradingView 175.738 Million shares of Riot Platforms, Inc. are free floating and the remaining 5.16% are carefully held.

In Q2, 2023, the Bitcoin mining firm RIOT Inc. reported 9.38% much less income than the estimated determine. Nevertheless, the reported EPS was 14.83% better than the estimated EPS.

Technical Ranges

Help Ranges:$10.09 & $8.94

Resistance Ranges: $11.51 & $15.55

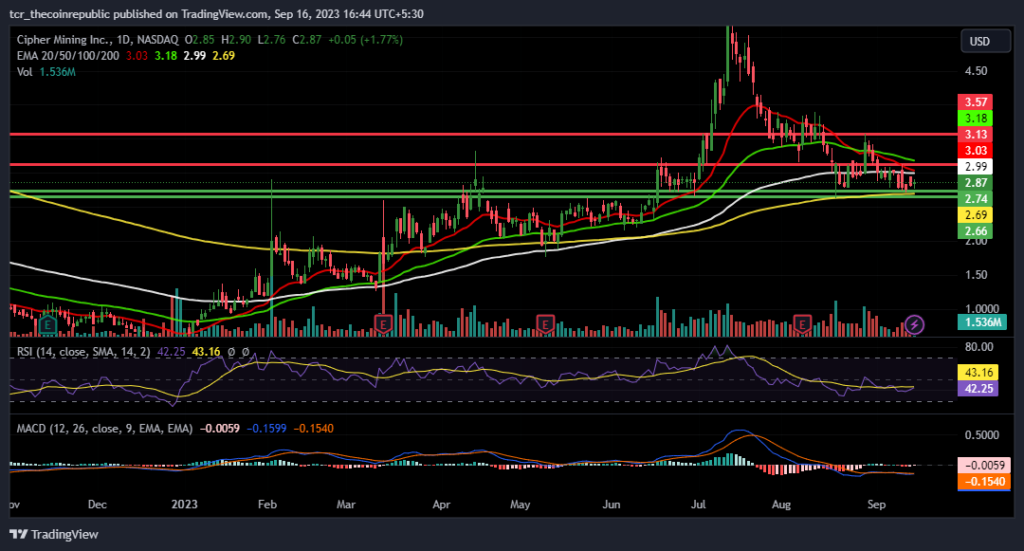

Technical Evaluation of CIFR Inventory

Cipher Mining, Inc. inventory misplaced 5.90% of its buying and selling value within the weekly time-frame and declined over 15.50% in a month. At press time CIFR inventory was buying and selling at $2.87 with an intraday buying and selling quantity of 1.536 Million.

CIFR inventory peaked at $5.30 and its lowest traded value was $0.38. On September 15, CIFR inventory opened at $2.85, and closed at $2.87.

Cipher Mining, Inc. has a market capitalization of $720.243 Million. Regardless of a brief time period decline, CIFR inventory value surged over 396.97% in YTD time-frame and 68.82% in a 12 months.

The annual value goal of CIFR inventory is $5.25, which is round 82.93% better than its present buying and selling value. Furthermore, the MACD is reflecting negativity and is shifting parallel to the sign line.

Technical Ranges

Help Ranges: $2.74 & $2.66

Resistance Ranges: $3.13 & $3.57

Conclusion:

over the previous one week, main crypto mining shares resembling CIFR inventory, MARA inventory and RIOT inventory have declined over 2-12 p.c. Regardless of constructive momentum within the crypto market, crypto mining is reflecting delicate negativity. As per market analysts, possibilities of interim reversal are low, and value would possibly slip additional.

Disclaimer

The views and opinions said by the writer, or any folks named on this article, are for informational concepts solely and don’t set up monetary, funding, or different recommendation. Investing in or buying and selling crypto or inventory comes with a threat of monetary loss.

[ad_2]

Source link