[ad_1]

Obtain free FTX Buying and selling Ltd updates

We’ll ship you a myFT Each day Digest e-mail rounding up the newest FTX Buying and selling Ltd information each morning.

The monetary particulars of the FTX saga will not be surfacing fairly as shortly because the guilty pleas. However Monday introduced some enjoyable bits of data for these of us nonetheless gawking on the wreckage nearly a 12 months later.

The primary was a presentation breaking down the asset-recovery efforts of FTX’s present administration:

The $7bn determine matches the estimates offered by the management team earlier this 12 months, so this breakdown isn’t precisely new, however there are some enjoyable particulars however.

Within the chart above, the “Digital Property A” group is liquid crypto together with Bitcoin, Ethereum and the relatively-not-illiquid Solana. The “Digital Property B” seem like shitcoins, kind of, with the most important place $362mn of Serum (as of Aug. 31).

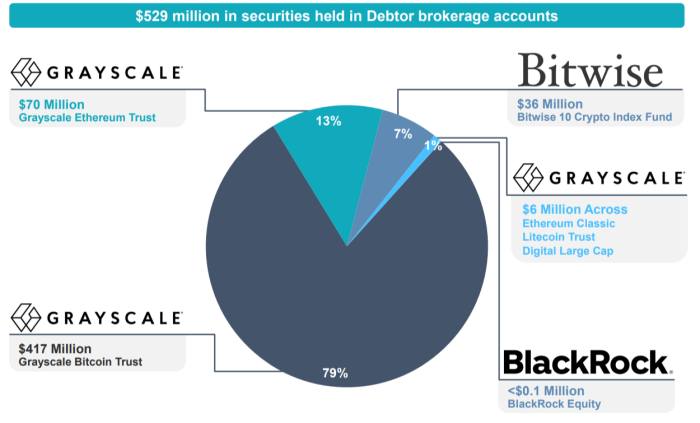

Additionally, huge congrats to FTX after last month’s Grayscale court ruling, we guess? The largest holding in FTX’s brokerage accounts is the Grayscale Bitcoin Belief, which has greater than doubled this 12 months due to its narrower low cost to NAV and Bitcoin’s rebound.

It has additionally obtained a handful of unsolicited questions on a few of its stakes in different companies, based on the presentation:

Administration can also be floating restarting FTX. ¯_(ツ)_/¯

Anyway, the second courtroom submitting comes from the prison trial of Sam Bankman-Fried. SBF’s defence attorneys have requested the choose to ban testimony from Prof Peter Easton of Notre-Dame, who shall be performing as an professional witness for the prosecution. (A part of their argument appears to be that he’s not adequate at computer systems to be an professional.)

The federal government opposes that, in fact, citing Easton’s experience and the work he has executed on the case to this point. Find the prosecutors’ filing here.

However what’s most entertaining is that the federal government goes forward and reveals the professor’s ongoing work calculating Alameda’s historic balances with FTX — principally the agency’s web P&L — from final 12 months:

Ahahaha that’s unimaginable! Let’s look a bit nearer at that X-axis . . .

So for one lovely second final 12 months, Alameda booked (barely) constructive efficiency. We predict it’s good that the terminally on-line younger crypto founders bought their want fulfilled for a day.

[ad_2]

Source link