[ad_1]

- Bitcoin’s greed has slowed, with a noticeable lack of risk-taking among investors.

- However, a dip could soon incentivize investors to HODL.

The past 24 hours have been a whirlwind for the crypto market, with Bitcoin [BTC] hitting the $100K milestone before plunging over 5% later in the day.

Typically, such dips attract bargain hunters, but subdued investor greed signals waning enthusiasm for holding.

This bull run has already minted countless millionaires and billionaires cashing in on substantial gains. Now, the focus shifts to those betting on Bitcoin’s next peak as a long-term investment.

What remains crucial is the balance between these opposing forces – will profit-takers dominate, or will risk-takers push for outsized returns?

Lack of risk appetite is holding Bitcoin back

On the 1-day timeframe, Bitcoin’s price chart shows mixed signals: a bearish MACD crossover and an RSI in neutral territory, despite Bitcoin reaching $100K.

While there’s still room for growth, it all comes down to whether investors are ready to embrace the volatility for the chance of multiplied gains.

Unlike the previous ATH in March, the greed index has remained under 90 this time, indicating a lack of risk-taking. This is pushing Bitcoin back into the FUD (fear, uncertainty, doubt) zone.

Psychologically, this could create strong resistance among both new and seasoned investors, with many likely opting to cash out for immediate gains rather than holding for the long term.

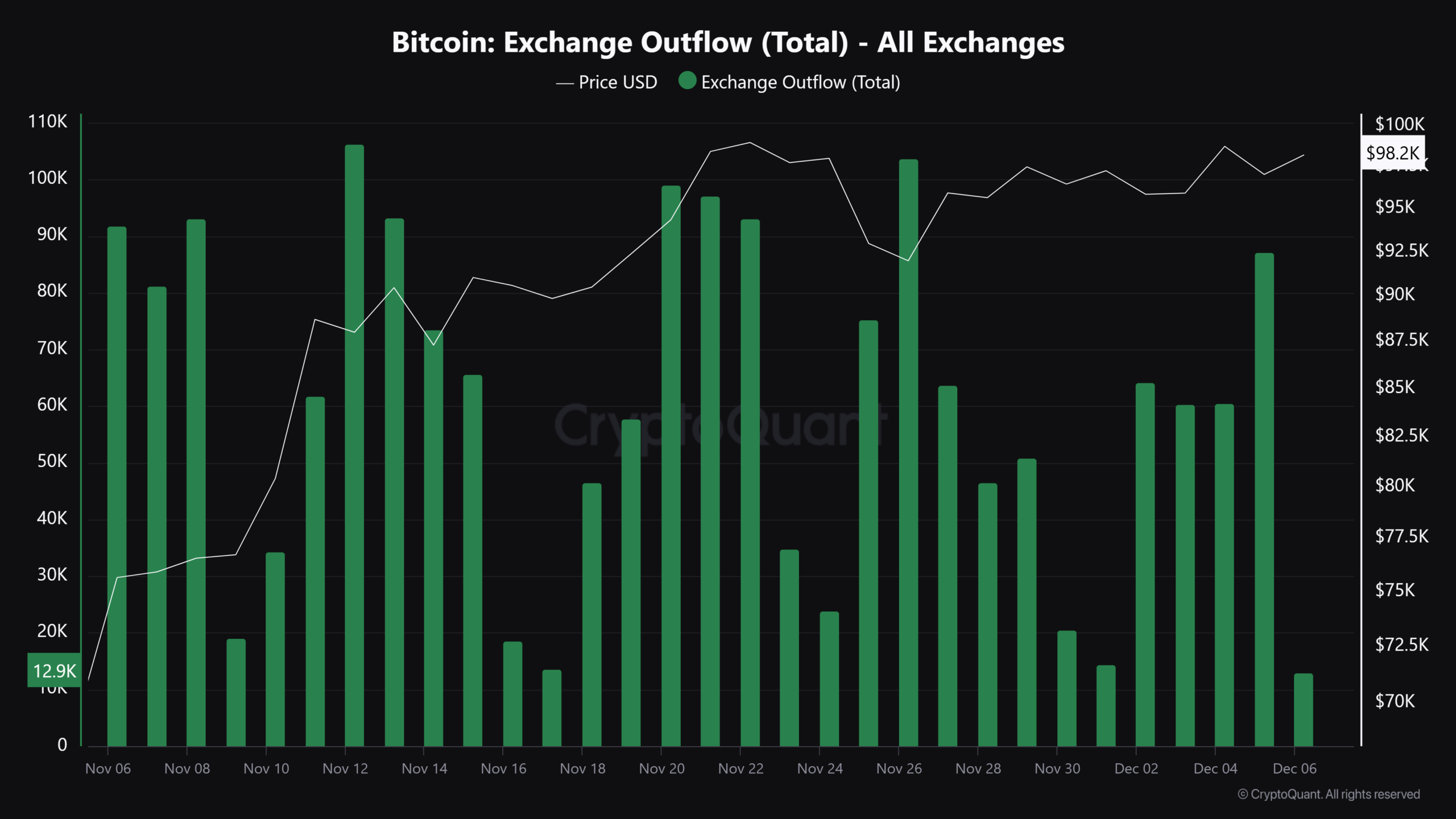

As a result, the $100K milestone didn’t even last a day, with profit-takers dominating the exchange flows. Both short-term and long-term holders cashed in on gains from previous dips, while risk-takers failed to step in and neutralize the selling pressure.

If this trend continues each time Bitcoin hits $100K, it could create an endless loop, where the lack of greed gives profit-takers a better chance to escape the market before prices can truly sustain higher levels – creating conditions ideal for a short squeeze.

So, should you cash out too when BTC hits $100K?

Following the new ATH of $103,629, Bitcoin’s price closed at $92,285 – its lowest point of the day, creating another dip-buying opportunity, particularly for short-term traders looking to capitalize on a potential rebound.

As a result, Bitcoin volume rose by 5%, reaching around $124 billion, with exchange outflows (coins withdrawn from exchanges) continuing to dominate the trading platforms, indicating strong investor conviction.

Whales have also seized the opportunity, scooping up 600 Bitcoins at a bargain price of $98,083.

Together, these factors suggest a potential bottom formation around $96K, where both investor and trader interest could converge, setting the stage for an even greater bounce back.

This is positive news for bulls. A confirmed $96K bottom, with new capital entering the market, would push Bitcoin just 4% into realized profits by the time it hits $100K.

This modest gain may not trigger a significant sell-off, as it’s unlikely to break even for many investors, encouraging them to HODL.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Therefore, the next key price range to watch is $96K – $98K, where notable activity is anticipated. Renewed greed in this range could fuel further momentum.

So, this might be the optimal time to buy for a potential $103K breakthrough. However, monitoring the liquidity within this price band will be crucial in the coming days.

[ad_2]

Source link