[ad_1]

- Ethereum may experience increased liquidity as the election cycle comes to a close.

- However, various factors cast doubt on its rebound potential.

With just a week until the election, the crypto market is poised for heightened liquidity – a potential catalyst for Ethereum [ETH] to break free from its downward slump. As ETH sits at a favorable greed index, this could signal a promising buying opportunity.

However, uncertainty clouds its rebound. If the previous pattern repeats, Solana could once again capitalize on Bitcoin’s market peaks, as it did recently with four days of strong daily gains even as BTC pulled back, potentially limiting ETH’s recovery prospects.

As a result, this weekend could prove pivotal, setting the stage for ETH to aim for the $3K mark, provided market conditions are favorable.

Ethereum’s core metrics facing pressure

This cycle has been particularly challenging for Ethereum. Despite a 40% increase in daily active addresses across its mainnet and Layer 2 networks, the ETH price hasn’t kept pace, faltering nearly 7% after closing at $2.7K just a week ago.

To compound these issues, Ethereum’s network fees have reached their lowest levels, falling behind competitors like Solana. This creates an additional challenge for Ethereum; with such low fees, concerns about network security could arise.

Overall, a confluence of factors has prevented ETH from capitalizing on Bitcoin’s peaks. Investors are growing increasingly uncertain about Ethereum’s future, leading them to see greater potential in other blockchains.

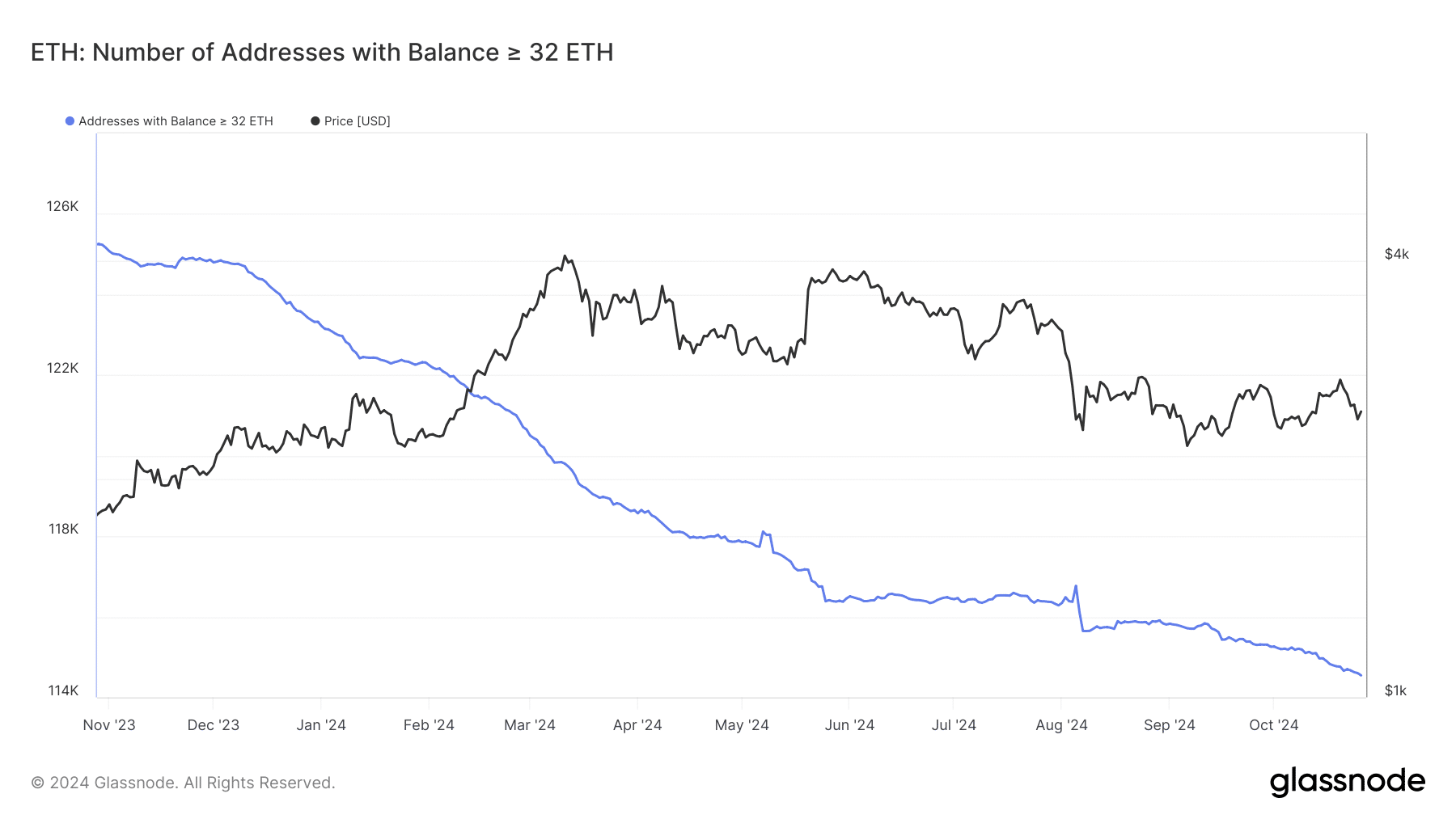

Adding to these challenges, the number of validators on the Ethereum network has dropped significantly, with staked wallets at a year-low. The proof-of-stake (PoS) consensus mechanism requires a minimum of 32 ETH to stake, and this decline in validators raises concerns about the network’s overall health.

Delays in transaction validation can lead to network congestion, driving users away. This cycle has seen a notable migration from ETH to SOL, where Solana’s high throughput enables faster transaction speeds and lower fees.

This trend underscores Ethereum’s struggle to retain its user base.

Election liquidity won’t be enough

If the network doesn’t tackle these challenges, the election buzz may only yield short-term gains for ETH, lacking the strength needed for a true breakout.

Ethereum must revitalize its market dominance, which has severely dwindled in the previous market cycle, currently sitting at just 13% – its lowest level against Bitcoin since April 2021.

While high Bitcoin dominance typically signals the start of an altcoin season, if this trend doesn’t reverse, ETH may struggle to reclaim its leading position in the market.

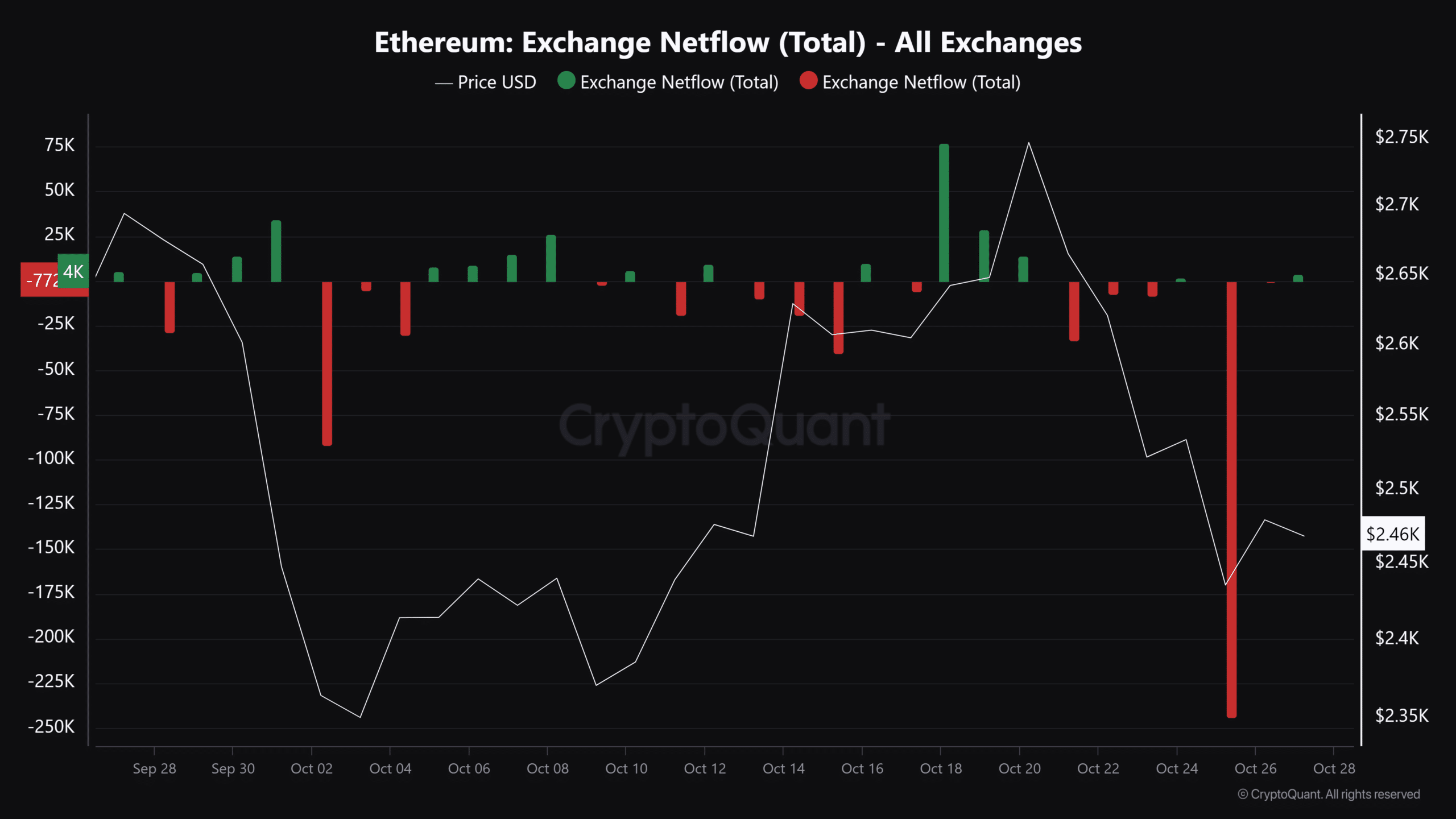

Interestingly, a spike in ETH outflows occurred just two days ago, with 244,000 ETH withdrawn from exchanges. This suggests that investors perceive the current price as a dip, potentially helping bulls maintain the $2.4K support line.

However, the impact on the price failed to materialize.

Read Ethereum’s [ETH] Price Prediction 2024–2025

That said, as the election approaches its conclusion, there’s a significant chance that ETH might experience short-term gains. This could help reverse its current trend and assist bulls in keeping bearish pressure in check.

However, the prospects for Ethereum to break out of its slump remain limited unless it manages to maintain network health. Without addressing these issues, there’s a significant risk that the current underperformance could become a lasting trend, jeopardizing ETH’s market position.

[ad_2]

Source link