[ad_1]

- BTC has surged by 5.91% over the past month.

- Analyst finds 350k new addresses are critical for Bitcoin to see a sustained uptrend.

Since hitting a local low of $58k, Bitcoin [BTC] has experienced a strong upswing on monthly charts to hit a local high of $69k.

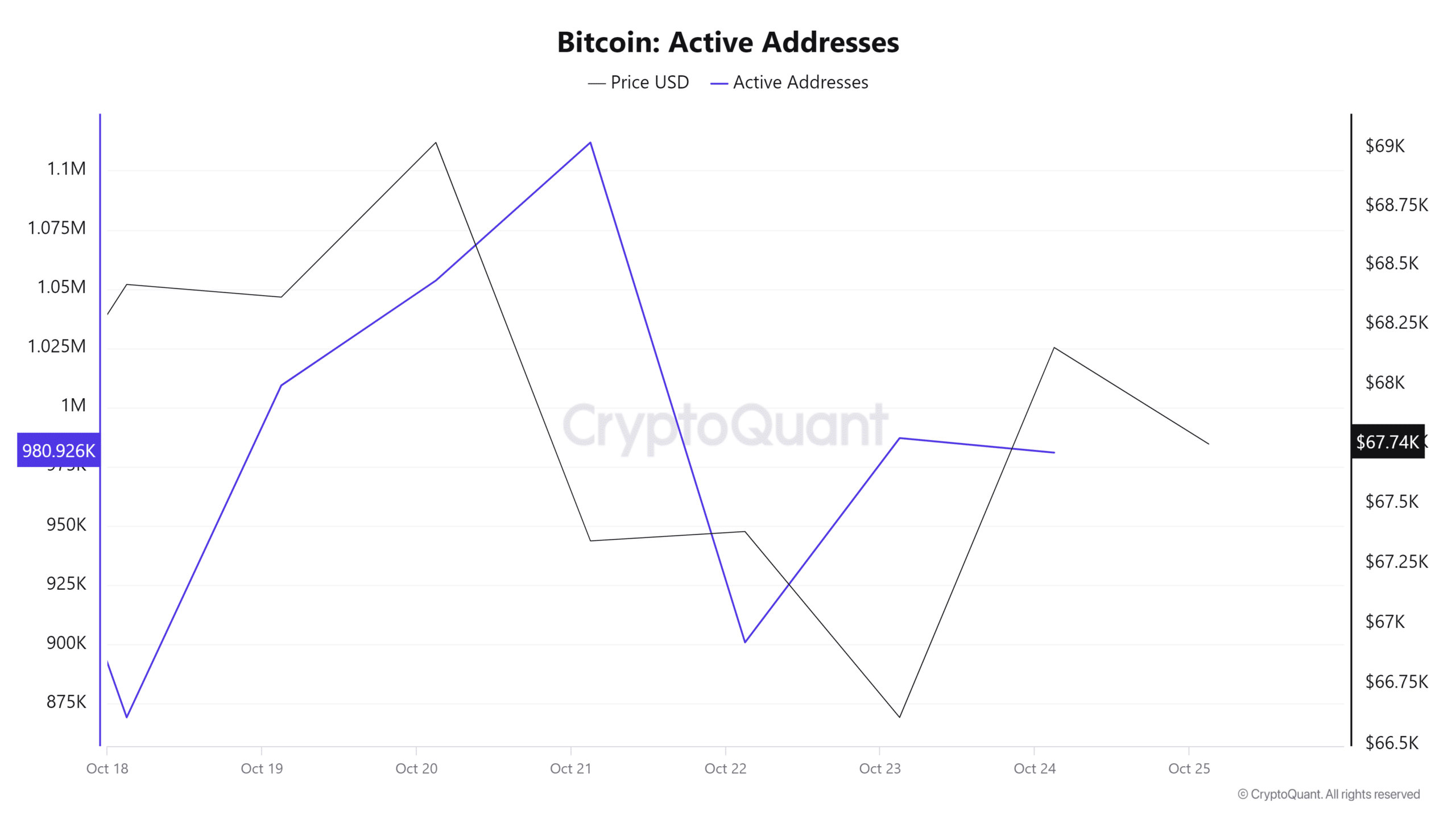

However, despite this upward momentum, Bitcoin’s daily active addresses have expressed a sharp decline. As such, active addresses have declined from a high of 1.1 million to 980k. This drop in active addresses has left analysts talking.

Inasmuch, Cryptoquant analyst Burak Kesmeci has suggested that 350k new addresses are the most critical for BTC to sustain an uptrend.

Why 350k addresses are critical

The analyst posited that new addresses are essential for Bitcoin bulls to gain market strength.

According to him, the market is healthy only if the number of new Bitcoin addresses increases.

Therefore, the 350k level is a pivot separating the bulls and bears. When the number of new addresses falls below 350k, the market faces a strong downward movement as bears take over thus starting a bear season.

Subsequently, when addresses remain above this level, it means bulls are gaining strength and the uptrend holds.

Historically, Bitcoin addresses have played a critical role in seeing both bull and bear seasons. For example, over the past 6 years, Bitcoin addresses have fallen below 250k three times where BTC declined.

In 2018, it dropped from $19k to $6k, in 2021, it dropped from $64k to $30k, and in 2024 from $73k to $49k.

Therefore, when new addresses flip 350k, the market will be healthy enough for investors. Although 2024 has seen a surge in new addresses, it has not surpassed 350k. As such, they fell to 210K in June 2024 and rose to 349K on October 14, 2024. However, they have declined again to 249k.

According to this analogy, the BTC market is not strong enough for a sustained rally.

What it means for BTC charts

Although Bitcoin is yet to flip 350k new addresses, the crypto is currently experiencing a strong uptrend. As such, prevailing market sentiment favors BTC for more gains on price charts.

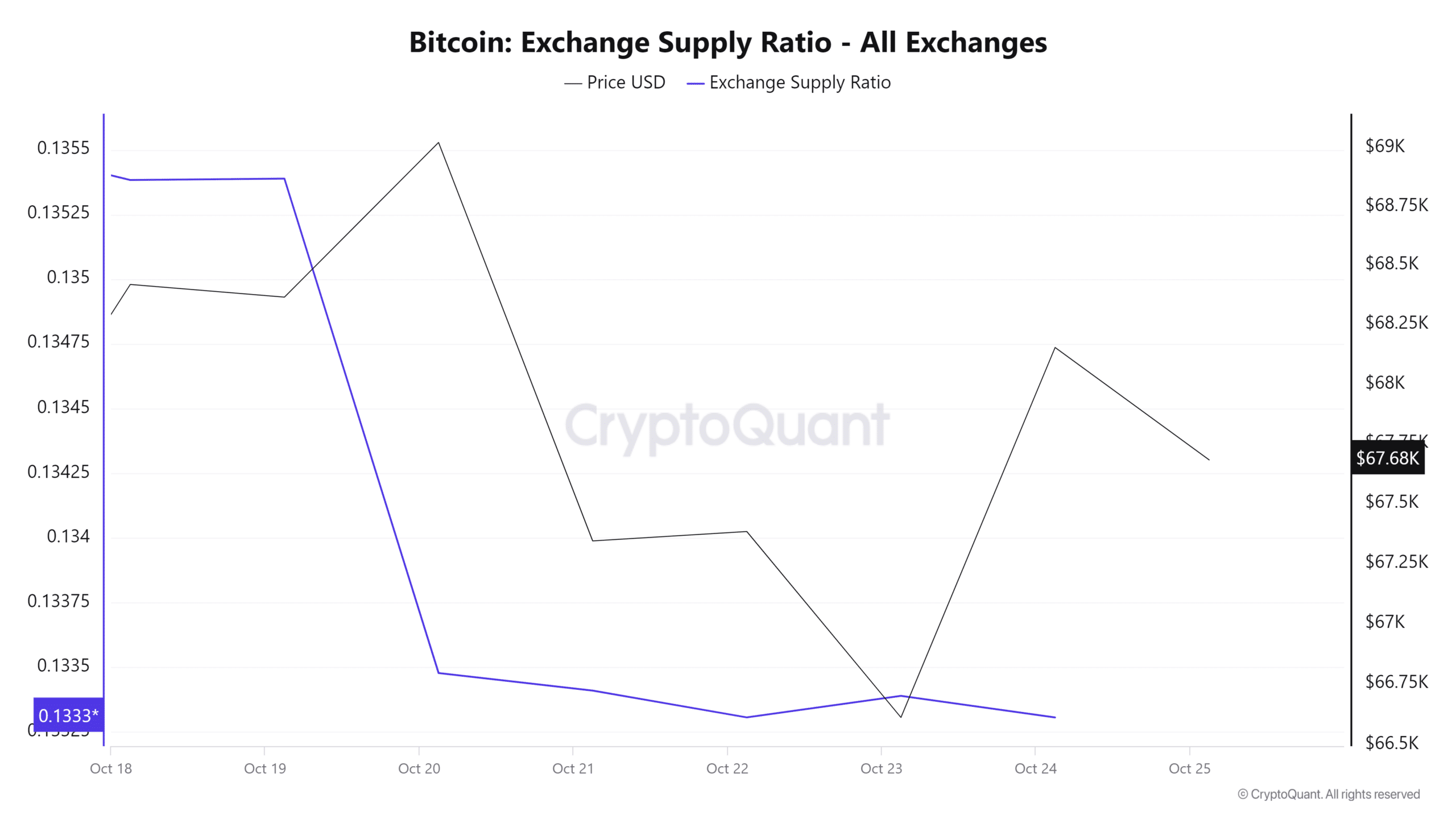

For example, the exchange supply ratio has experienced a sharp decline over the past week. This suggests that holders are accumulating and storing their Bitcoin off exchanges signaling they have no immediate intentions to sell.

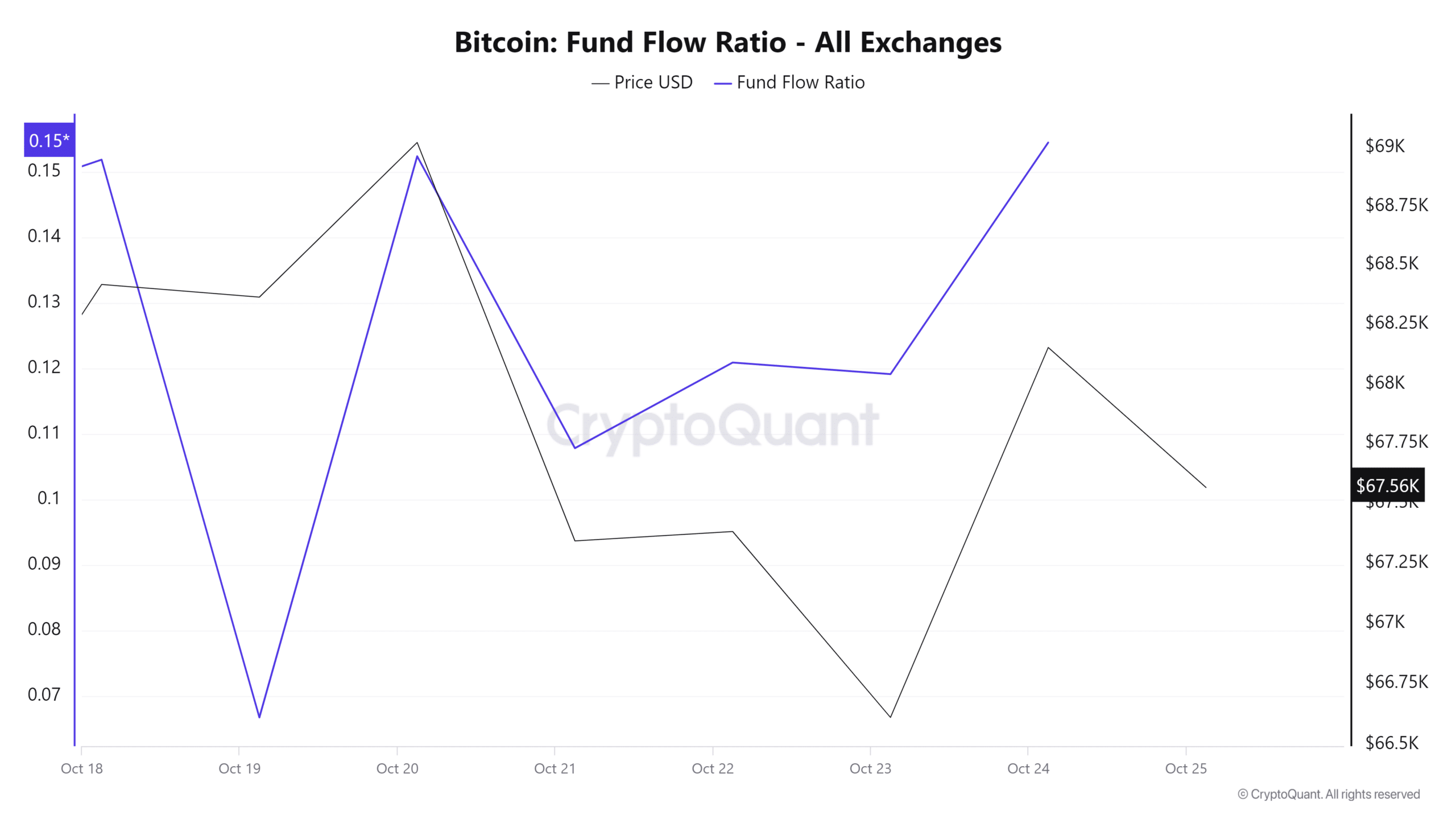

Additionally, Bitcoin’s fund flow ratio has increased over the past week from a low of 0.06 to 0.15. This indicates that more investors are buying BTC signaling increased demand and a bullish market sentiment.

Is your portfolio green? Check the Bitcoin Profit Calculator

In fact, at the time of this writing, BTC was trading at $67714. This marked a 5.91% increase on monthly charts.

Therefore, if the prevailing market sentiment holds, BBC will attempt $69400 resistance where it has faced multiple rejections.

[ad_2]

Source link