[ad_1]

- BlackRock’s Bitcoin ETF saw inflows of $184.4 million, boosting 2024 totals to $17.944 billion.

- Institutional ETFs are nearing Satoshi’s holdings, potentially surpassing them by year-end.

After a period marked by minimal activity, BlackRock’s Bitcoin [BTC] ETF (IBIT) has regained momentum, recording substantial inflows starting on the 23rd of September.

Bitcoin ETF performance analyzed

Notably, on the 25th of September, IBIT saw an impressive influx of $184.4 million, while the total inflow across all Bitcoin ETFs amounted to $105.9 million.

In contrast, Grayscale’s GBTC, which usually experiences outflows, reported zero movement on the same day.

However, Fidelity’s FBTC and Ark’s ARKB experienced outflows of $33.2 million and $47.4 million, respectively.

This resurgence in ETF activity has propelled the U.S. BTC ETF to an astounding $17.944 billion in inflows for 2024, marking a record-breaking year-to-date accumulation of 916,047 BTC—only about 84,000 BTC shy of the coveted 1,000,000 BTC milestone.

Seeing this impressive growth, Eric Balchunas, Bloomberg’s Senior ETF Analyst took to X and noted,

“U.S. bitcoin ETFs had good day yesterday pushing YTD flows to new high water mark of $17.8b. They’re now 92% of the way to owning 1million bitcoin and 83% of way to passing Satoshi as top holder. Tick tock..”

Is Satoshi Nakamoto’s place under threat?

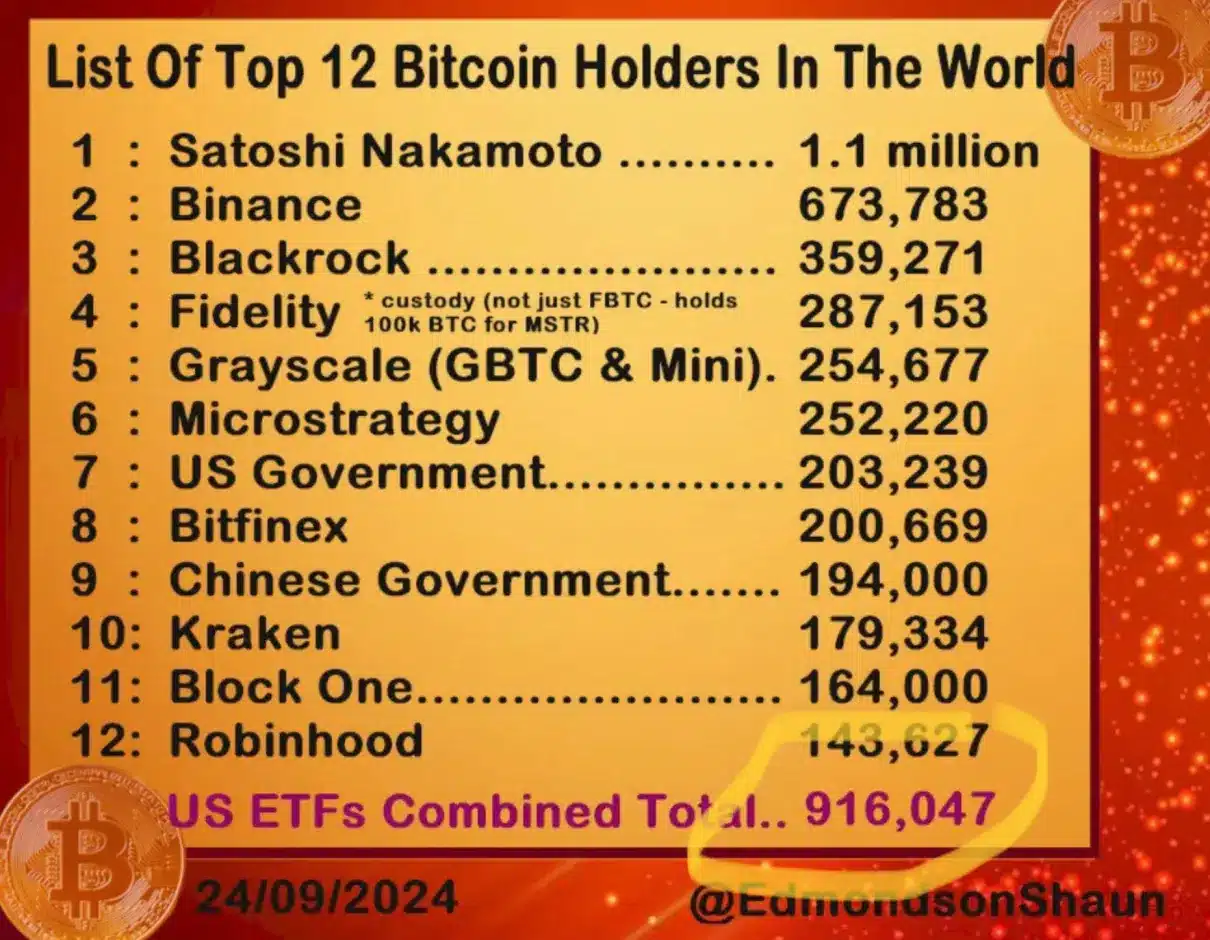

Satoshi Nakamoto, the creator of Bitcoin, is estimated to hold approximately 1.1 million BTC, a figure that institutional BTC ETFs are rapidly approaching.

Recent data indicates that these ETFs have now accumulated about 83% of Satoshi’s holdings, and if the trend of increasing inflows continues, it could soon surpass him.

Currently, Satoshi Nakamoto leads the list of the top Bitcoin holders, closely trailed by Binance with 673,783 BTC.

Notably, major asset managers like BlackRock, Fidelity, and Grayscale collectively hold a significant 901,101 BTC through their ETF products, with individual holdings of 359,271 BTC, 287,153 BTC, and 254,677 BTC, respectively.

In contrast, the remaining five asset managers with BTC ETFs possess a combined total of just 14,946 BTC.

Sharing a similar line of thought was Spencer Hakimian, Founder of Tolou Capital Management who said,

“ETF’s going to be bigger than Satoshi by Christmas Day.”

What’s more to it?

Meanwhile, MicroStrategy, led by Michael Saylor, ranks sixth with 252,220 BTC and is on a path to potentially join the top tier of Bitcoin holders.

Thus, as BTC ETFs continue to capture attention, Bitcoin itself has seen a resurgence in price.

After facing challenges in breaking through the $60,000 barrier, BTC was trading at $64,358, reflecting a modest increase of 0.91% over the past 24 hours.

[ad_2]

Source link