[ad_1]

- Drop in fees signals a challenging period for the network’s profitability

- Supply on exchanges fell, with other developments supporting a price hike

The total fees generated by the Bitcoin [BTC] network fell by 18.25%, compared to the previous week’s value. According to IntoTheBlock, Bitcoin made only $5.90 million.

However, that was not the only thing. The decline also meant that the network registered the lowest fees since November 2023.

Lower transactions equal lower fees

For those unfamiliar, the trading volume of Bitcoin usually determines how much in fees the network makes. If volume is high, it means user demand for block space would increase.

Therefore, miners would be able to validate new blocks while making profits. The last time such a thing happened was during the halving when the Runes protocol came into play.

At the time, fees spiked and miners’ profitability hit a high point. Alas, in recent times, that has not been the case, with BTC’s price being one of the culprits.

At press time, Bitcoin’s price was $58,135. Before its most-recent hike, the coin was trading at a level as low as $54,832, while struggling with falling interest and low demand.

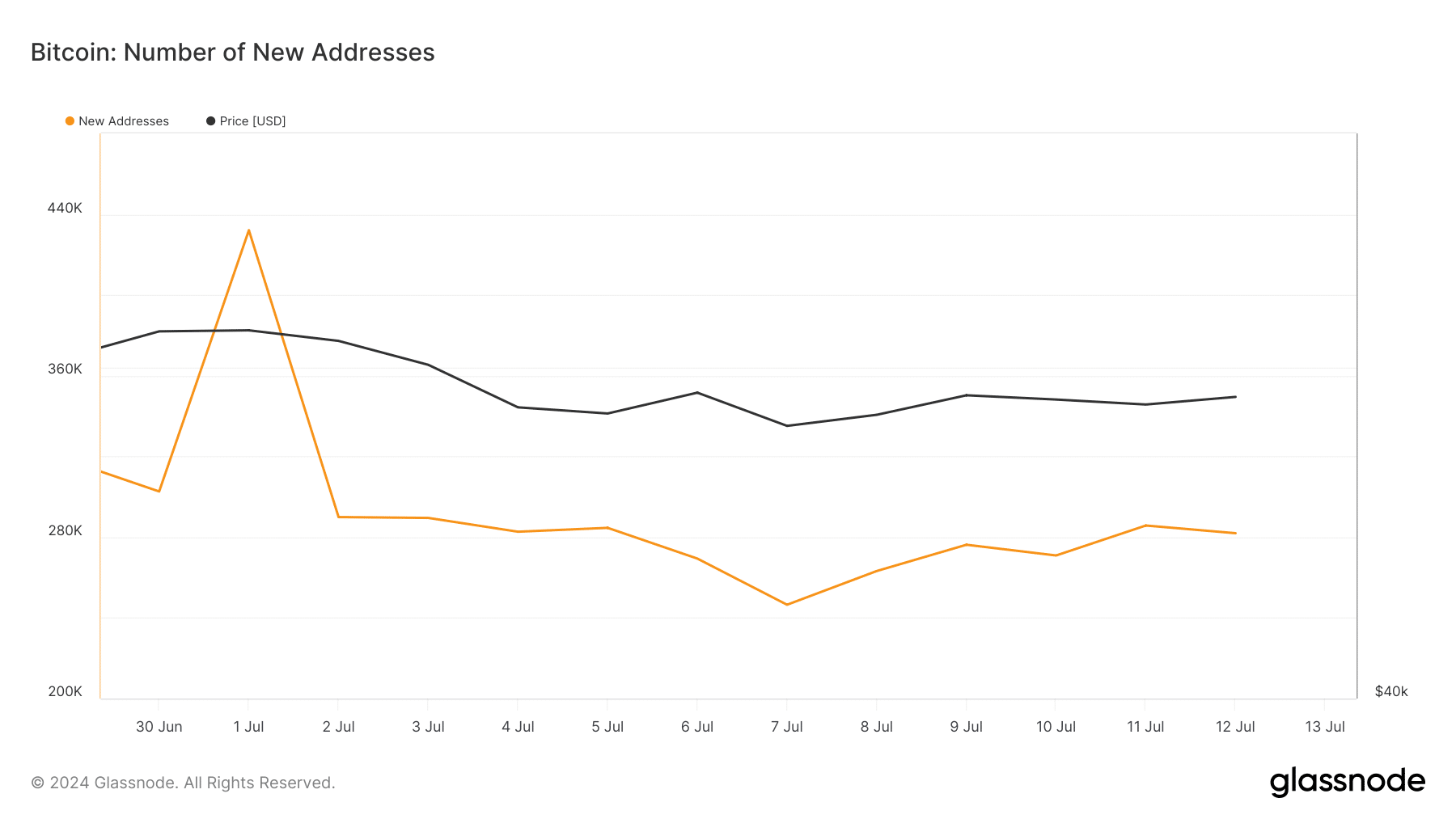

AMBCrypto found evidence of the low demand by looking at the number of new addresses. According to Glassnode, the number of new Bitcoin addresses on 12 July was just 289,915. Towards the beginning of the month, however, this same metric stood at 432,026.

This decline implies that there has been a drop in first time transactions made by unique addresses on the network.

BTC set to walk its way back up

If this figure continues to fall, it would be inevitable not to record another decline in Bitcoin fees. However, if a jump occurs in the coming weeks, the network might make more revenue and BTC’s price might also appreciate.

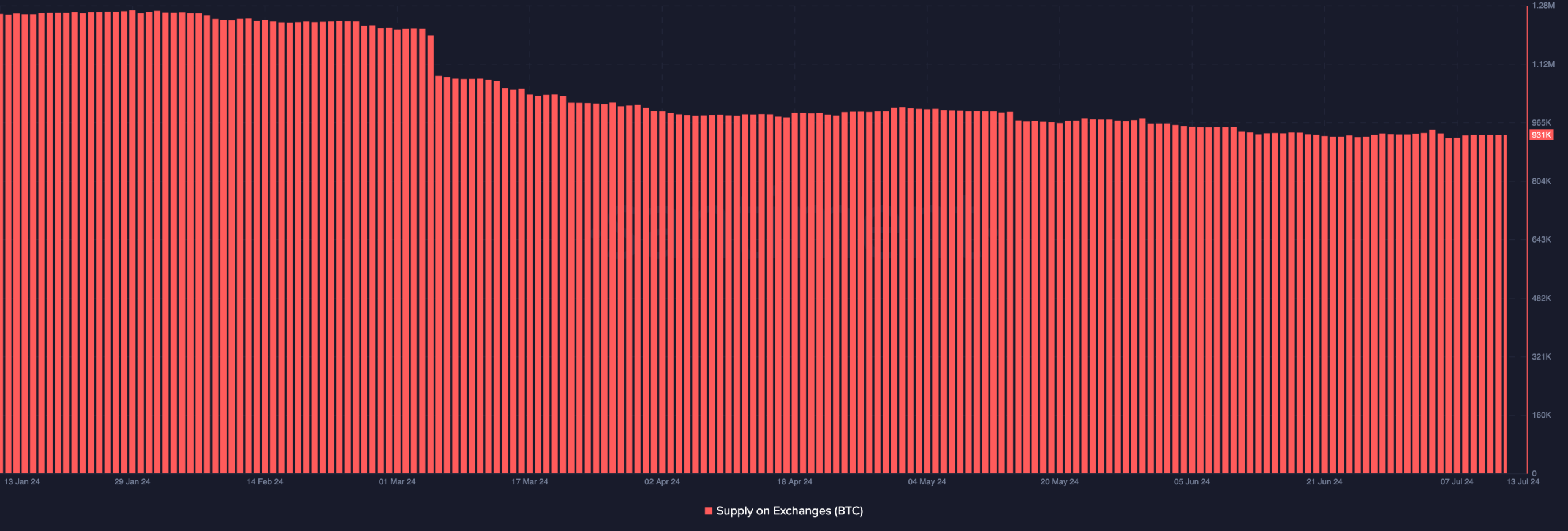

Additionally, we looked at the supply on exchanges. When the supply on exchanges increases, it means that holders are most likely looking to sell. If this happens, the price of Bitcoin might fall on the charts.

At the time of writing, the supply was down to 931,000. Should this remain the case as time goes on, the cryptocurrency’s price will rebound and it might re-test $60,000 in the short term.

Also, it seemed that Bitcoin may be heading towards a perfect condition for a notable hike. For example – AMBCrypto reported how the Crypto Fear and Greed Index dropped to extreme fear, hinting at a buying opportunity.

Besides that, the German government had a hand in pushing the price down on the back of its massive sell-offs. Finally, Bitcoin also registered it highest ETF inflows for the month on 12 July.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Should these condition remain, and if they are later accompanied by buying pressure, BTC’s price might begin a hike that takes it towards $63,000 or $65,000 in a matter of weeks.

However, this prediction could be invalidated if another round of whale sell-offs appear. If that is the case, Bitcoin might fall to $57,000 again.

[ad_2]

Source link