[ad_1]

- Analyst claims that the price impact on BTC from miners has declined.

- However, the total miner supply stood at over $100 billion, hence a key price factor.

Bitcoin [BTC] was back to its three-month-long range lows near $60K amidst compounding negative sentiment drawn from several factors.

Market observers have cited macro uncertainty, the Bitcoin miner crisis, and supply overhangs from various entities, including planned Mt. Gox repayments.

However, one analyst, Fred Krueger, had downplayed the impact of Bitcoin miners on BTC price action based on the amount held by top miners and monthly supply. He said,

“These miners no longer matter to the price of Bitcoin. The top 5 together hold 34K BTC. Even if they sold half of everything they have, that’s only 1 billion USD, or 0.1% of the value of the asset. In terms of new supply, these 5 generate 2K BTC per month. It no longer matters.”

No, BTC miners still matter

Marathon Digital, Clean Spark, and Riot Blockchain are amongst the top public BTC miners per market cap. However, other analysts countered Krueger’s argument.

One of them, James Van Straten, underscored that most of the miners’ selling pressure was from unprofitable private miners.

“Public miners only have 20-25% of the hash rate. A lot of private companies that hold BTC are going under/spending BTC. This is one of the primary reasons why BTC struggles after each halving.”

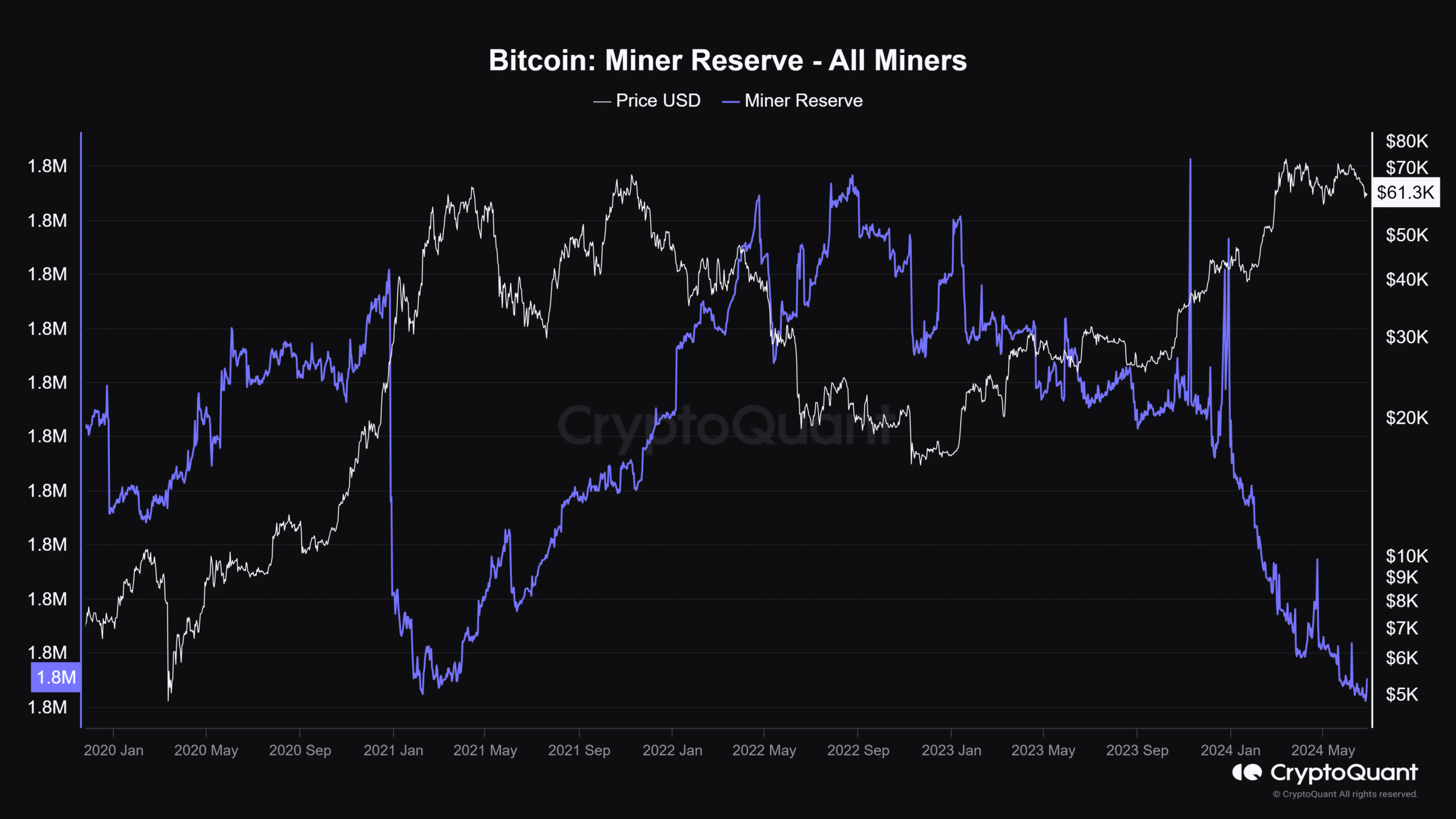

Per Straten, the total supply held by miners was staggering at 1.8 million BTC, worth about $109.8 billion at current market prices.

The analyst added that despite a decline in the total supply held by miners, the staggering amount was still a “constant sell pressure.”

AMBCrypto analysis of the total BTC miner reserve confirmed Straten’s take. The metric had dropped to 1.8M BTC, which matched the lows seen in 2021.

A recent AMBCrypto report established that BTC Miner to Exchange Flow has declined, denoting less BTC being forward to exchanges for sell-offs.

However, this also meant that future price upswings would tip the miners to offload at higher profits.

Another analyst, Willy Woo, also maintained that the miners still matter.

“Strip that away to get the real long term demand and supply. New investors, OG sellers, miners selling new supply in impulses. Turns out they still matter.”

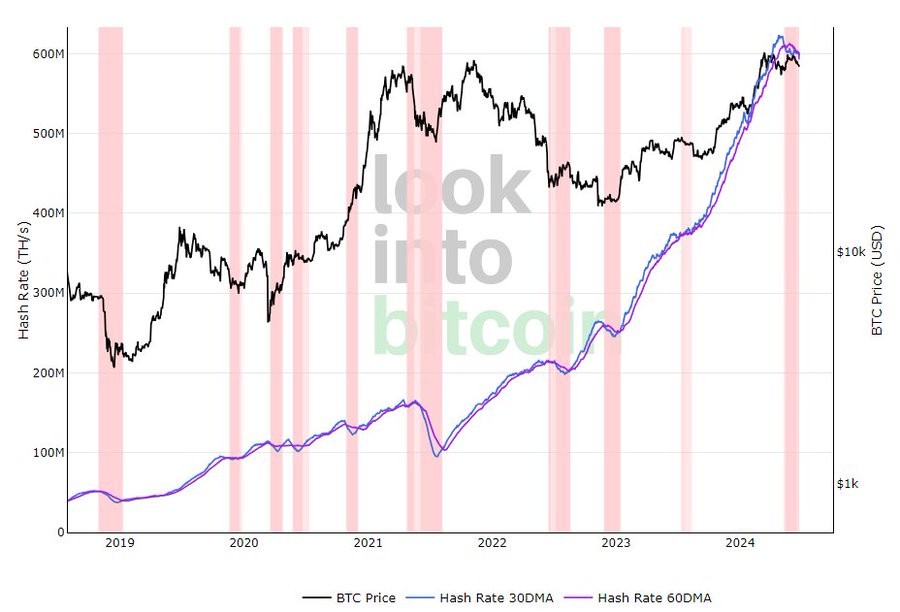

In the meantime, the miner capitulations were far from over, and hashrates remained low. One user noted that the current one was the longest capitulation since the 2022 crypto winter.

“Hashrate continues to fall. This is now the longest #bitcoin miner capitulation since the bottom of the 2022 bear market.”

Historically, BTC prices bounce back whenever hashrates increase. If this trend continues, it could reinforce the idea that miners still have a say in BTC prices.

[ad_2]

Source link