[ad_1]

Altcoins have taken another leg down to start the week while most digital assets continue a multi-month downtrend.

At time of writing, the total market cap of all crypto assets (TOTAL) is valued at $2.32 trillion, down from $2.39 trillion earlier in the day – a $70 billion haircut.

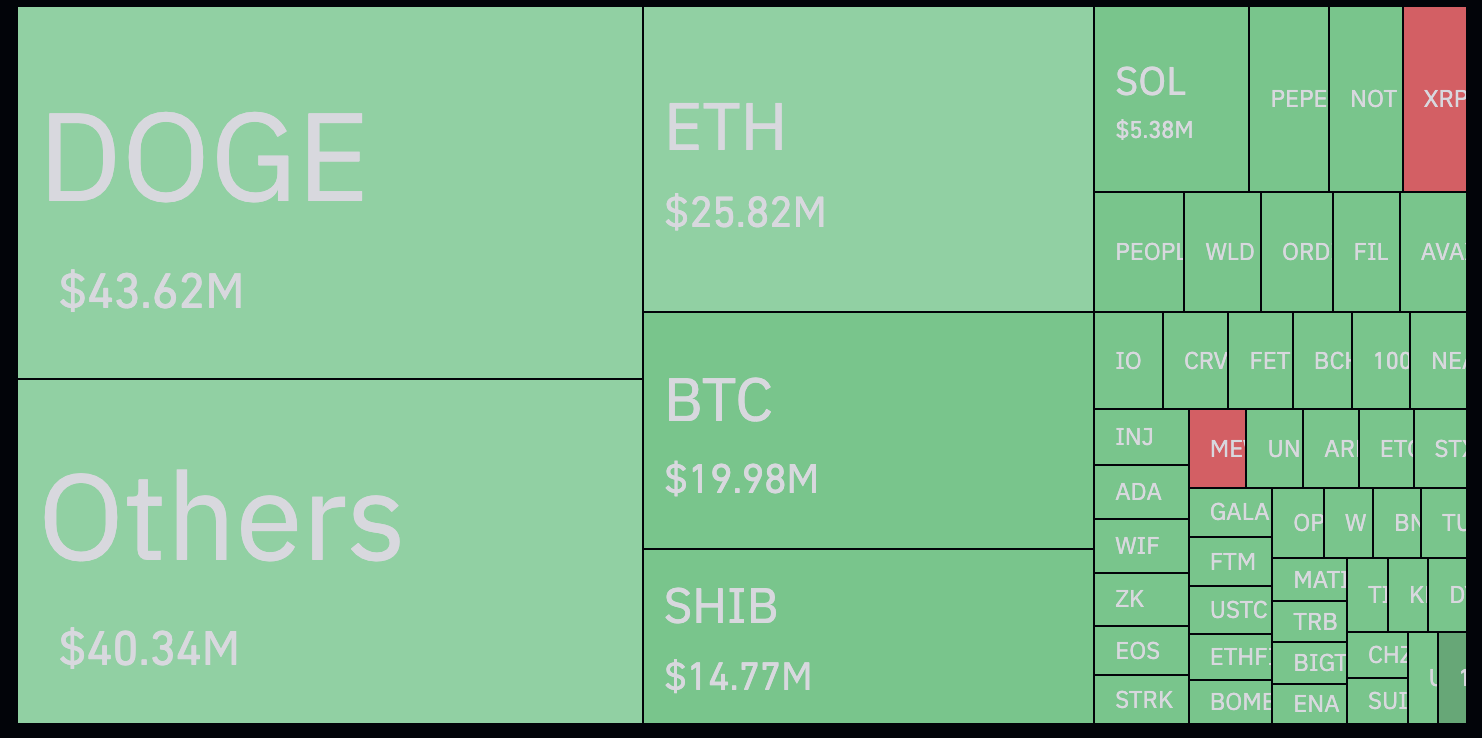

According to crypto data aggregator Coinglass, there has been over $242 million in liquidated positions, largely from traders attempting to long altcoins.

Coinglass’s current data shows that traders bullish on Dogecoin (DOGE) have been the hardest hit of anyone in the last 12 hours, with other altcoins in the memecoin sector like Shiba Inu (SHIB) not far behind.

The decentralized finance (DeFi) sector is also facing a bloodbath, with multiple coins now at or close to all-time lows.

DYDX, the native token of the Ethereum-based decentralized exchange (DEX), hit $1.40 early on Monday and is now 95% down from its all-time high and only a 28% move from all-time lows.

Curve Finance (CRV), one of the biggest DEXes in the space, hit an all-time low of $0.23 late last week after its founder faced roughly $100 million in liquidations.

According to digital assets manager CoinShares, institutional investors withdrew over $600 million in capital from exchange-traded products (ETPs) last week, likely due to the latest Federal Open Market Committee (FOMC) meeting being more hawkish than expected.

“This occurred under similar circumstances: a period of significant inflows followed by a more hawkish-than-expected FOMC meeting, prompting investors to scale back their exposure to fixed-supply assets. These outflows and recent price sell-off saw total assets under management (AuM) fall from above US$100bn to US$94bn over the week.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Natalia Siiatovskaia/A. Solano

[ad_2]

Source link