[ad_1]

- Mt. Gox transferred 42,830 BTC, valued around $2.9 billion, to new addresses on the 28th of May.

- Rising Bitcoin supply and potential large-scale sell-offs by Mt. Gox creditors could pressure prices.

The Tokyo-based Mt. Gox, once the behemoth of Bitcoin [BTC] exchanges, handling 70% of all transactions by 2013, has re-entered the cryptocurrency narrative after a significant period of dormancy.

The platform, which ceased operations and entered bankruptcy following a massive security breach in 2014 that led to the loss of 800,000 bitcoins, is now making headlines again.

Recent activities suggest a significant movement of funds, which has piqued the interest of investors and analysts across the globe.

Mt. Gox resurfaces, makes historic Bitcoin transfers

As part of the ongoing bankruptcy resolution, Mt. Gox’s trustees have begun transferring substantial bitcoin holdings.

Data from Arkham Intelligence indicated that 42,830 BTC, valued around $2.9 billion, were moved to new addresses in the early hours of the 28th of May.

This marks the first such activity in five years and is a precursor to a potential distribution of these assets to creditors before the end of October 2024.

The looming question is the impact of these moves on the Bitcoin market, particularly whether this will lead to a selling spree among the recipients.

Following the transfer, Bitcoin experienced a slight dip, approximately 2%, which brought its trading price down to about $67,830.

This shift occurred amidst a broader context of Bitcoin’s recent 24-high of over $70,000.

Observers are keenly watching the potential ripple effects of Mt. Gox’s large-scale asset movements, given the historical precedents set by similar large disbursements in the cryptocurrency space.

In-depth analysis by AMBCrypto has explored various metrics that could influence Bitcoin’s resilience to potential market shocks stemming from these releases.

Supply dynamics and investor sentiment

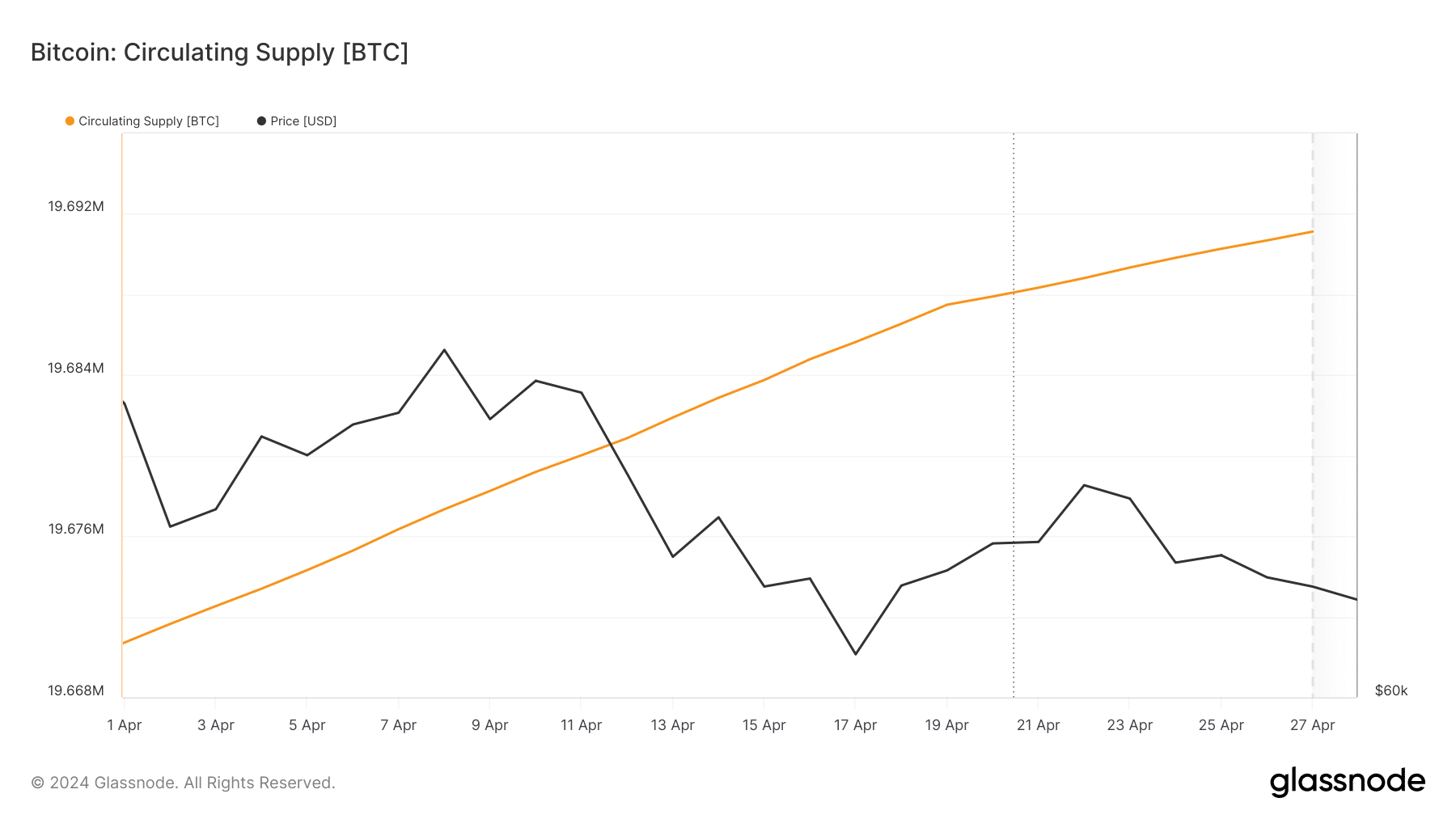

Complicating the market outlook is the behavior of Bitcoin’s circulating supply and investor demand.

Data from Glassnode indicates an increase in circulating supply, which, if not matched by demand, could exert downward pressure on Bitcoin prices.

This is a classic economic scenario where an oversupply, without corresponding demand, leads to price depreciation.

This trend could become particularly impactful if Mt. Gox creditors choose to sell during a time of increasing supply like this.

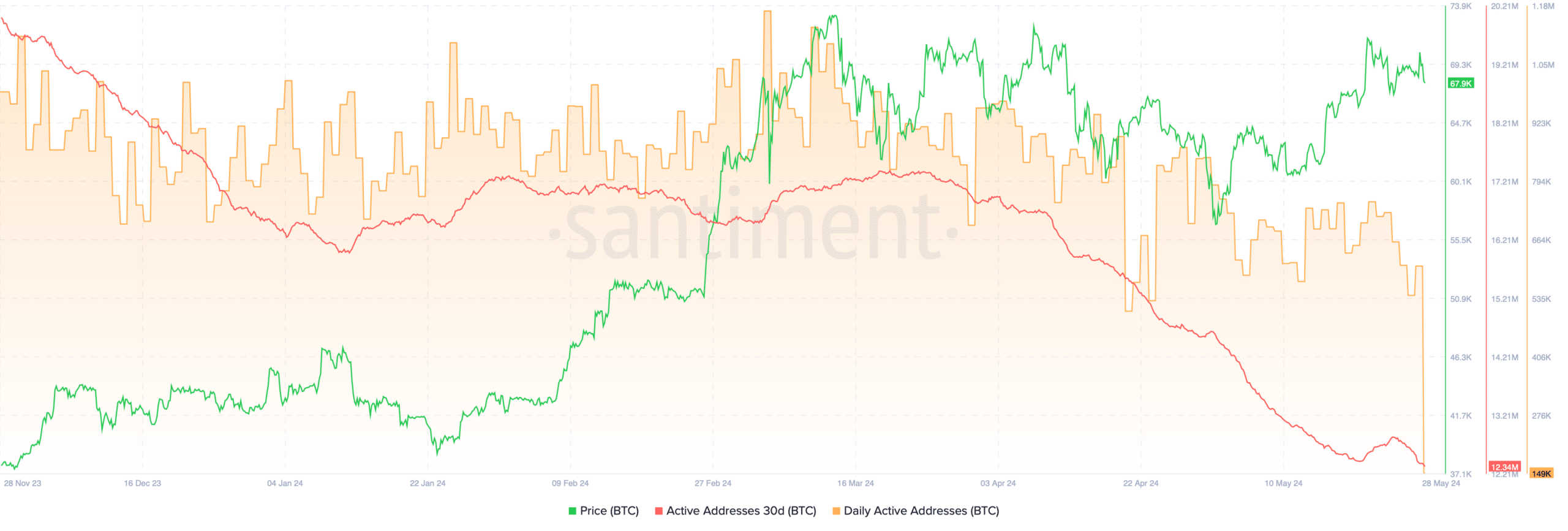

Conversely, according to Santiment data, Bitcoin’s daily active addresses and 30-day active addresses are also declining, suggesting a reduction in demand.

In such a market condition, a sell-off by Mt. Gox creditors could also lead to a sharp price correction in BTC.

However, there are counterbalancing forces at play.

The approval and operation of Bitcoin ETFs, which are consistently purchasing significant amounts of Bitcoin daily—now holding 855,619 Bitcoin and buying an average of 6,200 BTC per day—might mitigate potential market shocks.

These ETFs could absorb some of the increased supply if Mt. Gox creditors begin to sell, potentially stabilizing prices.

Further buoying investor sentiment, AMBCrypto recently reported that the Bitcoin Rainbow Chart—an indicator used to gauge long-term value trends—shows Bitcoin currently positioned in the ‘Buy’ zone.

Is your portfolio green? Check out the BTC Profit Calculator

Historically, entering this zone has preceded substantial price increases.

The current positioning suggests that this could be an opportune moment for investors to acquire Bitcoin at a lower price before it ascends into the ‘Accumulate’ and ‘HODL’ zones.

[ad_2]

Source link