[ad_1]

- Bullish Ethereum whales got liquidated due to highly volatile price movements.

- Holders remained unprofitable despite rising prices.

Ethereum [ETH] has experienced massive volatility over the past week, causing traders to lose money left right and center.

Whales see red

Not only retail investors, but some whales have also been subject to liquidations over the past few days.

According to Lookonchain’s data, a whale, despite previous losses totaling $4.5 million, doubled down on its ETH position, demonstrating confidence in the asset’s potential, and ended up losing money.

The investor also made a move involving the withdrawal of 8,249 ETH from Binance [BNB], converting it to Compound [COMP], and borrowing 17.3 million Tether [USDT] from the platform to make the sizeable bet.

Other traders got liquidated as well. According to Coinglass’ data, $6.28 million worth of long Ethereum positions were liquidated within a 24-hour window.

Despite these setbacks, the growing number of long positions taken towards ETH grew significantly.

This suggested a rising optimism among traders, reflecting a bullish sentiment towards Ethereum’s future prospects.

Implied Volatility for ETH also surged in recent days, mirroring the heightened uncertainty and risk prevailing in the market.

Even though a high IV is more bearish in nature and most traders prefer to short an asset during periods of high IV, the overall sentiment towards ETH has remained positive.

Looking at the data

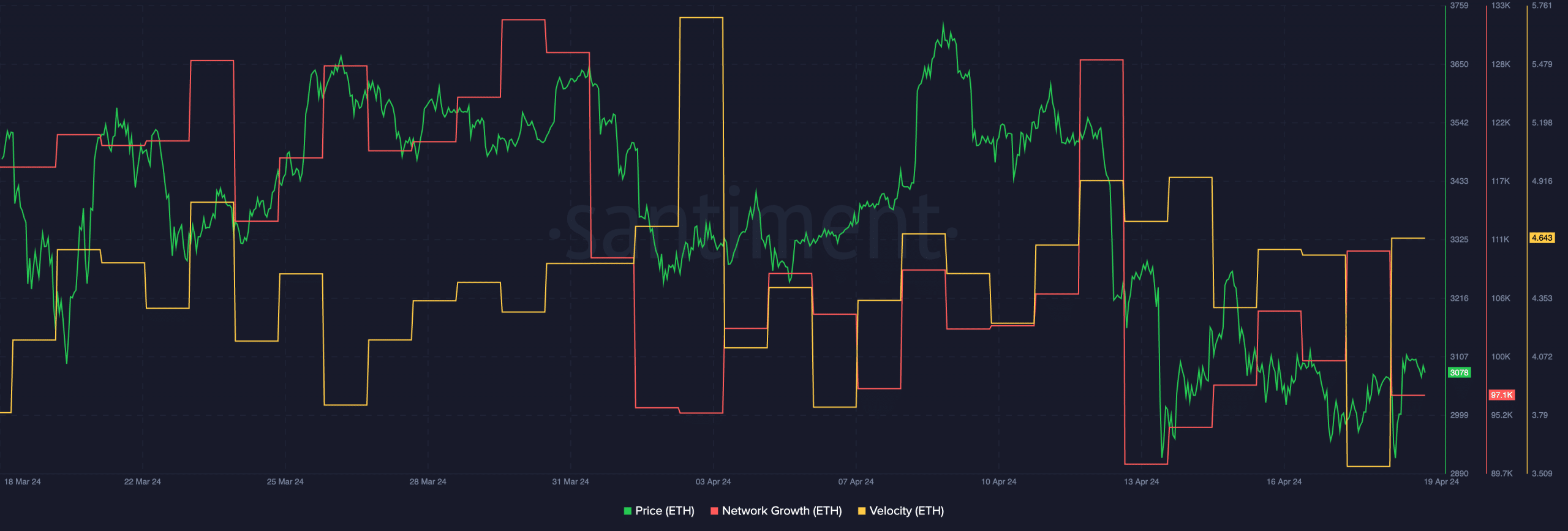

In the last 24 hours, ETH’s price grew by 3.78% signifying short-term bullish momentum. However, according to AMBCrypto’s analysis of Santiment’s data, the network growth around ETH declined.

This indicated that new addresses were losing interest in the ETH token.

While Network Growth had declined, indicating a potential slowdown in new user adoption, the rise in velocity suggested increased trading activity and liquidity in the market.

Read Ethereum [ETH] Price Prediction 2024-2025

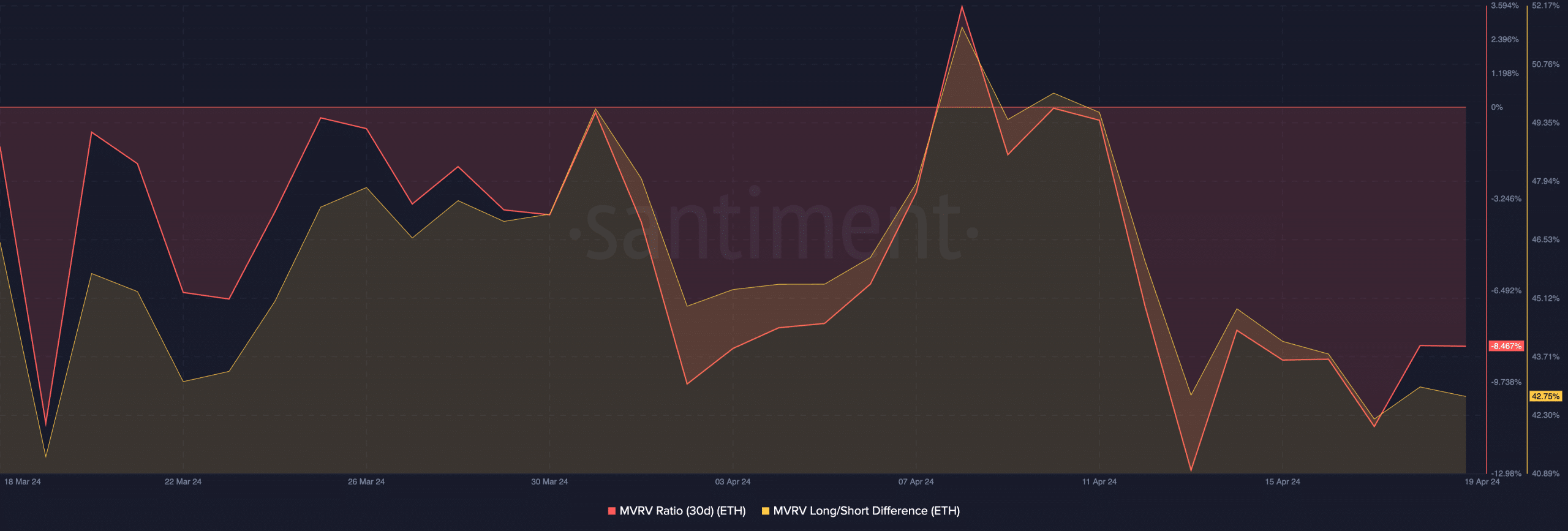

Despite the surge in price, the MVRV ratio for ETH remained negative at press time, signaling that Ethereum holders were yet to realize profits.

This scenario implied a continued holding pattern among Ethereum investors, potentially supporting further upward momentum for ETH’s price as holders awaited more favorable market conditions.

[ad_2]

Source link