[ad_1]

Whats up and welcome to the newest version of the FT’s Cryptofinance e-newsletter.

In case you hadn’t observed, bitcoin is on a little bit of a tear this month.

Its 16 per cent acquire in December alone takes the features for the yr to greater than 160 per cent and the $44,000 value was final seen 20 months in the past.

Like Dorothy found in The Wizard of Oz, it was all a dream. The crashes, company failures, felony prices and lawsuits that piled up on crypto in that interval instantly appear a distant reminiscence.

Individuals equivalent to Sam Bankman-Fried and Changpeng Zhao are now not the highest bosses however seen because the outdated guard on the way in which out and related to previous crimes and misdemeanours.

Across the trade the arrogance is tangible. Need to invest in a bitcoin personal credit score fund run by a start-up backed by Sam Altman? How about shopping for a crypto fund that’s buying and selling at as a lot as eight occasions its underlying value?

The tide is carrying sooner or later, within the type of a spot bitcoin change traded fund within the US. Mistakenly or not, the expectation is that it may come as quickly as subsequent month.

There may be one unheralded facet to this newest rally: the affect of Asia. The area has not been as forceful in clamping down on unhealthy behaviour because the US.

For instance, each South Korea and the US wish to extradite Do Kwon, the entrepreneur behind the $40bn collapse of crypto token TerraUSD, to reply prices. However the place South Korea desires to talk to him for allegedly violating capital market guidelines, the US has charged him with eight felony counts, together with securities, commodities and wire fraud.

“A lot of the regulatory crackdown we’ve seen this yr has occurred firmly within the US. Singapore, Japan, South Korea, they’re extra hospitable to crypto,” stated Ram Ahluwalia, chief government of funding adviser Lumida Wealth Administration.

“These markets are extra speculative, and crypto subsectors like gaming are a lot extra in style on the market,” he added.

A lot in order that the primary sovereign foreign money that individuals use to commerce in opposition to crypto tokens is now the Korean gained, not the US greenback.

The gained accounts for 41 per cent of the market, in line with CCData, up from 24 per cent in September. In the identical interval the US greenback’s share of the market has fallen from 51 per cent to a tick below 40 per cent.

“The truth that bitcoin broke via resistance within the Asian hours is a testomony to how necessary retail volumes in that area, specifically South Korea, have gotten,” stated Michael Safai, chief government at buying and selling agency Dexterity Capital.

“Institutional grabs headlines, however retail movement is the lifeblood of the crypto markets,” he added.

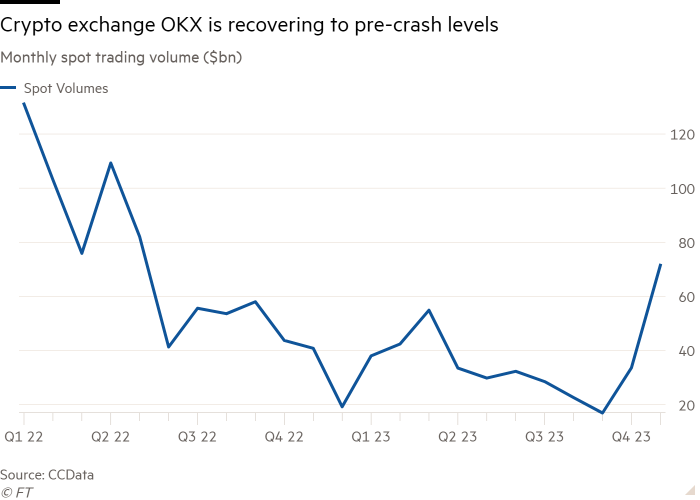

That resurgence can be proven out there shares of OKX and Bybit, two of Asia’s hottest exchanges.

Quantity in spot markets on OKX jumped to greater than $71bn final month, greater than double October’s $33bn, and a peak not seen since Could 2022, CCData stated. OKX’s month-to-month derivatives quantity additionally leapt to $659bn in November, up from $429bn in October.

Bybit’s volumes are at a degree final seen in February 2022. Final month it registered $56bn in spot volumes whereas derivatives volumes shot as much as $375bn, up from the earlier month’s $262bn.

“A number of crypto’s speculative and retail firepower stays intact in Asia,” Ilan Solot, co-head of digital property at Marex, advised me.

And notably, their features have come at Binance’s expense. OKX and Bybit began the yr with a 4 and 1 per cent and Binance on 55. Now OKX has 8, Bybit 6 and Binance simply 31 per cent.

“Wall Road’s crypto embrace doesn’t simply buoy establishments, it might probably reignite retail, together with in different components of the world, it’s like a constructive suggestions loop,” Solot added.

What’s your tackle bitcoin’s latest rally and Asia’s function in crypto markets? As all the time, electronic mail me your ideas at scott.chipolina@ft.com.

Weekly highlights

-

Late on Thursday a US choose dominated that former Binance chief government Changpeng Zhao will stay within the US till his sentencing, which is because of happen in February. The choose stated that, whereas Zhao supplied a major bail bundle, it was “insufficient to make sure [Zhao’s] return when contemplating the huge sources and property at his disposal”.

-

Kristin Johnson, commissioner on the US Commodity Futures Buying and selling Fee, stated the hefty $4.3bn penalty levied in opposition to Binance ought to function a warning to others. Talking on the FT’s Crypto and Digital Belongings Summit, Johnson stated: “Take the trace, you might save your self so much in any variety of alternative ways.”

-

France’s third-largest financial institution Société Générale this week launched buying and selling of its EUR CoinVertible stablecoin on crypto change Bitstamp, turning into the primary main financial institution to launch its personal dollar-pegged token on a crypto change.

Soundbite of the week: You need solutions?

On the FT’s crypto summit on Tuesday I spoke to Richard Teng, Binance’s new chief government.

He’s been within the function for simply over two weeks since CZ stepped down as a part of the DoJ settlement and has promised that Binance will study from previous errors. He’d additionally harassed that customers ought to really feel assured within the energy, security and stability of the change.

With this pledge in thoughts I requested the Binance chief among the questions which have dogged the corporate in recent times, like the place its firm headquarters is or the standing of an audit. Sadly, these questions nonetheless stay unanswered. At one level he stated:

“Why do you’re feeling so entitled to those solutions?” And: “Is there a necessity for us to share all of this data publicly? No.”

Knowledge mining: Hungry for extra

A good indicator as to the sturdiness of a rally is whether or not traders are shopping for a variety of one thing.

Numbers shared by CCData recommend that will certainly be the case. Common weekly buying and selling volumes throughout 25 of the highest digital property funding merchandise, such because the Grayscale Bitcoin Belief or ProShares Bitcoin Technique ETF, have hit the $3bn mark twice this quarter.

Volumes are additionally exhibiting some consistency and have sat comfortably over $2bn for 4 consecutive weeks, which suggests some actual urge for food on the market.

FT Cryptofinance is edited by Philip Stafford. Please ship any ideas and suggestions to cryptofinance@ft.com.

[ad_2]

Source link