[ad_1]

Unlock the Editor’s Digest at no cost

Roula Khalaf, Editor of the FT, selects her favorite tales on this weekly publication.

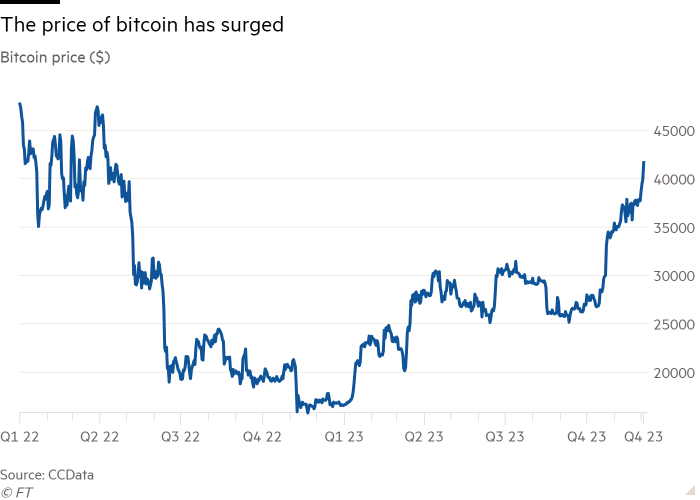

Bitcoin surged to its highest value in almost 20 months whereas gold hit an all-time peak on Monday, as frenzied investor hypothesis that rates of interest will fall subsequent 12 months rippled by belongings throughout the globe.

The cryptocurrency soared to greater than $42,000 on Monday, additionally boosted by optimism that the hardest regulatory punishments for the business have handed. It later fell again to $41,662, up 7.4 per cent on yesterday.

Gold rallied as a lot as 3 per cent to $2,135 per troy ounce on Monday, a brand new document, earlier than slipping to $2,025 per troy ounce, in keeping with LSEG knowledge.

The strikes observe a latest rush into shares and bonds, fuelled by rising expectations that the US Federal Reserve will quickly minimize borrowing prices regardless of chair Jay Powell’s assertion on Friday that it was “premature” to conclude that the central financial institution has gained its battle with inflation.

“You have a look at bitcoin and gold and also you see a really related form of evolution,” stated Luca Paolini, chief strategist at Pictet Asset Administration. “All of the asset courses that are inclined to do effectively when the Fed cuts charges aggressively are doing effectively.”

Merchants at the moment are betting the primary fee discount might come as quickly as March after a pointy decline in authorities and company borrowing prices as US bond markets loved their greatest month-to-month rally in almost 4 a long time in November.

Decrease yields on ultra-safe US Treasury debt have made different belongings comparatively extra enticing to buyers. The S&P 500 index closed at its highest stage since March 2022 final week, though it was down 0.6 per cent halfway by Monday’s session. Current US financial knowledge has been resilient even whereas inflation has fallen, additional boosting dangerous belongings comparable to shares.

Max Kettner, chief multi-asset strategist at HSBC, stated markets had been within the grip of an “everyone-is-happy-Goldilocks rally” throughout “just about all asset courses”.

Merchants stated the momentum to purchase bitcoin, whose worth has climbed greater than a fifth prior to now month, was additionally pushed by rising curiosity amongst buyers after the closure of two of probably the most high-profile prison instances that had hung over the marketplace for the previous 12 months.

Final month the US efficiently prosecuted Sam Bankman-Fried, former chief govt of FTX, and Binance, the world’s largest crypto alternate. Bankman-Fried was convicted of fraud and Binance paid $4.3bn in penalties after pleading responsible to prison prices associated to cash laundering and monetary sanctions breaches.

However regardless of many merchants’ fears, US authorities didn’t shut down Binance. The cryptocurrency alternate continues to face a separate lawsuit from the Securities and Alternate Fee for allegedly violating securities legal guidelines.

“The message from many institutional buyers was that they wanted two issues earlier than trying on the house once more: closure on FTX and readability round Binance,” stated Henri Arslanian, co-founder of 9 Blocks Administration, a crypto hedge fund supervisor based mostly in Dubai.

Ethereum, the second most actively traded cryptocurrency, additionally rose 8.3 per cent to $2,260 on Monday, its highest stage since Could final 12 months.

Traders are additionally hopeful the SEC will approve an alternate traded fund for bitcoin in coming weeks. The regulator has refused for a decade to approve spot bitcoin ETFs, inventory market funds that make investments straight within the cryptocurrency.

A few of Wall Avenue’s largest buyers, together with BlackRock and Franklin Templeton, have joined corporations comparable to VanEck and WisdomTree in submitting filings with the SEC.

The market has lengthy seen spot bitcoin ETFs as a strategy to wrest management of digital belongings from scandal-ridden crypto teams in favour of mainstream companies comparable to BlackRock.

“ETF hypothesis goes to proceed to drive behaviour within the crypto market this week as buyers purchase into the narrative of the transformative affect opening the market to institutional buyers may have on the ecosystem,” stated Simon Peters, market analyst at eToro.

Whereas the SEC has launched into a year-long crackdown on crypto — together with enforcement actions towards teams comparable to US-listed alternate Coinbase — strain is rising on the regulator to approve a bitcoin spot ETF.

Crypto asset supervisor Grayscale scored a watershed authorized victory this 12 months when a federal appeals court docket dominated the SEC was mistaken to reject its utility to transform its flagship Grayscale Bitcoin Belief into an ETF.

[ad_2]

Source link