[ad_1]

On-chain information exhibits the Ethereum lively addresses have noticed a big spike lately. Right here’s what this might imply for ETH’s worth.

Ethereum Every day Lively Addresses Have Seen A Surge Not too long ago

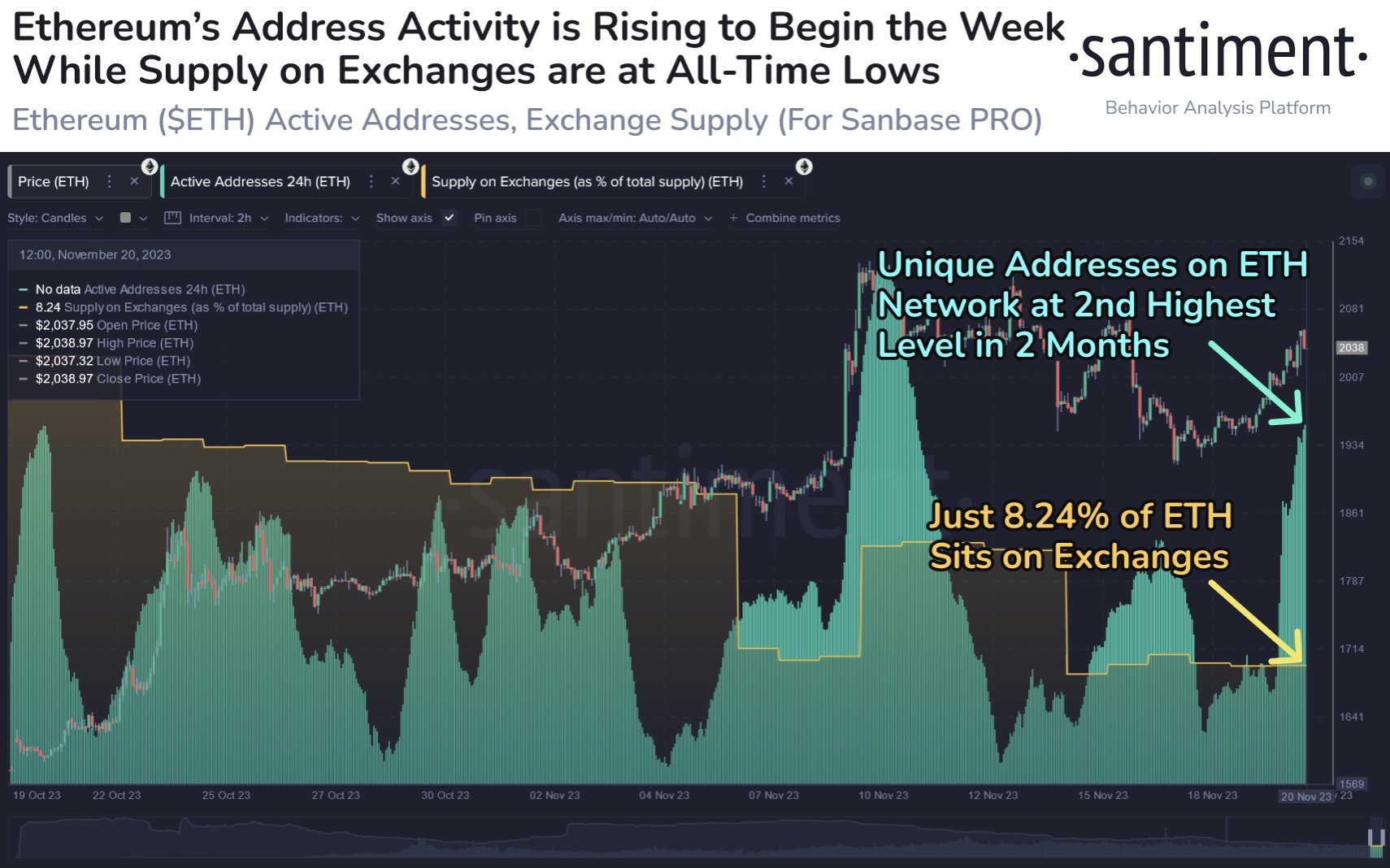

In accordance with information from the on-chain analytics agency Santiment, the ETH lively addresses are at the moment at their second-highest degree for the reason that center of September. The “active addresses” right here seek advice from these addresses on the Ethereum blockchain which can be participating in some kind of transaction exercise.

Within the context of the present dialogue, the distinctive variety of these lively addresses is of curiosity. Word that this metric takes into consideration each the senders and receivers.

The lively addresses could also be thought of analogous to the distinctive customers current on the community, so their quantity can present hints in regards to the diploma of site visitors that the chain is observing proper now.

When the worth of the indicator is excessive, it implies that the ETH community is receiving a considerable amount of site visitors at the moment. This may very well be an indication that there’s excessive curiosity within the asset among the many merchants.

Then again, the metric being low implies the market is uninterested within the asset at the moment as not many customers are partaking with the blockchain in the intervening time.

Now, here’s a chart that exhibits the pattern within the Ethereum lively addresses over the previous month:

The worth of the metric appears to have been fairly excessive in latest days | Supply: Santiment on X

As displayed within the above graph, the Ethereum lively addresses indicator has seen a spike lately, implying that numerous holders have began participating in trades.

Since addresses will develop into lively whether or not the investor is promoting or shopping for, it’s exhausting to say precisely what impact this newest exercise might need on the asset’s worth, however typically, a high traffic surroundings is fertile floor for volatility.

From the chart, it’s seen that the lively addresses additionally jumped to excessive ranges earlier within the month. Ethereum first traveled excessive alongside this rise in consumer engagement however then the asset topped out and noticed a pullback quickly after because the metric peaked.

An indicator that will have helped predict this decline upfront may very well be the mixed quantity of provide sitting within the wallets of all exchanges. Traders normally switch their cash to those platforms for promoting functions, so a rise on this indicator may very well be an indication that there’s a selloff happening.

And certain sufficient, the supply on exchanges registered a soar because the asset noticed the aforementioned pullback. As is obvious from the graph, Ethereum hasn’t seen such a spike this time but, implying that the present handle exercise could also be an indication of shopping for.

If that is certainly the case, then this excessive site visitors might doubtlessly assist gasoline the rally and permit Ethereum to go to larger ranges.

ETH Worth

On the time of writing, Ethereum is buying and selling just under the $2,000 mark, down 3% previously week.

ETH has been shifting sideways lately | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link