[ad_1]

Hey and welcome to the newest version of the FT Cryptofinance publication. This week we’re having a look at a possible new crypto arms race

Singapore has given blockchain agency Paxos an in-principle inexperienced mild to subject a stablecoin — a form of crypto token pegged to a tough foreign money.

The agency plans to launch the cryptocurrency via its new Singaporean entity. It is going to be pegged to the US greenback and totally backed one for one by the greenback and money equivalents.

Shut followers of the crypto sector will bear in mind Paxos because the issuer behind BUSD, the Binance-branded stablecoin that has light to near-irrelevancy ever since falling foul of New York regulators earlier this year.

Nonetheless the Paxos approval marks a possible change of fortune for the crypto sector’s report in Singapore, after the collapse of a number of high-profile initiatives within the metropolis state, together with crypto hedge fund Three Arrows Capital and stablecoin operator Terraform Labs.

Singapore state-owned investor Temasek was additionally compelled to put in writing off its $275mn stake in former business bellwether FTX after the change’s well-known collapse into chapter 11 a yr in the past. Temasek has stated its belief in FTX’s former chief government Sam Bankman-Fried — now convicted of fraud and different fees — appeared “misplaced”.

Readers of this article will know that the UK has already laid its stablecoin playing cards on the desk, setting out tips to manage the digital tokens in a bid to attempt to facilitate their use as a fee possibility for on a regular basis items and companies.

So Singapore’s recent embrace of a key digital belongings market one week later may lead you to imagine the worldwide stablecoin arms race is heating up, particularly as the big shadow solid by the US Securities and Alternate Fee and its crypto crackdown seems to be right here to remain.

Whereas it’s tempting to recommend that the US’s actions on crypto open the door for the sector to increase elsewhere, the accessible knowledge doesn’t appear to again up the declare.

There’s little compelling proof to recommend demand exists for dollar-pegged stablecoins in Singapore, and even in Asia as an entire.

Figuring out the components of the world the place stablecoin curiosity is highest is a problem: crypto merchants usually use digital non-public networks, or VPNs, to disguise their location from the prying eyes of regulators or governments that don’t take kindly to crypto buying and selling.

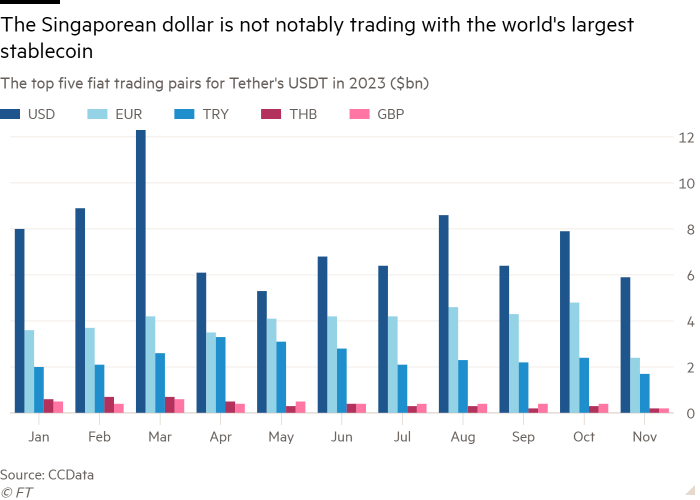

Curiosity available in the market can nonetheless be gauged by measuring the biggest buying and selling pairs between the world’s sovereign currencies and largest stablecoins. If, for instance, one of many high fiat buying and selling pairs for Tether — the world’s largest dollar-pegged token — is the Singaporean greenback, it will be truthful to infer that merchants from the town state signify one of many stablecoin’s hottest markets.

However, in keeping with numbers offered by business knowledge platform CCData, the highest 5 buying and selling pairs for Tether’s USDT token are the US greenback and the euro, adopted by the Turkish lira, Thai baht and the British pound.

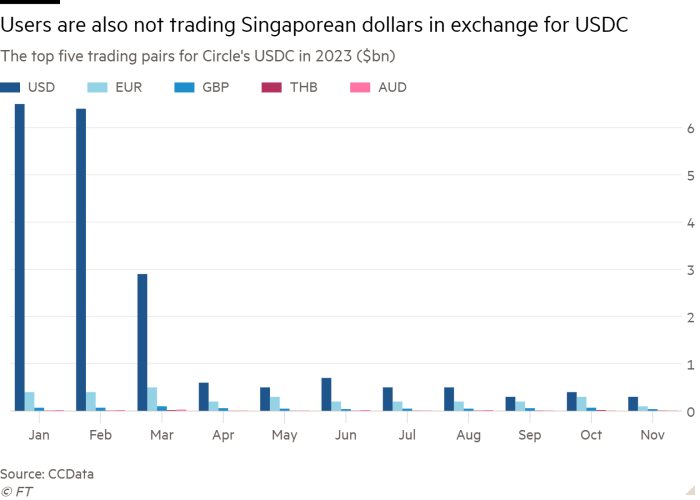

The outlook for Singapore’s stablecoin push doesn’t enhance whenever you take a look at Circle’s USDC stablecoin, the second-largest token of its type with roughly $24bn circulating available in the market. Predictably, the US greenback and the euro cleared the path, trailed this time by the pound, baht and the Australian greenback.

Different notable stablecoins embody DAI — an algorithmic cryptocurrency very like the failed Terra token of 2022 — and BUSD, which, regardless of hemorrhaging market share since its issuance was banned by the New York State Division of Monetary Companies, nonetheless stays the fifth-largest stablecoin available in the market.

Important buying and selling pairs for these tokens once more supply little encouragement for a metropolis state making an attempt to reassert its grip on crypto markets: the Korean gained, Brazilian actual and Mexican peso all make notable entries for these tokens, whereas the Singaporean greenback is nowhere to be seen.

Paxos’s push into Singapore, in keeping with Paxos’s head of technique Walter Hessert, is fueled by its ambition to “open the monetary system to everybody, introducing vital alternatives to international markets and billions of customers”.

However since its $188bn peak in April final yr, the stablecoin market cap has fallen roughly 33 per cent to $126bn immediately. So whereas Paxos tries to interrupt new floor in Singapore, it’s doing so in a market that’s not increasing.

What’s your tackle Singapore’s most up-to-date crypto strikes? As at all times, electronic mail me at scott.chipolina@ft.com.

Weekly highlights:

-

Rebuild or retreat: those are the choices left facing the crypto industry following the downfall of Sam Bankman-Fried. Some indicators level to an business able to relax into gear, together with a possible SEC-approved bitcoin spot ETF. However whenever you zoom out, you discover an business that has been gutted by scandals, a retail market that has not returned, and crypto’s staunchest advocates calling for a “parallel institution”.

-

Crypto media group The Block was bought to enterprise capital agency Foresight Ventures this week, in a transfer that secures the news outlet’s future after its former chief government was proven to have taken secret loans from Bankman-Fried. The Singapore-based investor took a majority stake in The Block: an individual acquainted with the matter stated it was investing $56mn for 80 per cent.

-

Keep in mind Twister Money, the crypto platform that had sanctions imposed by the US for allegedly laundering $7bn price of crypto funds for North Korean hackers? Effectively, its customers this week appealed against the US Treasury’s decision to penalise the platform, difficult the federal government’s jurisdictional attain over it. Yesha Yadav, legislation professor at Vanderbilt College, informed me the attraction “makes it clear that there’s a nice deal at stake for decentralised finance”.

Soundbite of the week: US laws can’t repair crypto crime

Throughout a congressional listening to on illicit exercise within the digital belongings business, president of consulting agency Dynamic Securities Analytics, Alison Jimenez, stated US laws aimed toward reeling within the crypto sector could not shield customers in opposition to dangerous actors within the area.

“US laws nonetheless doesn’t change the underlying options of cryptocurrency. I’m involved that we’d have nice guidelines, and if the US establishments observe them that’s fantastic, however US residents and clients will nonetheless be victims of these exterior organisations which can be going to return right here . . . we’d be capable of alter and restrict a number of the points we see inside exchanges however [crypto] isn’t going to cease being a useful gizmo for criminals.”

Knowledge mining: One other faux information worth bump

BlackRock’s foray into the crypto area continued this week after the world’s largest asset supervisor filed with the SEC for a spot ethereum change traded fund.

The worth of ether jumped modestly in consequence, however you may additionally recall when the worth of bitcoin surged a couple of weeks in the past on inaccurate experiences that BlackRock’s software for one more spot ETF monitoring bitcoin had been authorised by the SEC.

This week, the speculative nature of the crypto market was seen once more when one more faked submitting hit the crypto market, this time for a iShares XRP Belief registered in Delaware. A BlackRock consultant informed the FT it had not filed for an XRP Belief, however the worth of the XRP briefly surged nonetheless.

FT Cryptofinance is that this week edited by Laurence Fletcher. Please ship any ideas and suggestions to cryptofinance@ft.com.

[ad_2]

Source link