[ad_1]

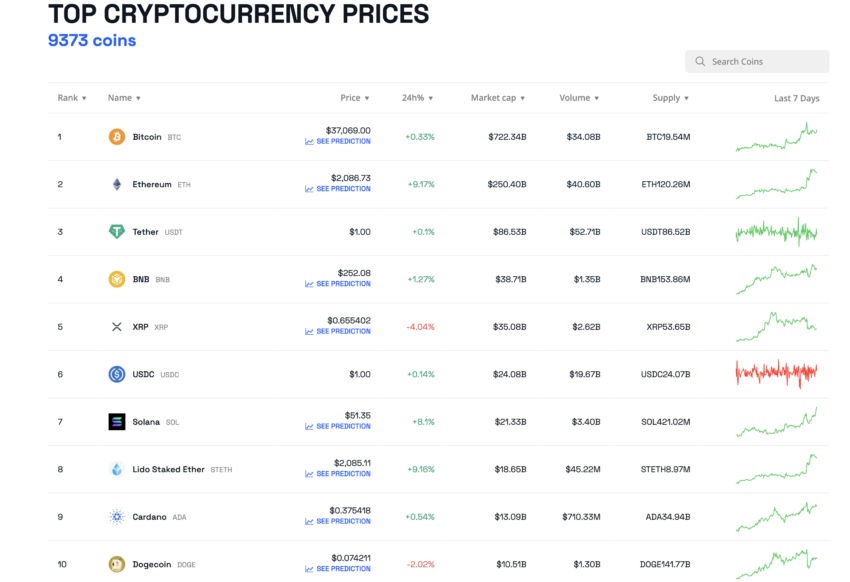

Crypto information: This previous week noticed a number of Ethereum whales and specialists weigh in on the rising institutional curiosity in crypto. Arthur Hayes, the previous CEO of BitMEX, warned that the rising institutional curiosity in Bitcoin (BTC) nullifies the unique premise of cryptocurrencies like Bitcoin shortly earlier than BlackRock reportedly registered an Ethereum Belief on Friday.

Hayes stated on Sunday that gamers like BlackRock threat turning Bitcoin into an institutional asset. Additionally this week, BeInCrypto examined the strikes of the largest Bitcoin and Ethereum (ETH) whales, together with one whose success reveals Ethereum’s incomes potential.

Hayes Sermonizes From Bitcoin Holy Writ

With an virtually spiritual fervor, Hayes described why establishments threaten the existence of Bitcoin. If these behemoths introduce crypto mining ETFs, they might turn out to be “brokers of the state” designed to maintain residents inside the normal cash system for tax causes.

By hoarding the asset, huge corporations would hold Bitcoin stagnant and never circulating like a foreign money. Establishments elevating Bitcoin’s value accomplish that on the expense of its soul, Hayes argued.

Learn extra: What Is Bitcoin? A Information to the Unique Cryptocurrency

It doesn’t look like establishments are listening, although. On Thursday, BlackRock appeared to have registered a brand new Ethereum Belief in Delaware following its spot Bitcoin exchange-traded fund (ETF) utility in June.

And lots of market individuals welcome the worth will increase which have made holders worthwhile once more. Is Hayes proper? Solely time will inform.

Bitcoin Whales Feed Passively

Within the meantime, crypto buyers on the prime of the Bitcoin food chain are cashing in. On Tuesday, BeInCrypto checked out how the largest non-public wallets are investing.

Wallets holding a whopping $9.1 billion had been examined utilizing knowledge from blockchain explorers. It seems that 80% of the whales investigated have been dormant since their preliminary buy. The next addresses obtain computerized funds, that are the one energetic transactions that happen often:

37XuVSEpWW4trkfmvWzegTHQt7BdktSKUs

1LdRcdxfbSnmCYYNdeYpUnztiYzVfBEQeC

1AC4fMwgY8j9onSbXEWeH6Zan8QGMSdmtA

1LruNZjwamWJXThX2Y8C2d47QqhAkkc5os

Just one pockets, with an preliminary deposit of $1.9 billion, was energetic in the previous few months, with its proprietor withdrawing $1,000 in September. The remaining are incomes passive earnings by means of common computerized funds.

Learn extra: How to Start Copy Trading: A Definitive Information for Inexperienced persons

However Ethereum Whales Are Looking

Whereas the most important Bitcoin whales are snoozing, the subsequent apex predator is waking up. On Nov. 2, a crypto whale earned a cool profit of $5.41 million by means of carefully-timed trades.

This handle despatched 24,495 ETH ($45 million) to Binance and used an Ethereum value enhance to web themselves a revenue of $5.47 million. Two days later, the whale deposited 31.8 million USDT into Binance and withdrew 8,698 ETH ($16 million) some hours later.

Learn extra: How to Buy Ethereum (ETH) and Every thing You Must Know

The success charge of this whale’s Ethereum trades is 87.5%, boasting seven out of 12 worthwhile transactions since February. Their exercise means that Ethereum will be extraordinarily profitable for many who know learn how to time trades.

Can Two Whales Sit Atop the Meals Chain?

Crypto investor Layah Heilpern is biding her time earlier than the subsequent bull run. The influencer has been buying up wads of Ethereum, which she plans to promote when markets decide up.

On Nov. 6, the investor outlined her funding thesis. She argues that Ethereum is a protected asset as a result of the US Securities and Trade Fee (SEC) has not deemed it a security.

“Safer than all of the alts and nonetheless smaller market cap than bitcoin so will pump more durable when cash flows in.”

And this can be nearer than even she thought. In response to QCP Capital,

“ETH’s outperformance over BTC in a single day will be attributed to BlackRock’s 19b-4 submitting with NASDAQ for an Ethereum Belief, which is able to herald BlackRock’s submitting for a spot ETH ETF within the close to future. We anticipated the same playbook to when BlackRock first submitted an utility for a spot BTC ETF.”

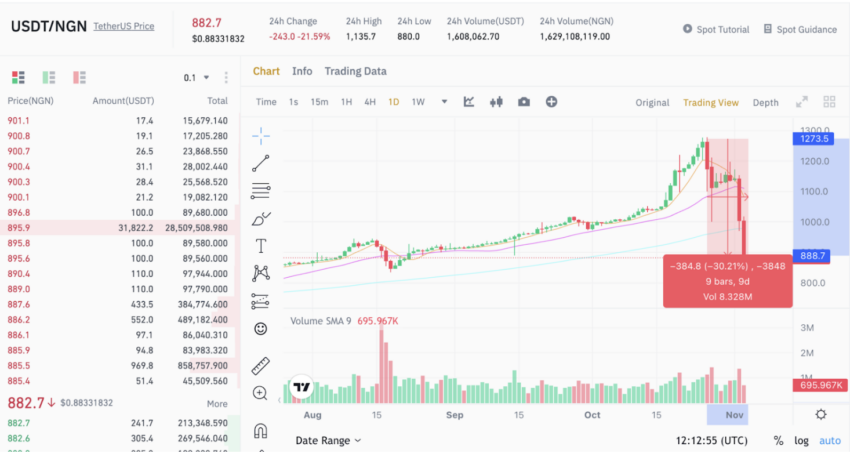

The Hunt Might Be Over for P2P Merchants in Nigeria

As soon as a vibrant crypto hub in Africa, Nigerians are running out of options. Following the exit of Paxful, a well-liked P2P market that after attracted vital volumes earlier than its exit, Binance could also be subsequent on regulators’ radars.

Learn extra: 10 Best P2P Crypto Exchanges You Want To Know About in 2023

The charismatic but mysterious founding father of Binance, Changpeng Zhao, tweeted a cryptic submit that fueled rumors that the Central Financial institution of Nigeria was trying to manipulate P2P rates. The nationwide foreign money has fallen 30% in opposition to the US dollar-backed stablecoin USDT.

The central financial institution could wish to restrict greenback use after its strategies to spice up the Naira have succeeded. It has cleared $6.7 billion value of money owed with Citibank, Stanbic IBTC, and Commonplace Chartered Financial institution.

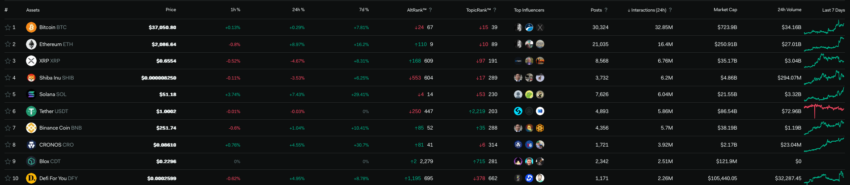

Crypto – Socially Talking

Prime 10 Crypto Performers This Week

Do you might have one thing to say in regards to the largest information in crypto this week or the rest? Please write to us or be part of the dialogue on our Telegram channel. You may also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

All the knowledge contained on our web site is revealed in good religion and for common info functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own threat.

[ad_2]

Source link