[ad_1]

Ethereum has been in a descending channel in opposition to Bitcoin since August of final yr, which means Bitcoin has been the higher funding over this time. Nevertheless, historic tendencies present the tides could possibly be altering quickly, with Ethereum probably on the point of getting into an accumulation section.

Ethereum Value Motion

Ethereum is buying and selling at $1600, marking a 22% lower from its worth final August. Bitcoin, however, is 8% up over the identical interval.

This can be a widespread pattern that occurs throughout bear markets. Cash with bigger market capitalizations are typically extra resilient in opposition to worth decreases as traders change into extra risk-averse and look to protect their capital. Whereas Ethereum isn’t quick at a market capitalization of $187 billion, it’s nonetheless significantly decrease than Bitcoin at $525 billion.

Throughout bull markets, cash with decrease market capitalization outperform Bitcoin once more as traders lean in direction of property with higher potential returns.

Ethereum Value In contrast Towards Bitcoin

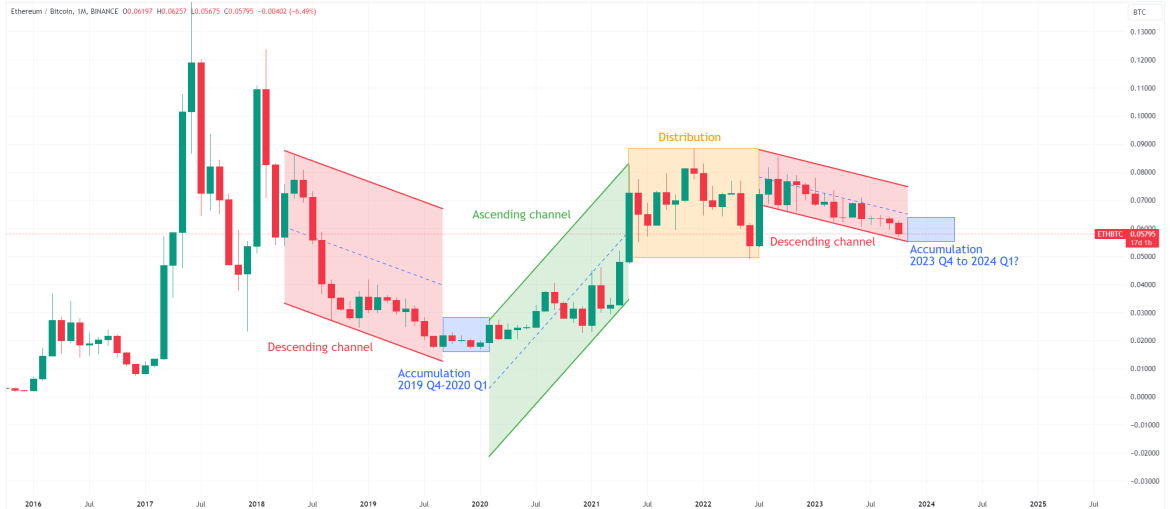

When evaluating ETH’s worth to BTC, it’s evident that Ethereum has been buying and selling inside a descending channel since final August. This sample, characterised by its decrease highs and decrease lows, usually signifies a bearish pattern available in the market.

ETH's valuation in opposition to BTC over time. Supply: ETHBTC on TradingView

The chart above highlights three different distinct phases:

Accumulation section: Throughout this section, worth tends to stabilize, hinting at an upcoming change in momentum

Ascending channel: Right here, the value experiences a big reversal, usually on a parabolic trajectory, characterised by highs and better lows.

Distribution section: Within the ultimate section, the value ceases its upward motion. Buyers usually use this section to capitalize on their features and liquidate their positions.

The accumulation section is usually the perfect time for traders to transform their Bitcoin into Ethereum. This section is marked by worth holding on on the backside after which displaying indicators of reversal. Ethereum continues to be forming decrease lows in opposition to Bitcoin, so it has not entered the buildup section but. Nevertheless, the final cycle exhibits that this could possibly be altering quickly.

Final Cycle

Reflecting on the final cycle, Ethereum was in a descending channel in opposition to Bitcoin for 17 months. The buildup section then occurred from September 2019 up till February 2020. Based mostly on the four-year concept, which suggests related phases available in the market happen each 4 years, this exhibits that the buildup section must also be approaching very quickly on this cycle.

But, whereas the final cycle affords priceless insights, it’s vital to notice that no two cycles are the identical. Within the present cycle, ETH’s worth motion has not seen as a lot of a drop as within the earlier cycle, which could possibly be attributed to altering fundamentals and asset maturation.

Remaining ideas

Whereas an accumulation section for Ethereum has not been confirmed but, there stays the potential for its worth to drop even additional relative to Bitcoin. Nevertheless, if the earlier cycle is something to go by, we might enter the buildup section quickly. This section usually presents prime shopping for alternatives for Ethereum.

Funding Disclaimer: The content material offered on this article is for informational and academic functions solely. It shouldn’t be thought-about funding recommendation. Please seek the advice of a monetary advisor earlier than making any funding selections. Buying and selling and investing contain substantial monetary danger. Previous efficiency just isn’t indicative of future outcomes. No content material on this website is a suggestion or solicitation to purchase or promote securities or cryptocurrencies.

Featured picture from ShutterStock, Charts from TradingView.com

[ad_2]

Source link