[ad_1]

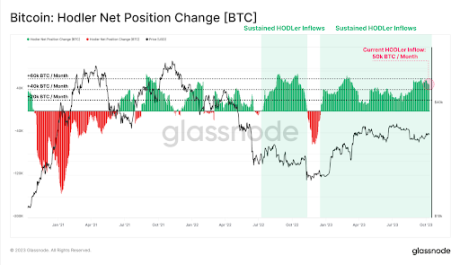

A brand new report from Glassnode, an on-chain analytical agency, has buttressed recent data indicating Bitcoin holders are including to their holdings. These long-term Bitcoin traders, usually often known as “HODLers,” don’t seem like phased by the latest volatility in Bitcoin’s worth.

In line with on-chain knowledge, long-term holders have been quickly amassing Bitcoin, including greater than 50,000 BTC every month to their holdings.

Month-to-month Accumulation Of BTC Price $1.35 Billion

Bitcoin is presently exhibiting indicators of slowing down, as its worth simply dipped under $27,000. It might seem that short-term speculators are largely in charge for the persistent promoting strain, as knowledge exhibits whale traders are seeing this chance to purchase extra BTC at a reduction reasonably than safe income.

In line with Glassnode’s HODLer Internet Place Change metric, long-term holders are buying a median of fifty,000 BTC price $1.35 billion on the present worth of Bitcoin each month.

One other metric, the Lengthy-Time period Holder Provide, which measures the quantity of BTC’s market cap with holders, additionally reached an all-time excessive of 14.859 million BTC. This implies 76.1% of the overall circulating provide has not moved previously 5 months. Consequently, 94.8% of the overall Bitcoin provide has not moved previously month.

Supply: Glassnode

To again up this knowledge of elevated accumulation, well-liked crypto analyst Ali Martinez shared chart knowledge from Santiment exhibiting Bitcoin whales have bought round 20,000 BTC for the reason that starting of October, price roughly $550 million.

At this fee, the variety of BTC vaulted by holders is poised to go 50,000 in October. This elevated accumulation means that long-term holders stay assured in Bitcoin’s long-term potential and see this worth correction as momentary.

#Bitcoin whales have bought round 20,000 $BTC for the reason that starting of October, price roughly $550 million! pic.twitter.com/47ZePiaIII

— Ali (@ali_charts) October 10, 2023

BTC worth falls under $27,000 | Supply: BTCUSD on Tradingview.com

Bitcoin Provide Tightens

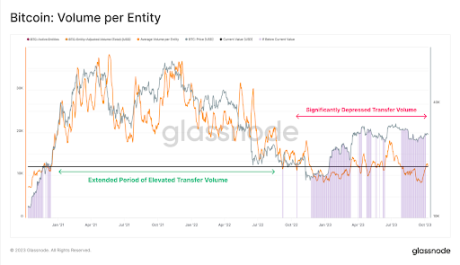

In line with Glassnode, solely 11.5% of BTC’s circulating provide modified palms within the final 3 months, indicating a protracted inactive period of on-chain activity. That there are fewer transactions means that traders are unwilling to promote on the present worth because the business awaits approval of spot Bitcoin ETFs.

Supply: Glassnode

If this present pattern holds, then the present downtrend may very well be short-lived, particularly if sentiment amongst smaller merchants additionally turns towards shopping for. A predominantly maintain mentality would give the asset time to recuperate and set up vital assist that serves as a bounce-off level for one more rally.

Bitcoin is presently buying and selling at $26,766 and is down by 1.31% in a 24-hour timeframe because it approaches the next major support close to the $26,500 degree. If sufficient massive gamers accumulate at these decrease costs, it could set up a worth flooring as bulls push the value again up.

As crypto analyst James Straten factors out, Bitcoin might soar 50% as a part of the correlation between the Grayscale Bitcoin Belief and the value of BTC.

Featured picture from Shutterstock, chart from Tradingview.com

[ad_2]

Source link