[ad_1]

Sam Bankman-Fried’s tweets have come again to hang-out him.

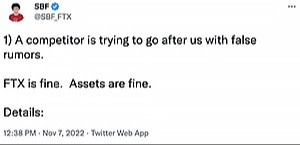

As clients raced to withdraw their cash from his embattled FTX cryptocurrency change almost one 12 months in the past, Bankman-Fried tried to cease the run on the financial institution with a message to his greater than 1mn followers: “FTX is okay. Belongings are positive.”

In testimony on Friday, FTX co-founder Gary Wang, one in every of Bankman-Fried’s closest pals, stated the message was a lie: “No . . . FTX was not positive,” he instructed jurors. “Belongings weren’t positive.”

Prosecutors have seized on this and different posts from the fallen billionaire’s prolific Twitter account as they attempt to persuade a New York jury that Bankman-Fried lied to the general public, his clients, lenders and traders, about secret dealings that permit his personal buying and selling agency, Alameda, raid billions in FTX buyer cash.

As Bankman-Fried’s trial acquired beneath means this week, prosecutors many times confirmed the jury screenshots of his posts on Twitter, since renamed X, and contrasted the general public statements with insider testimony from Bankman-Fried’s closest associates.

Wang, who has pleaded responsible and is co-operating with the federal government, described how the night time earlier than he had helped Bankman-Fried to pin down precisely how a lot cash Alameda owed to FTX clients. “The change was quick $8bn,” he stated.

Offered with a second tweet, the place Bankman-Fried reassured clients that “FTX has sufficient to cowl all consumer holdings”, Wang once more stated that his good friend had lied.

“FTX didn’t in actual fact have sufficient property to cowl all consumer holdings,” Wang instructed the jury.

The panel of 12 jurors and 6 alternates features a retired funding banker at Salomon Brothers, two Metro North practice conductors, and a skilled accountant who’s the workplace supervisor for her husband’s landscaping enterprise.

They must resolve whether or not the pallid 31-year-old Bankman-Fried, sitting a couple of toes from them on the defence desk, is known as a grasp felony, or only a spectacularly failed entrepreneur.

Bankman-Fried, who faces a lifetime in jail, has pleaded not responsible and maintains his innocence. His attorneys stated in opening arguments he had made errors within the rush to construct FTX right into a $40bn firm on the forefront of the crypto trade, however that Bankman-Fried had acted in “good religion” with out the intent to defraud anybody.

The trial, which has change into a check case for efforts by the US authorities to stamp out the freewheeling offshore cryptocurrency trade, will hinge on the private relationships and intimate conversations of a handful of Bankman-Fried’s oldest pals and closest enterprise associates.

The temper within the twenty sixth ground courtroom in decrease Manhattan was tense as Wang — who first met Bankman-Fried at a highschool summer time programme for presented maths college students and lived with him in faculty at MIT — walked swiftly previous the defence desk to take his seat on the witness stand.

When the prosecutors requested him to determine Bankman-Fried within the courtroom, Wang strained out of his seat to see his former good friend among the many sea of attorneys.

Bankman-Fried was emotionless all through the week’s testimony, tapping intensely on a laptop computer and avoiding eye contact with the witnesses. Wang will probably be cross-examined on Tuesday. Some of the awaited witnesses, Caroline Ellison, his one-time girlfriend and Alameda’s CEO, will take the stand early subsequent week, prosecutors stated.

“That’s completely devastating testimony,” stated Daniel Silva, a former federal prosecutor at regulation agency Buchalter. “The federal government has a compelling case . . . It is a nice story. It’s a film script in an indictment.”

Juxtaposing this testimony with Bankman-Fried’s tweets has change into a strong device for the federal government. The jury noticed a tweet from July 2019 the place Bankman-Fried stated Alameda’s account on FTX was “identical to everybody else’s”.

However Wang testified that on the identical day, FTX had carried out adjustments within the bowels of its pc code that gave Alameda limitless rights to borrow from FTX — one in every of a number of distinctive privileges he helped hardwire into the change.

The jury additionally heard from an FTX buyer, a London-based cocoa dealer, who stated Bankman-Fried’s assurance within the November tweets led him to depart his funds on the change till it was too late.

Matt Huang, an investor at VC agency Paradigm, which put $278mn into FTX, testified that his agency had requested in regards to the change’s relationship with Alameda earlier than investing and was instructed that Alameda acquired no particular remedy.

Prosecutors have additionally tried to ascertain that Bankman-Fried knew about and orchestrated Alameda’s secret entry to buyer cash for years earlier than the change collapsed.

Wang testified to conversations about Alameda’s borrowing way back to 2019. He described how the crash in crypto costs in spring 2022 prompted a number of third-party crypto lenders to demand reimbursement of loans from Alameda.

He walked the jury by a spreadsheet the place he had calculated Alameda’s money owed to FTX in June 2022 at $11bn, and described a gathering on the change’s Bahamas workplace the place Bankman-Fried requested in regards to the calculations earlier than instructing Ellison to repay the third-party loans.

“The cash finally got here from FTX clients,” Wang stated. “We stated publicly that we might not use buyer funds like this.”

Requested who he meant by “we”, Wang stated merely: “Sam”.

[ad_2]

Source link