[ad_1]

Blockchain analytics platform Santiment says that the chances are Bitcoin (BTC) will quickly transfer to the upside as a result of one issue.

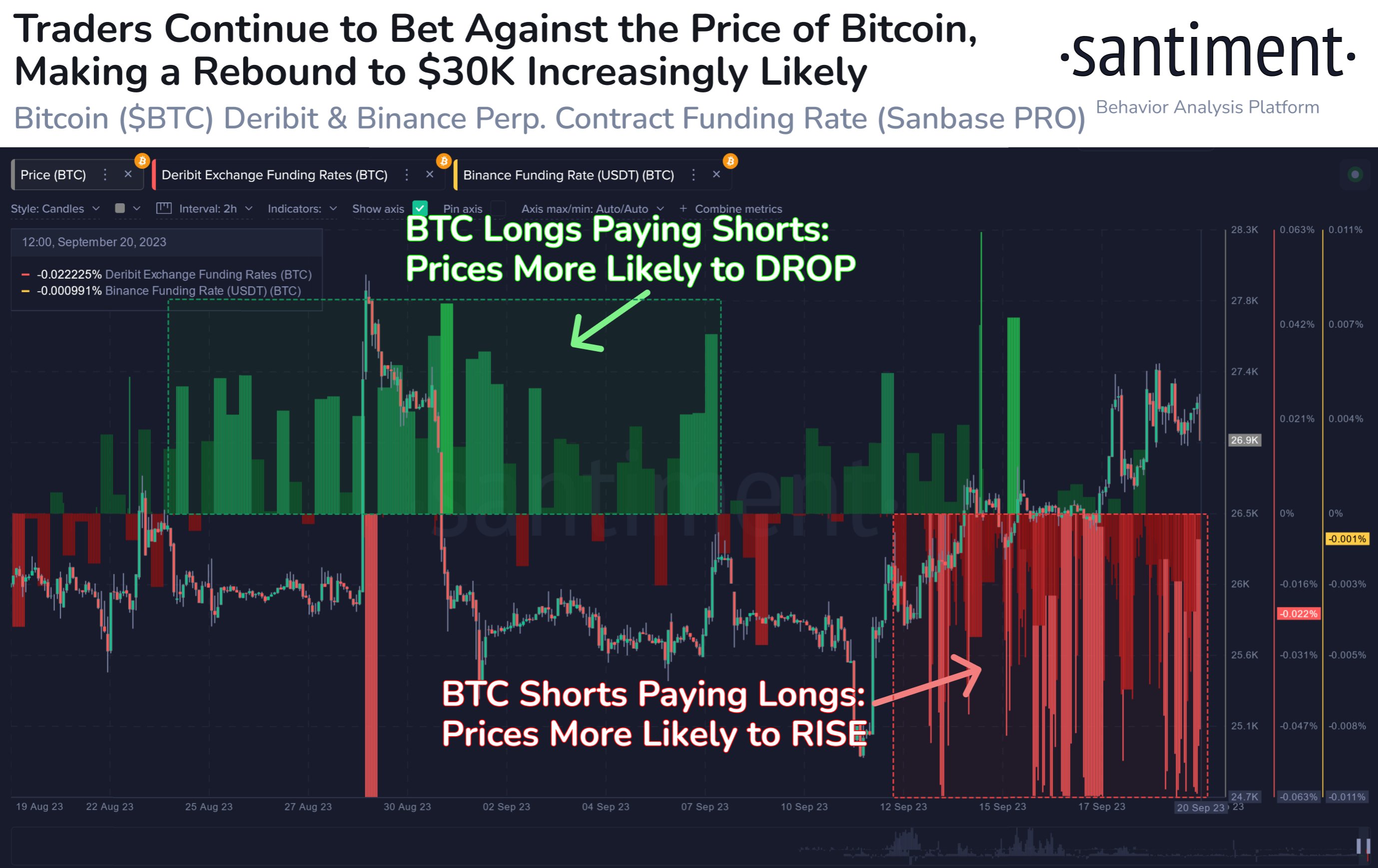

The analytics platform says that Bitcoin is seeing plenty of brief curiosity on two main crypto exchanges, which may set the stage for a brief squeeze and ship BTC past $30,000.

“Bitcoin merchants are aggressively shorting on each Deribit and Binance, making potential liquidations extra prone to enhance costs. BTC’s value is +4% for the reason that enhance in shorting began appearing final week. This has chance of continuous.”

A brief squeeze occurs when merchants who borrow an asset at a sure value in hopes of promoting it for decrease to pocket the distinction are compelled to purchase again the property they borrowed as momentum strikes in opposition to them, triggering additional rallies.

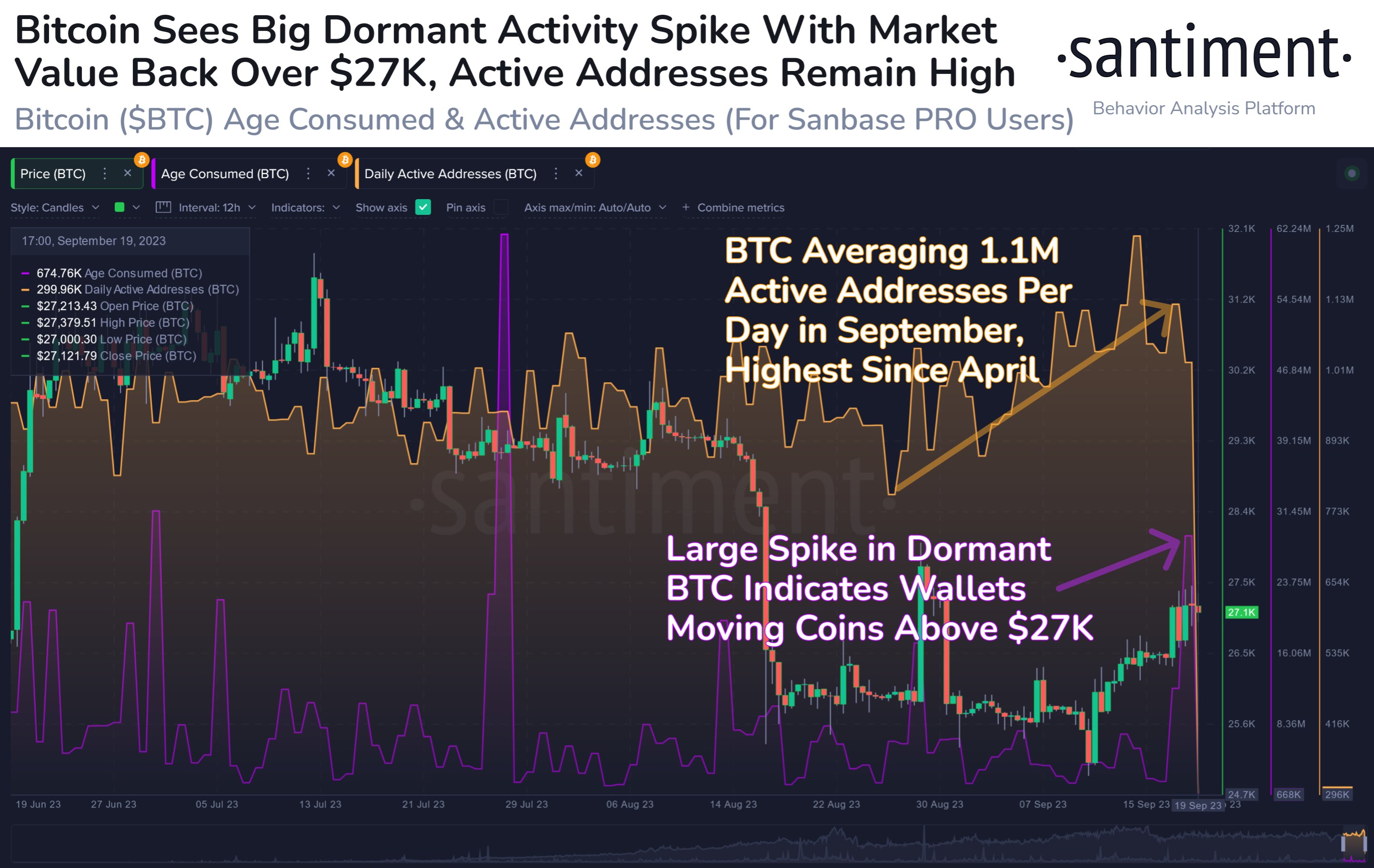

Santiment additionally says that Bitcoin’s community exercise shot up this month as BTC crossed the $27,000 degree.

“Bitcoin’s on-chain exercise continues to be considerably greater than it has been since April. Utility is notably greater, and the third largest day [of activity] in dormant BTC in three months additionally occurred yesterday. The low $27,000 degree is proving to be polarizing.”

The analytics agency is protecting an in depth eye on what number of stablecoins deep-pocketed crypto traders are holding. A rise after a interval of decline may point out Bitcoin will transfer to the upside, in keeping with Santiment.

“Whales have been dropping stablecoins, indicating that their shopping for energy isn’t fairly as sturdy as when Bitcoin was above $30,000 again in June. [Holdings are] now on the lowest degree in six months. Search for $5 million+ whale wallets to extend once more to sign a turnaround.”

Bitcoin is buying and selling for $26,588 at time of writing, down 2.2% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Price Action

Observe us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in affiliate marketing online.

Featured Picture: Shutterstock/DomCritelli/Natalia Siiatovskaia

[ad_2]

Source link