[ad_1]

NiseriN

Utilized Digital (NASDAQ:APLD) seems well-positioned for dramatic progress in 2023-2024 by growth in cryptocurrency mining and new cloud computing companies. Whereas the corporate has taken on extra debt and dilution to fund investments, prudent financing actions present the mandatory capital to scale operations. An in depth evaluation of the debt construction, fairness issuance, and monetary projections highlights Utilized Digital’s potential.

Crypto Mining Enterprise Firing on All Cylinders

Utilized Digital has quickly expanded its crypto mining capability to satisfy buyer demand. The corporate at present has round 285 megawatts on-line, up from 185 megawatts on the finish of Might 2022. This whole capability is totally contracted out to clients underneath long-term offers. To additional assist progress, Utilized Digital plans to carry a further 200 megawatts on-line within the close to future. This added capability is totally contracted out to clients.

Utilized Digital has positioned itself with 485 megawatts of energized crypto mining capability, both on-line or deliberate to be on-line quickly. Multi-year buyer offers present income visibility as the corporate scales up mining operations. Utilized Digital continues to see robust demand that permits full capability utilization whereas requiring fast growth of latest capability to assist operational wants.

Utilized Digital’s revenue jumped from $7.5 million in fiscal This autumn 2022 to $22 million in This autumn 2023, pushed by expanded crypto mining capability in North Dakota. With amenities in Jamestown and Ellendale ramping up utilisation, the corporate is poised to develop as 200 extra megawatts come on-line. Utilized Digital’s energized capability and favorable working situations in North Dakota place the corporate to quickly scale revenues as demand warrants. The crypto mining experience and growth capability developed in North Dakota present a launching pad for Utilized Digital’s subsequent part of transformational progress.

Administration estimates that crypto mining might produce annual recurring income of $300 million at robust 30%+ gross margins at full utilization. This regular money move helps progress plans. Multi-year buyer offers underpin income visibility.

New AI Cloud and HPC datacenter Providing Gaining Traction

Utilized Digital is increasing its AI cloud companies enterprise and growing next-generation HPC information facilities to drive future progress. The corporate initially launched an AI cloud platform supported by its 9-megawatt HPC facility in Jamestown. Utilized Digital introduced an agreement with its first AI cloud buyer value as much as $180 million over 24 months, with a further $180 million possibility for a complete potential of $360 million. The corporate secured a second AI cloud settlement value as much as $460 million over 36 months. To satisfy AI cloud demand, Utilized Digital acquired over 26,000 GPUs to be put in by April 2024.

For HPC information facilities, Utilized Digital has 300 megawatts of capability deliberate, together with 200 megawatts in North Dakota and a brand new Utah facility. By leveraging experience in HPC infrastructure and buyer momentum in its AI cloud enterprise, Utilized Digital goals to capitalize on surging progress in AI, ML, and associated high-performance computing functions.

Strategic Positioning in Aggressive Markets

Utilized Digital operates within the quickly evolving cryptocurrency mining and cloud computing markets. Key rivals in crypto mining embrace Marathon Digital (MARA), Bitfarms (BITF), and many others. The crypto mining trade has seen growing hashrate issue and mining pool consolidation, presenting challenges to smaller gamers. Nevertheless, Utilized Digital has carved out a robust market place by its North Dakota operations which give cheap, sustainable energy. This aggressive benefit enabled it to seize market share and increase capability amidst the crypto downturn in 2022.

In cloud computing, rivals like AWS (AMZN), Microsoft Azure (MSFT), and Google Cloud (GOOG) are dominant gamers. Nevertheless, Utilized Digital is differentiated by its deal with AI/ML and high-performance computing workloads. Its first-mover benefit in providing tailor-made HPC infrastructure for AI workloads presents a chance to ascertain itself as a frontrunner on this area of interest phase. Not too long ago, the corporate announced that it has achieved “Elite Companion” standing within the NVIDIA Companion Community (NVDA), reflecting the synergies between Utilized Digital’s HPC functions and NVIDIA’s GPUs and Networking. This partnership supplies cutting-edge applied sciences and experience that may allow clients to extend velocity and effectivity, accelerating innovation in AI/ML computing.

General, Utilized Digital has strategically positioned itself in enticing progress markets, albeit aggressive ones. Its execution in sustaining aggressive benefits will decide future success.

Debt Profile Helps Progress Whereas Managing Dangers

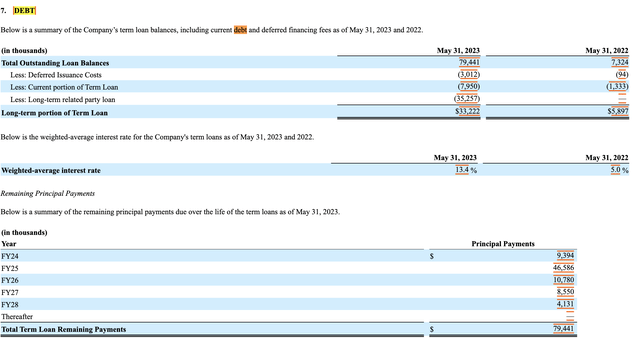

Utilized Digital has expanded its debt capability by prudent financing to fund its progress investments. The corporate’s complete long-term mortgage balances have risen considerably, from $7.3 million to over $79.4 million inside 12 months. This increased debt load has additionally elevated the weighted common rate of interest on the loans from 5% to 13.4%.

In keeping with Utilized Digital’s latest 10-K filing, the reimbursement schedule on these extra important debt balances is unfold over time reasonably than concentrated within the close to time period. Greater than 50% of the overall debt might be due for reimbursement by 2025. Nevertheless, the remaining balances have longer maturities, staggered from 2024 to 2028. This staggered maturity schedule helps keep away from main reimbursement cliffs and smooths the debt profile over time.

The debt financing was essential to assist important progress tasks, resembling new information facilities, that require capital funding upfront however generate revenues over multi-year intervals. By aligning debt phrases with mission timelines, Utilized Digital maintains liquidity whereas benefiting from growth.

Fairness Issuance Dilutive However Will increase Flexibility

Along with prudent debt growth, Utilized Digital initiated an at-the-market (ATM) fairness sale program of as much as $125 million to bolster money reserves. The corporate has already raised $64 million by this ATM issuance.

The expanded share depend is dilutive, with over 25 million new shares representing a 25% dilution to current shareholders. Nevertheless, the fairness sale was vital to funding progress whereas limiting debt dangers.

It supplies Utilized Digital with a considerable liquidity buffer, growing money reserves from simply $29 million to almost $94 million professional forma for the $65 million ATM elevate. This flexibility helps the corporate pursue its progress targets.

Monetary Projections Help Progress Technique

Utilized Digital’s financing actions seem to align with supporting administration’s monetary projections for the mining and cloud computing companies. The corporate is focusing on $200 million in EBITDA by 2024. Based mostly on the median EV/EBITDA a number of of 6.7x for the corporate over the previous twelve months, this degree of EBITDA might doubtlessly drive an enterprise worth for Utilized Digital of $1.34 billion. Factoring within the diluted share depend from an ongoing $125 million share issuance, which expanded from practically 99 million to 124 million shares, the implied market capitalization helps a share value approaching $11. This represents over 100% upside from present ranges round $5.

Key Takeaways

Utilized Digital has made prudent financing selections to fund aggressive progress plans in crypto mining and cloud computing companies. Though debt and dilution current dangers, the pliability of the stability sheet provides Utilized Digital the capability to scale operations amid surging demand. If administration can execute on bringing new capability on-line to capitalize on crypto and AI/ML tailwinds, the corporate is positioned to ship large shareholder worth. Regardless of challenges, Utilized Digital’s strategic expansions in mining, AI cloud, and HPC information facilities underscore its potential to unlock transformational progress. Backed by prudent financing, execution now holds the important thing to realizing Utilized Digital’s bold imaginative and prescient.

For my part, Utilized Digital represents an intriguing progress story in two high-potential markets: crypto mining and cloud computing companies. Whereas dangers stay in executing their bold growth plans, prudent financing actions present the capability and suppleness to scale up operations. For traders with a excessive danger tolerance searching for publicity to crypto and AI tailwinds, Utilized Digital warrants consideration. Beginning with a small place to handle dangers could be an inexpensive method. Continued robust execution and capability utilization might be key indicators to look at shifting ahead.

[ad_2]

Source link