[ad_1]

On-chain information exhibits the Ethereum whales have just lately gone on a $425 million procuring spree, an indication that might be optimistic for the asset.

Ethereum Whales Have Participated In Accumulation Just lately

As identified by analyst Ali in a post on X, the ETH whales have made some massive purchases just lately. The related indicator right here is the “ETH Supply Distribution,” which tracks the entire provide quantity every investor group holds.

Buyers or addresses are divided into these teams based mostly on the entire variety of tokens they carry of their steadiness. As an illustration, the 1 to 10 cash cohort consists of all traders holding a minimum of 1 and at most 10 ETH.

Within the context of the present dialogue, the group of curiosity is that of the whales. The pockets vary of those humongous holders could be assumed to be 10,000 to 100,000 cash.

Because the whales maintain vital quantities of their wallets (the vary converts to about $16.3 million on the decrease finish and $163 million on the higher finish), they will naturally be influential entities on the community.

Now, here’s a chart that exhibits how the entire provide held by the Ethereum whales has modified over the previous week:

Seems like the worth of the metric has noticed some uplift in current days | Supply: @ali_charts on X

As displayed within the above graph, the provision held by the Ethereum whales has registered a notable improve just lately. Throughout this rise, these humongous holders have purchased round 260,000 ETH, price roughly $423 million on the present trade charge, inside 24 hours.

With this newest shopping for spree, the entire provide of this cohort has reached about 27.03 million ETH, that means that these traders now carry about 22.5% of the complete circulating provide of the cryptocurrency.

This accumulation from the Ethereum whales is of course a constructive signal for the coin, because it implies that these holders help the present costs, so the likelihood of a rebound could have develop into boosted.

Nonetheless, the identical analyst has identified that Ethereum’s present value is dangerous, as not many traders have their cost basis at this stage.

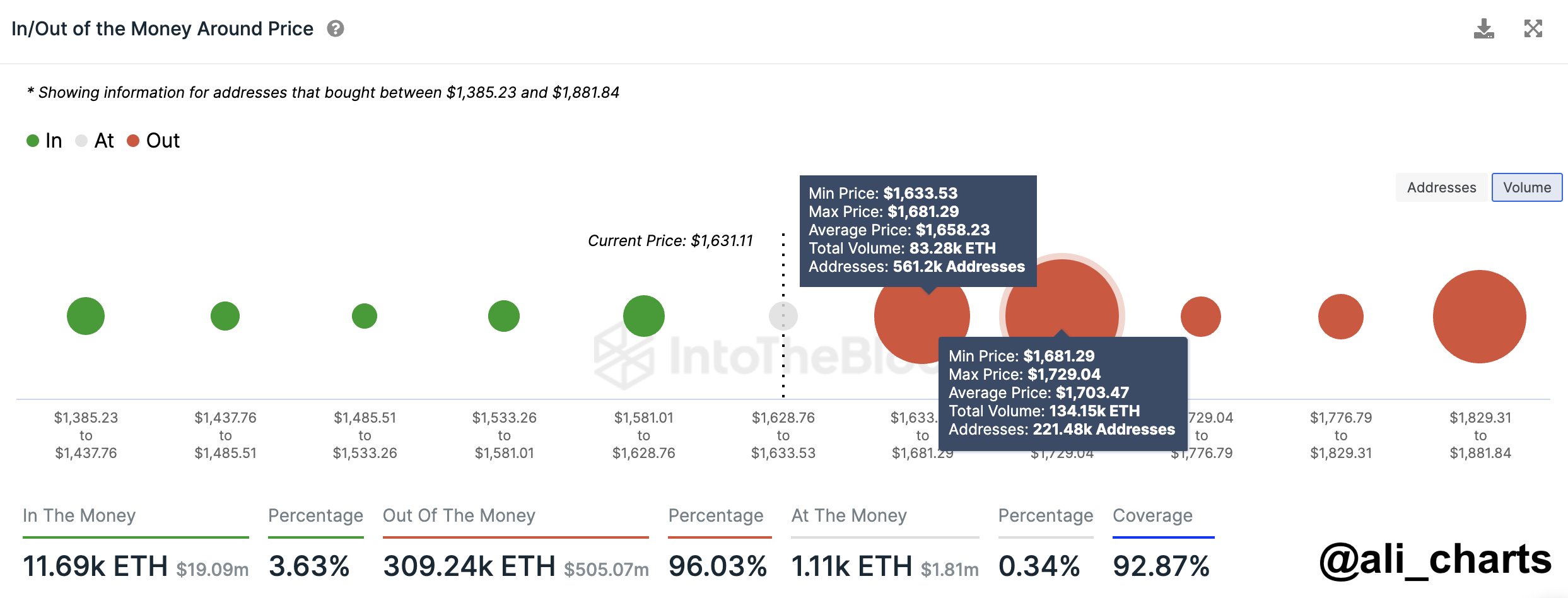

The density of traders who bought on the completely different ETH value ranges | Supply: @ali_charts

The above information exhibits the variety of traders that purchased in every Ethereum value vary. From it, it’s obvious that the present stage is comparatively skinny on holders, and the ranges under don’t host the fee foundation of that many holders.

Essentially the most dense teams are located within the value ranges simply above the present one, that means that on the present costs, all these traders can be sitting at losses on common.

Typically, zones with a excessive focus of value bases help the worth, however no such zone exists within the decrease ranges. Ali notes that this might result in a correction in the direction of the $1,200 stage, the following stage, with some help.

Shopping for from the whales on the present costs is of course a step in the fitting route for the asset, however it’s going to nonetheless have to recuperate a bit to the extra dense value foundation zones if a stable rebound has to construct up.

ETH Value

On the time of writing, Ethereum is buying and selling at round $1,600, down 5% within the final week.

ETH has continued to commerce sideways just lately | Supply: ETHUSD on TradingView

Featured picture from Todd Cravens on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link