[ad_1]

That is an opinion editorial by L. Asher Corson, a associate at UTXO Administration.

As a Bitcoin Maximalist, I really like Ordinals. Different Maximalists must also take into account loving Ordinals, as they display Bitcoin’s superiority in methods not beforehand doable. Ordinals allow functionalities that undermine the necessity for different blockchains to even exist. The use circumstances that had been demonstrated on different blockchains are actually doable natively on Bitcoin. Regardless of Bitcoin’s strengthening place, some self-proclaimed Maximalists on X (previously Twitter) bizarrely celebrated decreased community charges and declared Ordinals to have failed. This seemingly implies that Bitcoin would possibly in some way profit from a failure of the Ordinals protocol and decrease miner earnings. However Ordinals haven’t failed and the curiosity isn’t practically over. On the contrary, buying and selling quantity throughout digital artifacts, distinctive satoshis and BRC-20 tokens has been historic. In accordance with cryptoslam which tracks on-chain NFT quantity, Ordinals have performed over $500 million of buying and selling quantity since they had been launched in the beginning of 2023. Regardless of quantity and costs being down presently, buyers within the ecosystem are writing large checks to Ordinals corporations. Xverse, an Ordinals pockets, simply raised 5 million {dollars} on a 50 million greenback valuation from among the most refined buyers within the ecosystem. It’s much more probably we’re in the beginning of this phenomenon than the top.

What are Ordinals? It’s a protocol developed by Casey Rodarmor (@rodarmor) that permits any knowledge to be included in a Bitcoin transaction. It makes use of Ordinal Principle to affiliate that knowledge with a selected satoshi (the smallest unit of Bitcoin) which may be owned and traded. This innovation permits the creation and buying and selling of digital belongings straight on the Bitcoin blockchain with out a peg or a bridge.

Bitcoin Maximalists perceive that there have by no means been severe contenders to interchange bitcoin as digital cash, and it’s unlikely any will ever emerge. Viable altcoin use circumstances have by no means been based mostly on having higher financial properties than bitcoin as a result of that basically isn’t doable. Absolute digital shortage is unlikely to be found once more as a result of the circumstances surrounding Bitcoin’s creation had been so distinctive, partially, as a result of as we speak’s authorities understands the dangers of letting a decentralized community develop too massive they usually gained’t let it occur once more.

Alternatively, viable altcoin use circumstances are associated to options that Bitcoin couldn’t beforehand assist. A few of these use circumstances that the market has indisputably embraced embody: decentralized buying and selling, non-fungible tokens (NFTs), stablecoins, capital formation, borrowing/lending and on-chain leverage. Uniswap, a decentralized alternate, has performed virtually $500 billion in trading volume because it was launched in 2018. Moreover, Ethereum has performed $43.6 billion in NFT buying and selling quantity, in response to CryptoSlam!. Supply: CryptoSlam! NFT data, rankings, prices, sales volume charts, market cap

Though many don’t prefer it, these use circumstances will exist someplace as a result of the market has an urge for food for them. My robust desire is that they exist totally on Bitcoin and never on different chains. It could definitely be higher for Bitcoin and the hassle to separate cash and state, if there weren’t so many competing chains absorbing market share. Ordinals have the potential to not solely allow these use circumstances to be constructed natively on Bitcoin, but additionally to surpass their altcoin variations by way of implementation. These could be higher constructed on Bitcoin as a result of the protocol itself is extra decentralized and safe than altcoins. Bitcoin has the biggest market capitalization in comparison with all the opposite chains that may assist the event of those use circumstances. But additionally higher as a result of these use circumstances will probably be tailor-made to the Bitcoin neighborhood and can subsequently embody Bitcoin beliefs of decentralization, immutability and permissionlessness.

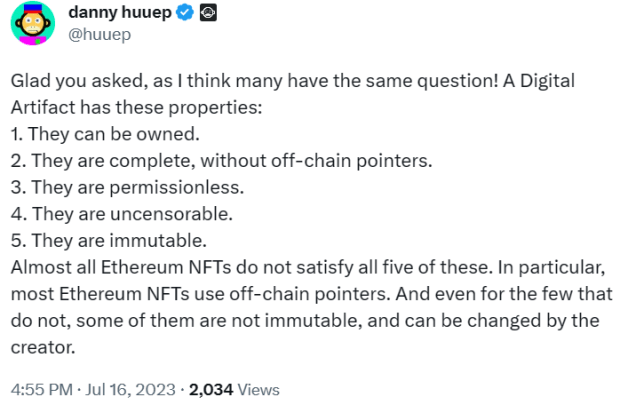

Though the protocol itself can’t cease scams, Rodarmor purposefully constructed Ordinals with Bitcoin beliefs on the forefront of his design choices. For instance, the Ordinals implementation of digital artifacts is objectively superior to the way in which virtually all NFTs had been applied on Ethereum and different chains. Danny Huuep describes the properties of a digital artifact, all of which Ordinals meet, extraordinarily nicely:

Supply: X

Think about a chunk of digital artwork value $1 million, or think about politically delicate info like categorised paperwork that element authorities atrocities. Ought to these priceless or delicate belongings be distributed utilizing know-how that may simply disappear or that may be simply modified? The reply is clearly no. It’s additionally considerably apparent that over time, the most effective artists, builders , activists, and buyers will gravitate in the direction of know-how with stronger immutability that’s able to defending their creation, info, or funding for tons of and even 1000’s of years. Within the case of digital artwork particularly, they are going to migrate to digital artifacts on Bitcoin that retailer the precise art work, as an alternative of NFTs that simply level to the place it’s saved on an off-chain server that might go down at any time.

Bitcoin stands alone atop the world of digital cash, and the rise of Ordinals solely cements that standing. This isn’t simply in regards to the concept of Bitcoin dominance in market capitalization phrases, however the sheer dominance of Bitcoin’s rules and the huge potential of its immutable blockchain. With Ordinals unlocking unprecedented alternatives inside the Bitcoin ecosystem, I see a seismic shift on the horizon. This shift ought to make Maximalists smile.

It is a visitor put up by L. Asher Corson. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

Disclosure: L. Asher Corson is a associate at UTXO Administration, subsidiary of BTC Inc., the mum or dad firm of Bitcoin Journal

[ad_2]

Source link