[ad_1]

Obtain free Cryptocurrencies updates

We’ll ship you a myFT Every day Digest e-mail rounding up the most recent Cryptocurrencies information each morning.

Small cryptocurrency exchanges rated as having increased ranges of threat for purchasers have been the principle winners from Binance’s hefty decline in market share within the 5 months since US regulators charged it with violating federal legal guidelines.

Corporations comparable to Huobi International and KuCoin, each primarily based within the Seychelles, are amongst these which have been in a position to enhance their share of the buying and selling of crypto tokens comparable to bitcoin and ether because the begin of this yr, based on information from trade analysis supplier CCData.

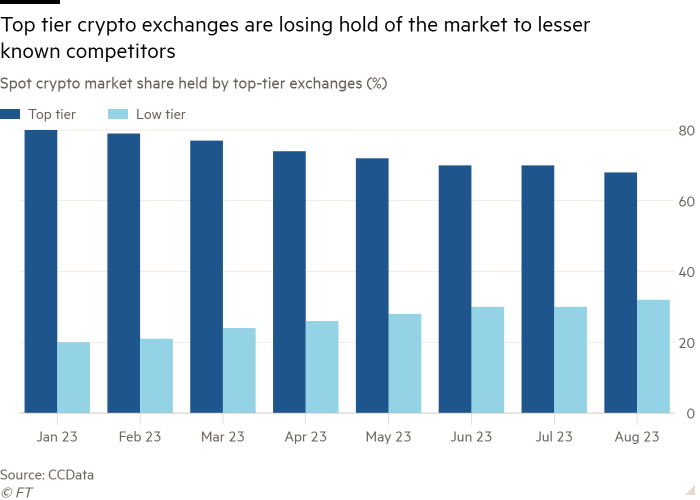

In distinction, exchanges which can be rated by CCData as “prime tier” — resulting from them surpassing a “minimal threshold for acceptable threat” to clients — have suffered a fall of their collective market share from 80 per cent to about 68 per cent because the begin of the yr. In the identical interval Binance, the trade chief, has fallen from 56 per cent to barely greater than 40 per cent.

The shifting panorama reveals merchants’ sensitivity to 2 lawsuits filed in opposition to Binance by US regulatory companies this yr. In March the Commodity Futures Buying and selling Fee alleged it illegally accessed US clients. The Securities and Alternate Fee adopted in June, accusing 13 Binance-related entities of violations together with allegedly mixing billions of {dollars} of buyer money.

“For a big portion of crypto merchants, anonymity and the flexibility to alternate funds that will have come from a excessive threat supply is extra vital than buying and selling on an alternate with a repute for compliance,” stated Tom Robinson, chief scientist and co-founder of blockchain tracing agency Elliptic.

Digital property dashboard

Click on here for real-time information on crypto costs and insights

CCData defines “prime tier” exchanges as those who have essentially the most sturdy approaches to defending buyer funds, safety and anti-money laundering requirements, to call just a few.

Huobi — which has elevated its share of the market by virtually 6 per cent since January — has led the way in which in 2023 for exchanges growing their share of the market whereas not being rated top-tier by CCData.

Others embody DigiFinex and KuCoin, who’ve elevated their share of the crypto market by 3.5 per cent and 1.3 per cent respectively since January. Huobi, DigiFinex and KuCoin didn’t instantly reply to requests for remark.

“It might be a chance for smaller exchanges as a result of they’re nonetheless working below the radar, and so they haven’t been sued by regulators,” stated CK Zheng, co-founder and chief funding officer at crypto hedge fund ZX Squared Capital.

“If I’m a newcomer to crypto and I don’t understand how exchanges work, I’d at the least get scared if I noticed one getting sued,” he added.

Different notable top-tier exchanges which have misplaced floor embody Coinbase and Binance US — the American arm of the Changpeng Zhao-led group — each of which have surrendered greater than 1 per cent of their share of the market since January.

“The Binance impact is large. Their market share took an enormous hit after the US’s crackdown on crypto,” stated Ilan Solot, co-head of digital property at London dealer Marex.

Click here to go to Digital Asset dashboard

[ad_2]

Source link