[ad_1]

That is an Perception article, written by a specific companion as a part of GIR’s co-published content material. Read more on Insight

In abstract

Cryptocurrency – it’s the most popular factor in investing. Or it was. With the values of cryptocurrencies plummeting, laws tightening and excessive incidences of fraud, what can buyers do to guard themselves and what are the rising traits to pay attention to?

Dialogue factors

- What are crypto property?

- How large is the fraud drawback?

- How are buyers defrauded?

- Can buyers defend themselves from fraud?

- What had been the key components impacting crypto in 2022?

- How are nations coping with crypto regulation?

Referenced on this article

- China’s powerful stance on crypto

- World regulatory developments

- Asia regulation

2022 – the crypto winter

With a gentle stream of calamities leading to a big downturn in asset costs, burnt buyers are fleeing the cryptocurrency market and it’s clear that the business is witnessing a serious stoop. The time period ‘crypto winter’ was first utilized in 2018 when the cryptocurrency market skilled a substantial downturn, and it made an look once more in 2022. The previous yr has seen the worth of widespread digital property reminiscent of Bitcoin and Ethereum slide from file highs. The decline began with the meltdown of TerraUSD (UST), when its value plunged to 10 cents and, together with its sister coin, Luna, misplaced nearly US$40 billion of worth in every week. Earlier than the crash, Luna was one of many high 10 largest cryptocurrencies in the marketplace. This occasion was the catalyst for a extreme decline in cryptocurrency costs, with most tokens dropping 50 per cent of their market valuation.

As the costs of varied currencies witnessed a free fall, many entrance runners of the crypto business confronted collapse. Crypto lender Celsius froze all account withdrawals, whereas Babel Finance suspended withdrawals, citing uncommon liquidity pressures. The crypto hedge fund Three Arrows Capital (3AC), which had invested closely in UST, defaulted on its mortgage funds to the crypto lender Voyager and subsequently filed for chapter in July 2022. Voyager, together with different lending platforms reminiscent of Genesis Buying and selling, incurred substantial losses and vital withdrawals main it to ultimately file for chapter. An article by CoinDeskin November 2022 said that cryptocurrency change FTX Buying and selling Ltd(FTX) had considerably overvalued its token, which accounted for a big portion of property at Alameda Analysis, its sister buying and selling platform. After a failed try by Binance to rescue FTX, the change collapsed because of a surge in buyer withdrawals, and FTX filed for chapter inside days.

Amid all this turmoil, in January 2023 crypto market capitalisation confronted one among its worst declines, falling 65 per cent from all-time highs in 2021. The outcome was an urgency amongst regulators to tighten laws and crack down on corrupt and delinquent digital foreign money corporations. In February 2023, the Securities and Alternate Fee (SEC) launched a collection of enforcement actions in opposition to a number of operators, together with Genesis and Gemini, over violating investor safety legal guidelines. The SEC additionally charged the founding father of UST and Luna of deceptive buyers, and Sam Bankman-Fried, the founding father of FTX, with further prison counts.

Crypto-related crime grew considerably, with the quantity of transactions associated to prison exercise sharply growing. Illicit use of cryptocurrencies hit a file US$20.1 billionin 2022 as transactions involving corporations focused by US sanctions skyrocketed, making up 44 per cent of the yr’s illicit exercise. To fight this, the EU has drawn up an intensive set of latest laws for governing crypto, whereas different nations, such because the US and the UK, are nonetheless contemplating their choices. In Asia, Singapore has established a stronger regulatory regime, whereas Hong Kong makes an attempt to tread a fantastic line between defending buyers and providing crypto teams a enterprise base.

Is that this the loss of life of crypto?

It appears not, as Bitcoin rebounded to over US$30,000 in April 2023, at the moment settling round US$26,000.The surging value comes at a time of deep uncertainty. There are theories that the worth rise is a perform of manipulation and propping up. Fears nonetheless proceed to encompass the safety of buyer funds, and new crypto buyers are pivoting to crypto exchange-traded funds (ETFs) as a safer entry level to digital property.

ETFs retain the attract for these buyers all in favour of cryptocurrencies however are new to the asset class, aiming to present retail buyers publicity to modifications in digital asset values with out the necessity to purchase or maintain them instantly. One other pattern grabbing the crypto business is the usage of synthetic intelligence (AI) crypto tokens. AI cryptocurrencies are tokens that energy AI blockchain platforms reminiscent of The Graph and SingularityNET.Customers pay with tokens to make use of the platforms and entry the advantages of the built-in AI techniques. Identification applied sciences are additionally being explored, as is obvious from the information that the CEO of Open AI,Sam Altman (who’s working to acquire funding to create a safe international cryptocurrency known as Worldcoin) is utilizing eyeball-scanning know-how to create a world identification system. These developments counsel that crypto prospects nonetheless maintain promise.

What are crypto property?

Cryptographic property are transferable digital representations, designed in a method that prohibits their copying or duplication. The know-how that facilitates the switch of cryptographic property is known as a ‘blockchain’. Blockchain is a digital, decentralised ledger that retains a file of all transactions that happen throughout a peer-to-peer community, enabling the encryption of knowledge. Cryptographic property and the underlying know-how present alternatives to digitise quite a lot of ‘actual world’ objects. Cryptocurrencies are probably the most generally recognized subset of crypto property, with Bitcoin being probably the most outstanding.As we speak we’ve completely different sorts of crypto asset, reminiscent of non-fungible tokens (NFTs), artificial property, stablecoins and utility tokens.

The tempo of growth within the crypto business has far outstripped regulators’ capability to reply. With social media, on-line boards, buying and selling purposes and plenty of crypto exchanges, the potential is excessive for inexperienced buyers to get burnt.

BitConnect, OneCoin, Bitclub Community, Axie Infinity, Pincoin, Thodex, Mining Capital, SushiSwap

These are a few of the largest crypto scams in historical past, with greater than 46,000 folks reportedly dropping over US$1 billion in crypto to scams between the start of 2021 and the primary quarter of 2022, based on the Federal Commerce Fee. Crypto scams are cons wherein scammers use some tried and a few new ways to steal cryptocurrency. Probably the most frequent scams is the funding rip-off, whereby fraudsters trick their victims into shopping for cryptocurrency and sending it to them. Amongst different ways, scammers impersonate companies, authorities companies and love pursuits.

Criminals not solely steal cryptocurrency, however additionally they use it to fund illicit exercise. In keeping with the 2023 Crypto Crime Report by Chainalysis, issued in February 2023, illicit transaction worth rose for a second consecutive yr in 2022, hitting a file US$20.6 billion. The Report categorized a variety of actions as illicit, together with transactions linked to youngster sexual abuse supplies, human trafficking, ransomware, stolen funds, terrorism financing, scams, cybercriminal directors, darknet markets and sanctions.

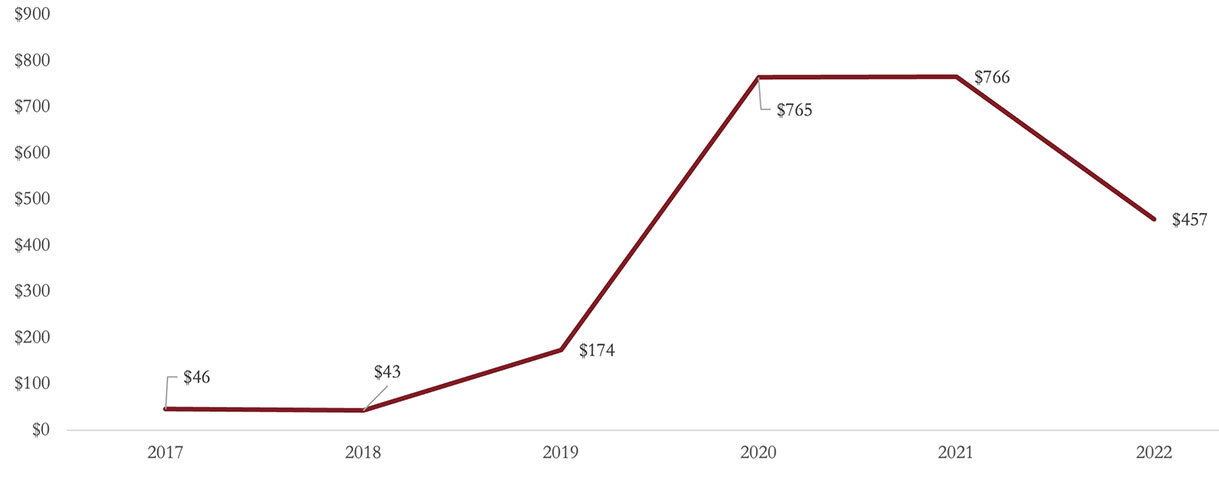

Determine 1: Whole illicit transaction worth 2017–2022

Supply: The 2023 Crypto Crime Report by Chainalysis

Fraudsters are drawn to cryptocurrency transactions as they’re pseudonymous and customarily perceived to be troublesome to get well.

Typical cryptocurrency transaction strategies embody:

- buying cryptocurrency by a cryptocurrency change;

- receiving cryptocurrency as fee for authorized or unlawful transactions;

- buying cryptocurrency for money at a cryptocurrency ATM; and

- exchanging fiat foreign money for cryptocurrency by casual peer-to-peer transactions.

Cryptocurrency transfers can’t be reversed, making them troublesome to hint, and with a lot of the normal public nonetheless unfamiliar with how crypto works, cryptocurrencies current quite a lot of alternatives for fraudulent exercise. Among the most typical kinds of crypto scams are as follows.

Bitcoin funding schemes

Scammers contact buyers claiming to be seasoned funding managers. They’re mainly Ponzi schemes whereby managers declare to have made tens of millions investing in cryptocurrency and request an upfront payment from potential buyers.

Ransomware or blackmail and extortion scams

Ransomware begins with cybercriminals coming into a system and encrypting information, then providing a decryption key if the sufferer agrees to pay a ransom by cryptocurrency. Extortions by ransomware attackers had been down 40.3 per cent to US$456.8 million in 2022 from US$765.6 million in 2021.Nonetheless, the decline just isn’t attributed to a drop in assaults however moderately on account of victims refusing to pay ransomware attackers.

Determine 2: Whole ransomware worth 2017–2022

Supply: The 2023 Crypto Crime Report by Chainalysis

Rug pull scams

Rug pull scams happen when funding scammers pump up a brand new undertaking, NFT or coin to get funding and promise large returns to attract in hefty investments. Nonetheless, the sport modifications because the funds from the undertaking are drained abruptly. One of these rip-off is dubbed a ‘rug pull’. A complete of US$26 billion was misplaced in over 600 circumstances to cryptocurrency and NFT rug pulls between the start of 2011 and June 2023.

Romance scams

There was a latest improve in romance scams, wherein the fraudster contacts the sufferer on-line, builds their belief, then solicits private info.

Faux job listings

Scammers will impersonate recruiters or job seekers to get entry to cryptocurrency accounts. The ‘jobs’ they’re hiring for are sometimes within the crypto area, together with crypto mining and recruiting different crypto buyers. The job seeker should make a fee in crypto to get began.

Faux cryptocurrency exchanges

Faux and unregulated cryptocurrency exchanges act as a legit change to commit a rip-off. When a sufferer makes an attempt to withdraw funds, obstacles seem, reminiscent of unannounced charges and taxes to be paid.

Flash mortgage assaults

Flash loans are loans for brief durations of time with the money-making trades carried out in a single transaction after which the flash mortgage is repaid. These loans are widespread within the cryptocurrency market as merchants use funds to purchase tokens on one platform with a cheaper price, after which promote that asset instantly on a distinct platform to generate profits. In February 2023, Platypus Finance was sufferer to a flash mortgage assault, leading to a US$8.5 million loss.

Is shopper safety doable?

There are some methods to guard present or future investments.

- Reliable digital fee token service suppliers: buyers ought to analysis their cryptocurrency exchanges earlier than they purchase crypto on them. Key parameters for selecting an change embody that it: ought to present related threat disclosures to retail shoppers and comply with correct segregation of buyer property; has processes for complaints dealing with; has not been hacked; and maintains excessive availability and recoverability of its essential techniques.

- Safe crypto wallets:storing crypto in a safe pockets ought to provide safety. Different safety methods embody sustaining robust passwords, spreading cryptocurrencies throughout completely different wallets, retaining the seed phrase secure in an offline location, utilizing two-factor authentication and, if technical expertise permit, holding each cold and warm wallets.

- Blockchains: there’s fixed threat of a 51 per cent attacok, which suggests if a miner or a gaggle of them get greater than 50 per cent of the networks, they will management the mining hash price.

- Know-your-customer (KYC) necessities: many nations now require foreign money exchanges to adjust to KYC necessities or at the least preserve information of shoppers’ identities. This enables fraud examiners and authorized advisers to trace the cash by courtroom orders or subpoenas.

- Regional regulation: the absence of a unified international regulatory frameworkis additionally showing to be a risk. Whereas the EU has enacted strict laws to restrict the usage of cryptocurrencies, some nations (reminiscent of El Salvador) have totally embraced cryptocurrencies.

- Complete white papers:buyers ought to overview each cryptocurrency’s white paper earlier than funding. The white paper particulars the usual for each foreign money, the crypto’s use circumstances and scalability and the creator’s plans for the longer term.

The crypto disaster of 2022

UST

Terraform Labs endeavoured to utilise blockchain know-how to assemble a decentralised finance community. Do Kwon, a Stanford College graduate and a former engineer at Apple and Google, launched UST as an algorithmic stablecoin in 2018.

UST was supported by Luna, which functioned as a parallel floating price cryptocurrency and was chargeable for sustaining a peg of US$1. In March 2022, the worth of Luna reached a peak of roughly US$120 per token, propelled by the potential of the UST/Luna ecosystem amid a surge within the cryptocurrency market.

In early Could 2022, buyers concurrently withdrew their funds because of a lack of confidence within the tokens. Inside a fortnight, the Terra stablecoin and Luna token continued their steep decline, main some media sources to categorise it as a possible Ponzi scheme or rug pull rip-off.

Whether or not an enormous UST sell-off was a response to rising rates of interest or there was a malicious assault on the Terra blockchain, is a matter of rivalry. A analysis report by Nansen, an organization that analyses blockchain information, investigated the UST loss of life spiraland it dispels the notion {that a} solitary attacker was chargeable for the depeg. Do Kwon acknowledged the potential of blockchain and decentralisation, motivating him to reorganise the coin and launch a brand new model.

In September 2022, South Korea issued an arrest warrant for Kwon, whereas Interpol reportedly issued a ‘purple discover’ for him. The SEC started an investigation of Terraform Labs in June 2022 to find out whether or not the advertising of the UST stablecoin violated federal laws.

In September 2022, a US$56.9 million class motion was filed in Singapore in opposition to Kwon, Terraform Labs, Nikolaos Alexandros Platias and the Luna Basis Guard. In February 2023, US monetary regulators charged Do Kwon and TerraForm Labs with ‘orchestrating a multi-billion-dollar crypto asset securities fraud’.

Ethereum fusion

Following UST’s demise, Ethereum, the dominant blockchain for good contracts, underwent a big transformation by switching from a proof-of-work to a proof-of-stake consensus system. This modification lowered vitality consumption by a exceptional 99.5 per cent, addressing considerations about blockchain’s environmental impression and bettering community efficacy..

Nonetheless, the shift to proof-of-stake additionally uncovered Ethereum to potential regulatory challenges, as proposed payments within the US Congress sought to impose strict laws on the sort of blockchain. This severely impacted Ethereum’s innovation potential as a number one blockchain hub.

3AC collapse

3AC was launched in 2012 by classmates Su Zhu and Kyle Davies, specializing in rising market foreign money buying and selling.At one stage, the fund had an estimated US$10 billion below its administration.

As of the tip of 2020, 3AC turned the most important holder of Grayscale Bitcoin Belief (GBTC) shares, with a place then value US$1 billion,because the hedge fund might purchase shares at a reduction in change for Bitcoin.Shares had been bought to bizarre merchants at a premium value. Nonetheless, with the appearance of ETFs on Bitcoin in Canada, GBTC misplaced vital worth.

3AC had invested in a variety of devices and tasks, so its success was instantly depending on the expansion of the crypto market. Along with investor funds, different loans had been additionally utilized, which had been invested in Luna and different much less liquid cash.

Because of these extraordinarily unsuccessful transactions and the collapse of UST and Luna, a liquidity disaster arose. Kyle Davies tried to take out a brand new mortgage from Genesis in mid-June 2022 to cowl his obligations. Sam Callahan of the BTC Financial savings Plan means that, in some unspecified time in the future, the crypto fund was a Ponzi scheme, because the founders resorted to discovering new buyers and lenders as losses mounted.

3AC was ordered to liquidate in June 2022 by a courtroom within the British Virgin Islands,and on 1 July 2022 it filed for chapter in a New York courtroom, owing over US$3 billion to collectors.

FTX collapse

In early November 2022, CoinDesk printed an article that solid critical doubts on the steadiness of the FTX crypto change.The article referred to a confidential doc obtained by the information website, revealing that roughly 40 per cent of the property held by Sam Bankman-Fried’s private hedge fund, Alameda Analysis, consisted of FTT tokensissued by the FTX change. Alameda’s complete property sat at US$14.6 billion, with the FTT tokens representing almost 90 per cent of the corporate’s web property.

Given the restricted marketability of such a lot of FTT tokens (in extra of US$5.8 billion), any liquidity necessities for repayments might result in a run on Alameda’s stability sheet and possible chapter.

What did FTX need to do with Alameda?

Each FTX and Alameda Analysis had been majority-owned by Sam Bankman-Fried. With the collapse, beforehand undisclosed particulars relating to the connection between these two corporations got here to mild.

Lucas Nuzzi, head of analysis at Coin Metrics, performed an evaluation utilizing open blockchain information and decided that the FTX change supplied Alameda with US$4 billion in emergency funding utilizing FTT tokens (conveniently issued by FTX itself).If Alameda had been to face chapter, the compensation of loans issued by the FTX change could be extremely unsure.

Panic ensued amongst FTX shoppers, with withdrawal volumes from the crypto change reaching US$6 billion by 8 November 2022.The FTT token had already skilled an 80 per cent decline because the starting of the month. The change imposed restrictions on withdrawal quantities.

FTX’s largest competitor, Binance, introduced its determination to liquidate the remaining FTTon its books, though inside just a few days it additionally stated it wished to totally purchase FTX.com.Nonetheless, after a overview of FTX’s funds,Binance withdrew its provide.

Alarming revelations included reckless lending practices, with FTX’s founder channelling over US$10 billion of buyer funds into high-risk bets, whereas the CEO of Alameda Analysis displayed a lack of know-how relating to due diligence and threat administration.

Additional misconduct occurred behind the scenes, as almost US$500 million was discreetly transferred out of the FTX change, indicating premeditated actions by these concerned.The failure of FTX triggered investigations by the Justice Division and the SEC into whether or not FTX inappropriately utilised buyer money to prop up Alameda. Sam Bankman-Fried was detained within the Bahamas on 12 December 2022 for defrauding buyers and mendacity to them. He faces eight prison fees and as much as 115 years in jail if convicted.

Influence on Bitcoin value

Between 7 November and eight November 2022, Bitcoin plunged by 22 per cent in lower than a day as buyers struggled to gauge the impression of a possible FTX collapse. It fell under US$16,000 a number of occasions within the subsequent weeks.

Regulators are speeding to maintain up

As cryptocurrency has advanced from a speculative funding to a brand new asset class, it has prompted governments to discover methods to manage it. Totally different nations have completely different approaches, including to the shortage of readability surrounding crypto regulation.

Within the US, the crypto laws are filled with problems, as there are a number of regulators in command of overseeing crypto corporations. The Biden administration signed an government order in March 2022 calling on federal regulators to evaluate the broad dangers and advantages supplied by cryptocurrencies. In January 2023, the administration launched a roadmap to mitigate crypto dangers.

The SEC has already moved in the direction of regulating the sector with its extensively publicised lawsuit in opposition to Ripple, alleging that it raised greater than US$1.3 billion by promoting its native token, XRP, in unregistered securities transactions. Extra not too long ago, the SEC has been focusing on exchanges reminiscent of Coinbase and Binance over their crypto merchandise.

The EU has been extra ahead wanting. It not too long ago ratified the primary cross-jurisdictional regulatory and supervisory framework for crypto property.The regulation goals to make sure that crypto transfers can all the time be traced, and suspicious transactions blocked, as is the case with every other monetary operation.

The UK is planning to introduce a sweeping new regulatory regime that goals to carry guidelines governing crypto tokens in keeping with these already in place for conventional monetary property reminiscent of shares and bonds. Nonetheless, the Monetary Conduct Authority’s present regulatory remit over crypto is proscribed to creating positive that crypto corporations that function within the UK adjust to anti-money laundering and counter-terrorism laws.

What about Asia?

In distinction to the remainder of the world, nations within the Asia-Pacific area have demonstrated extensively differing attitudes to the regulation of crypto property.

China’s crypto shutdown

China’s crypto ban in September 2021 focused three areas of digital asset dealing:

- Bitcoin mining: after China banned Bitcoin mining, it turned unlawful for Chinese language residents and companies to mine cryptocurrencies;

- crypto buying and selling and transactions: Chinese language buyers are usually not permitted to purchase, promote or transact in digital currencies reminiscent of Bitcoin or Ethereum; and

- employment within the crypto sector: if any tech corporations or entrepreneurs cope with cryptocurrencies, they may face vital penalties.

Though it’s unlawful to make use of and purchase crypto in China, there aren’t any particular insurance policies in opposition to holding digital property reminiscent of Bitcoin, Dogecoin or Ethereum. Nonetheless, evidently Bitcoin continues to be being mined in China. The Cambridge Bitcoin Electrical energy Consumption Index famous that mining exercise in China appeared on Bitcoin’s community in September 2021. In early 2022, China accounted for greater than 20 per cent of Bitcoin’s hash price, which is second solely to the US. Mainland China was additionally the world’s fourth-largest crypto market within the yr as much as July 2022.

China has additionally been engaged on its ‘digital yuan’ foreign money, a state-sponsored digital foreign money to trace all foreign money actions. The digital yuan might be distributed by the Folks’s Financial institution of China to business banks, and business banks might be chargeable for taking the digital foreign money into the fingers of shoppers. Customers may have a service whereby they will change cash for digital yuan.

Is Hong Kong the brand new frontier for crypto?

In keeping with the Worldwide Crypto Readiness Report, Hong Kong was probably the most ‘crypto-ready’ in 2022, topping all classes together with the variety of blockchain start-ups per 100,000 folks and the variety of crypto ATMs proportional to the inhabitants. Notably, this ranked it forward of the USA and Switzerland.

The Hong Kong authorities has been comparatively supportive of the sector and is extra ‘crypto pleasant’ than mainland China. The Hong Kong authorities ‘could be very critical about constructing a world digital asset centre’, stated Xiao Feng, chair of Hong Kong crypto change HashKey, which noticed 13,000 folks attend the primary day of its Hong Kong Web3 competition.

HashKey obtained a licence to function in Hong Kong in November 2022, making it one among two licensed crypto exchanges within the metropolis (alongside rival change OSL). Different corporations that plan to determine or increase their presence in Hong Kong embody exchanges KuCoin, Gate.io and Huobi, which introduced plans in February 2023 to maneuver its headquarters from Singapore.

The Hong Kong authorities additionally introduced its funding assist to the business by earmarking US$6.4 million for growing its Web3 ecosystem. Hong Kong’s monetary secretary, Paul Chan, additionally introduced the formation of a process pressure devoted to the event of digital property, composed of members from the coverage bureau, regulatory our bodies and the business.

Acceptance of crypto as a foreign money in Gatecoin

In a ruling in March 2023,the Hong Kong Excessive Courtroom confirmed that cryptocurrencies represent ‘property’ below Hong Kong regulation and are able to being held on belief. The ruling was made in a authorized dispute involving the crypto change Gatecoin, which collapsed in 2019. The courtroom stated that crypto property have property attributes and are ‘able to being held on belief’.

In mild of the latest high-profile collapses of some main cryptocurrency exchanges, this determination offers useful readability on the authorized remedy of cryptocurrencies in Hong Kong, notably in a winding-up situation. Legislation corporations have famous that the brand new ruling might present insolvency professionals with extra readability on crypto property and implies that crypto has property traits just like different property reminiscent of shares.

As Hong Kong pushes to place itself as a world digital asset hub, disputes surrounding crypto property and related applied sciences will solely develop into more and more frequent.

What did Singapore do?

The Financial Authority of Singapore (MAS) is concentrated on constructing a accountable and progressive digital asset ecosystem.Its purpose is to scale back potential shopper hurt from cryptocurrencies and related companies by attracting companies with glorious threat administration capabilities and worth propositions.

MAS encourages the expansion of the digital asset ecosystem by supporting initiatives reminiscent of tokenisation and distributed ledgers, but additionally warns in opposition to the dangerous apply of hypothesis on cryptocurrencies. Nonetheless, MAS can also be taking measures to handle the dangers of digital property and limit retail entry to cryptocurrencies.

Cryptocurrency just isn’t cash

A latest judgment in Singapore involving 3AC set a precedent for the authorized standing of cryptocurrencies. Algorand Basis filed an utility to wind up 3AC within the Singapore Excessive Courtroom, searching for to get well US$53.5 million in cryptocurrency. The central situation was whether or not cryptocurrency might be thought of a sum of cash, which might decide Algorand’s standing as a creditor and the validity of the applying. Nonetheless, the courtroom rejected Algorand’s argument, stating that cryptocurrency just isn’t thought of ‘cash’ for the needs of a winding-up utility, as figuring out its standing would require intensive examination and was not acceptable within the context of insolvency.

Conclusion

Because of the latest crises and collapse of a few of the largest impartial crypto exchanges, buyers have misplaced billions of {dollars}. This has had a drastic impression on shopper enterprise acceptance of latest concepts and on the selection of companies and investments, and has implications for coverage and laws. Nearly all of the unhealthy actors have been taken out, and the worth and market construction of Bitcoin had rebounded to a stable place as on the time of writing.

The failures of FTX, Celsius and Terraform Labs helped differentiate unregulated, centralised gamers that ran defective and fraudulent companies. It additionally signified the business’s maturation, which is able to proceed to advance as extra laws are applied.

Most of the eruptions of 2022 wouldn’t have occurred if the digital property sector had acceptable company governance constructions in place. The absence of transparency and weak governance, along with a perception that crypto is essentially distinctive and due to this fact can’t be addressed with time-tested approaches, are main contributors to the business’s downfall.

With the domino impact of the crypto crises leading to crypto-service corporations submitting for chapter, there’s a want for the crypto ecosystem to align its actions nearer with that of the standard finance business, benefiting from the teachings realized over centuries.

The key disruption triggered up to now yr has sparked an curiosity from market regulators to make sure financial and monetary stability as these property develop into extra extensively adopted. The alternatives for regulators embody an opt-in or pilot regime, a risk-based regime, a catch-all regime or a blanket ban. Whereas a risk-based regime is probably going the popular method, the frequent goal throughout all jurisdictions is the safety of customers, market stability, the minimising of regulatory arbitrage, and a nimble and agile regulatory framework that effectively accommodates the speedy market growth and monetary innovation that’s prevalent within the class of crypto property. Regardless of a troubled 2022, digital property proceed to evolve and stay a potent supply of innovation, and market members anticipate better integrity within the crypto asset market in 2023.

Notes

[ad_2]

Source link