[ad_1]

Chainlink’s LINK value is displaying constructive indicators tempo above $7.20. The worth may rise additional if it stays above the $7.30 assist zone.

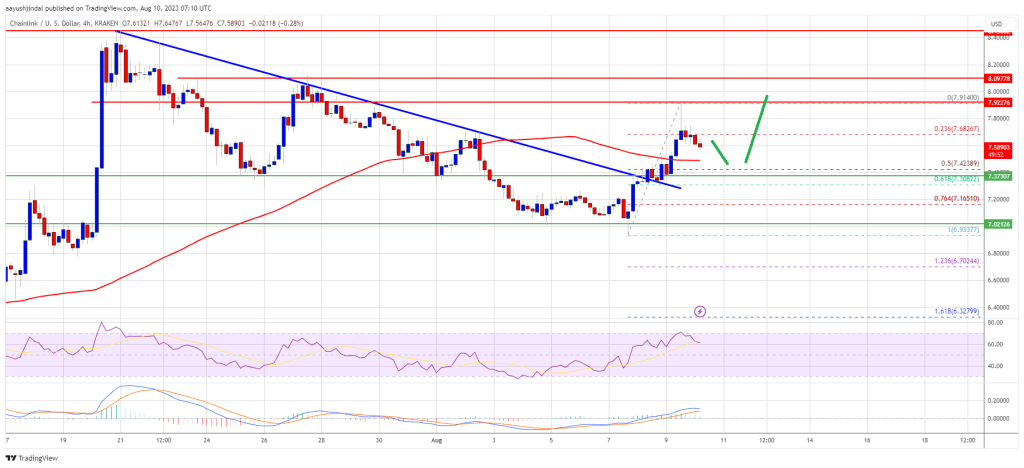

- Chainlink token value is displaying constructive indicators and rising from $7.00 towards the US greenback.

- The worth is buying and selling above the $7.30 stage and the 100 easy transferring common (4 hours).

- There was a break above a serious bearish pattern line with resistance close to $7.35 on the 4-hour chart of the LINK/USD pair (information supply from Kraken).

- The worth may achieve bullish momentum above the $7.35 resistance zone.

Chainlink (LINK) Worth Eyes Extra Positive factors

After a short-term draw back correction, LINK value discovered assist close to the $6.95 stage towards the US Greenback. A low was fashioned close to $6.933 and the value began a recent improve, not like Bitcoin and Ethereum.

There was a transparent transfer above the $7.10 and $7.20 resistance ranges. Moreover, there was a break above a serious bearish pattern line with resistance close to $7.35 on the 4-hour chart of the LINK/USD pair. Lastly, the pair traded near the $8.00 zone.

A excessive is fashioned close to $7.914 and the value is now correcting positive aspects. There was a transfer under the 23.6% Fib retracement stage of the upward transfer from the $6.933 swing low to the $7.914 excessive.

Supply: LINKUSD on TradingView.com

LINK value is now buying and selling above the $7.30 stage and the 100 easy transferring common (4 hours). It’s now going through resistance close to the $7.80 stage. The primary main resistance is close to the $7.95 zone. A transparent break above $7.95 might presumably begin a recent improve towards the $8.20 and $8.255 ranges. The subsequent main resistance is close to the $8.50 stage, above which the value may revisit $8.80.

Dips Supported?

If Chainlink’s value fails to climb above the $7.95 resistance stage, there may very well be a draw back correction. Preliminary assist on the draw back is close to the $7.50 stage and the 100 easy transferring common (4 hours).

The subsequent main assist is close to the $7.30 stage and 61.8% Fib retracement stage of the upward transfer from the $6.933 swing low to the $7.914 excessive, under which the value may check the $7.10 stage. Any extra losses may lead the value towards the $7.00 stage within the close to time period.

Technical Indicators

4 hours MACD – The MACD for LINK/USD is dropping momentum within the bullish zone.

4 hours RSI (Relative Energy Index) – The RSI for LINK/USD is now above the 50 stage.

Main Help Ranges – $7.50 and $7.30.

Main Resistance Ranges – $7.80 and $7.95.

[ad_2]

Source link