[ad_1]

hocus-focus/iStock Unreleased by way of Getty Pictures

The Bitcoin (BTC-USD) mining trade had a troublesome 2022. Many firms have been over-leveraged and blew themselves up when BTC fell under ranges that made operations unsustainable. Sphere 3D (NASDAQ:ANY) is a BTC mining firm that when had lofty targets that, thus far, have failed considerably spectacularly. Sphere 3 solely lately received into crypto mining after beforehand working as an information storage and administration enterprise. Bitcoin mining commenced in January 2022.

NuMiner and Gryphon Setbacks

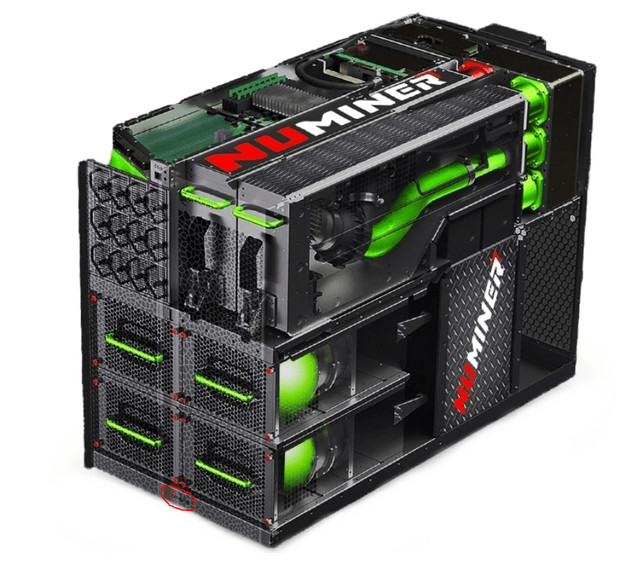

Shortly after mining operations started, Sphere 3D announced an order of 60,000 mining rigs from an organization known as NuMiner International. The rigs, known as the NM440, would have reportedly generated an astounding stage of effectivity that might have enabled a dramatic discount in vitality used to mine – thus, enhancing the gross margins for Sphere 3D. You may see an image of the NM440 under:

However past the effectivity of the machines, when totally energized the quantity of reported exahash capability enabled by the NM440 would have given Sphere 3D a surprising 32 EH/s. This could have actually made Sphere 3D the highest public miner by month-to-month manufacturing and certain by a large margin. Sadly, the NM440 by no means panned out for Sphere 3D. Skeptics on the time alleged the NM440 was nothing greater than a photoshopped mockup of a Cerebras Programs CS-2 machine constructed for AI compute; sentiment Cerebras Programs appeared to corroborate according to Bitcoin.com.

Throughout the identical time, Sphere 3D was working on a merger with the personal mining firm Gryphon Digital Mining. Gryphon is led by Rob Chang who has earlier public mining expertise at Riot Platforms (RIOT). Chang was to be the CEO of the brand new firm post-merger. The Gryphon deal subsequently fell apart shortly after the NuMiner state of affairs with each Gryphon and Sphere 3D amicably agreeing to half methods in April 2022:

After cautious consideration by each administration groups and their respective boards of administrators, the events amicably agreed to the termination as a consequence of altering market situations, the passage of time, and the relative monetary positions of the businesses, amongst different elements.

The day after the Gryphon deal ended, then Sphere 3D CEO Peter Tassiopoulos moved into a unique advisor function with Sphere 3D and present CEO Patricia Trompeter took over. Issues have not gotten simpler for Sphere 3D for the reason that NuMiner/Gryphon conditions as the corporate has handled all types of points associated to US customs delivery delays, deposits caught in third occasion chapter proceedings, and reliance on internet hosting providers to convey rigs on-line. Lastly, Sphere 3D recently sued Gryphon Digital Mining for what the corporate claims to be a breach of contract pertaining to fiduciary and operational obligations as a part of a Grasp Companies Settlement. Sphere 3D’s new internet hosting association is with Rebel Mining Company.

Manufacturing is Really Bettering

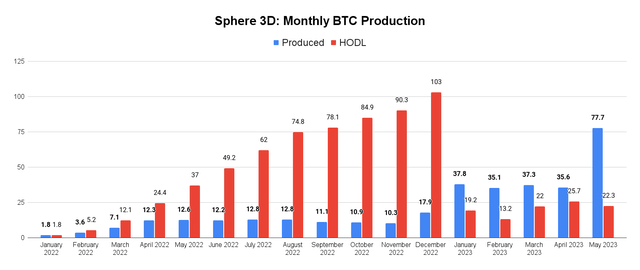

Regardless of the quite a few points pertaining to Sphere 3D’s operations, the corporate has been in a position to convey extra machines on-line this 12 months. In Might, the corporate mined practically 78 BTC. Whereas that is very small in comparison with different mining friends, it’s greater than double what the corporate was in a position to produce within the month of April and a 600% enchancment over Might 2022. On the finish of Might 2023, working exahash per second reached 1.0 EH/s. It is the very best stage of manufacturing Sphere 3D has attained but it surely must be famous that the corporate’s January investor deck was guiding for 1.66 EH/s by April.

Month-to-month BTC Manufacturing (Sphere 3D/Writer Graphic)

In January, Sphere 3D liquidated roughly 121.6 BTC when accounting for what was offered out of treasury and from January’s manufacturing. Bitcoin’s worth in January was between $17-24k. Utilizing a $20k BTC worth as a baseline estimate, we are able to fairly estimate Sphere 3D introduced in about $2.4 million from liquidations in January – although the corporate might have truly been ready to usher in greater than that if it timed gross sales nicely.

Path to Profitability?

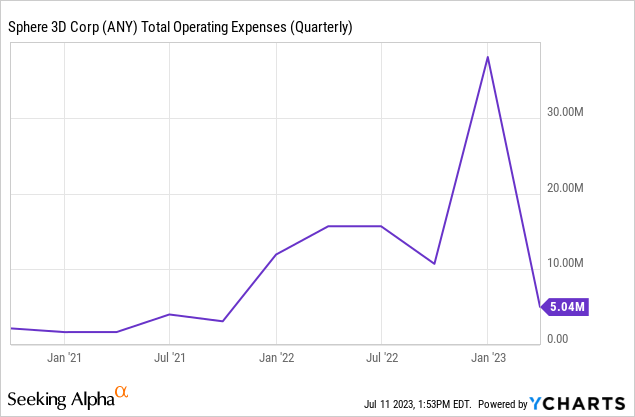

The largest concern going ahead for Sphere 3D is the corporate is operating out of money and scaling choices are restricted with out debt or dilution. Quarterly income has averaged simply $1.9 million during the last 4 quarters whereas opex has typically elevated nicely forward of what the corporate is bringing in.

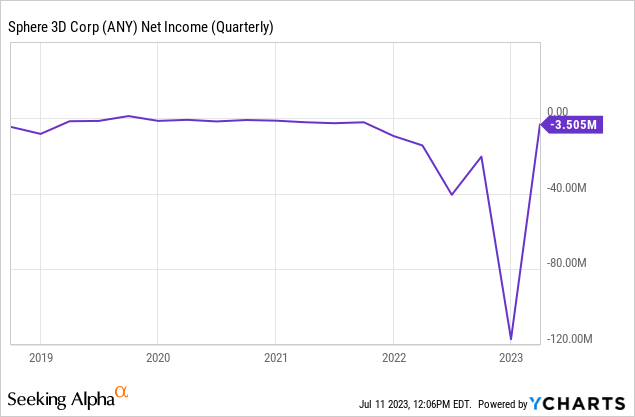

After we consider each opex and price of income in opposition to simply $7.7 million in TTM income, Sphere 3D’s unfavorable web earnings has totaled nearly $182 million during the last 4 quarters:

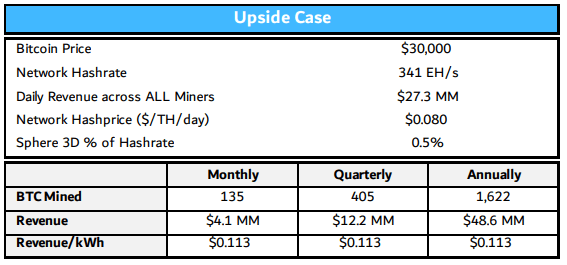

A big issue within the This autumn-22 unfavorable web earnings was a results of impairment of intangible property and investments associated to vendor bankruptcies and the efficiency of FileCoin (FIL-USD). As of quarter ended March 2023, Sphere 3D had simply $2.7 million remaining in money and $74.9 million in whole property in opposition to 10.7 million in whole liabilities. Within the January investor deck, the corporate laid out some situations for the place the quarterly income could possibly be if it may obtain 1.66 EH/s in 2023:

January Upside Estimate (Sphere 3D)

Even when Sphere was in a position to obtain 1.66 EHS, which it has but to do, Sphere’s inner upside estimate could also be overly optimistic. Within the Might Manufacturing replace, Trompeter stated this:

By the top of June, we count on to be near finishing our near-term objective of 1.3 EH/s put in hash fee by energizing a further 2,400+ miners which might be at the moment in-transit and are anticipated to reach at our internet hosting websites inside the subsequent few weeks. As soon as all 1.5 EH/s are totally operational within the month following, we count on to be delivering optimistic working money flows on a run-rate foundation at present market ranges.

Bitcoin was nearer to $25k when that press launch got here out but it surely’s attainable Trompeter was referring to finish of Might BTC ranges which have been nearer to $27k. On the present $30k stage, Sphere 3D might be money move optimistic subsequent quarter however I’ve doubts about that. If we assume a BTC per EH/s determine of 80, which might be according to what the corporate reported between April and Might, I see a breakeven determine nearer to $37k for Sphere 3D:

| 360 BTC @ | $30,000 | $32,500 | $35,000 | $37,500 |

|---|---|---|---|---|

| Income | $10,800,000 | $11,700,000 | $12,600,000 | $13,500,000 |

| Price of Rev | $8,550,000 | $8,550,000 | $8,550,000 | $8,550,000 |

| Opex | $4,500,000 | $4,500,000 | $4,500,000 | $4,500,000 |

| Earnings | -$2,250,000 | -$1,350,000 | -$450,000 | $450,000 |

Supply: Writer Estimates

My desk above assumes manufacturing capability of 1.5 EH/s averaged for the complete quarter and opex remaining flat from Q1. This additionally assumes community hashrate stays fixed which might be a counter-trend assumption. However to be clear, that is simply my estimate and never essentially indicative of the fact of Sphere 3D.

Dangers

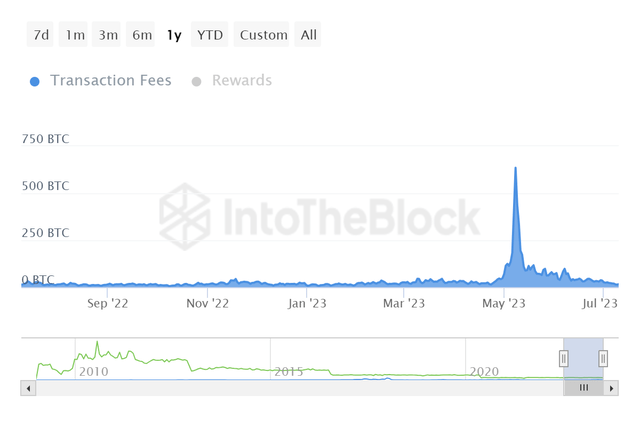

The following Bitcoin halving occasion is projected for April 2024. When this occurs, the block reward for mining BTC will drop from roughly 6.2 BTC to three.1 BTC. This implies all miners will successfully see their price of income double. Whereas we noticed transaction charges enhance miner income in Might, the Ordinals-driven development in Bitcoin’s price market hasn’t had comply with throw into the summer time months.

Miner Transaction Charges (IntoTheBlock)

Although the corporate does not have debt, there was dilution in latest quarters. Sphere 3D simply completed a reverse-split to stay compliant with itemizing insurance policies. And there was $8.5 million in stock-based compensation in 2022. Which implies stock-based compensation exceeded income for the 12 months. In my opinion, that is a crimson flag.

Abstract

If every thing goes proper from right here and Sphere 3D can scale manufacturing capability targets with out taking up debt, the corporate might theoretically get purchased out by a much bigger entity that desires to consolidate hashrate. However I do not know that I might financial institution on that given the macro uncertainty and the excessive price of credit score. ANY is an attention-grabbing maintain, however I believe there are higher Bitcoin proxies within the mining sector. And I will reiterate as soon as once more what I’ve stated in lots of articles up to now; the easiest way to guess on Bitcoin is to only purchase BTC.

Editor’s Observe: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

[ad_2]

Source link