[ad_1]

Obtain free Cryptocurrencies updates

We’ll ship you a myFT Every day Digest e mail rounding up the newest Cryptocurrencies information each morning.

Howdy and welcome to the newest version of the FT Cryptofinance publication. This week, we’re having a look at Coinbase’s different regulatory troubles.

Coinbase is in a authorized quagmire.

This week it filed its response to the Securities and Change Fee, which this month alleged the US-listed group had been operating an unregistered securities alternate and providing unlisted securities. It’s a case that guarantees to define the American crypto industry. It’s a hefty 177-page read.

However one other severe authorized subject bought misplaced amid the SEC headlines initially of the month. Alabama state securities regulators additionally filed an order that gave Coinbase simply 28 days to show it isn’t promoting unregistered securities in its state. After that it faces a cease-and-desist order.

It was filed on June 6 and was the results of a multi-state job drive that comprised California, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington and Wisconsin. Come July 4, time is up.

Collectively, the states have locked on to Coinbase’s staking rewards programme, a typical solution to provide traders a return on their belongings. Customers lock their crypto of their pockets — on an alternate similar to Coinbase — for a set interval however give permission for that third social gathering to stake their crypto on different crypto tasks that provide curiosity or a yield.

One of the vital well-liked methods is to place the staked asset to work serving to to safe a big public blockchain, similar to ethereum. The limitations to staking blockchains are fairly excessive and customers usually want to carry plenty of a specific cryptocurrency first. A pooled stake is one solution to do it.

Relying on the coin and the chance concerned, staking can earn an annual yield of between 4 and 17 per cent. The issue is that Alabama and others regard staking as an unregistered safety.

Coinbase disagrees. It “firmly believes that our staking companies on no account represent securities below any state or federal regulation, and we intend to defend this necessary a part of the cryptoeconomy”.

Coinbase has to combat every case state by state. It’s in energetic discussions with 5 states that issued stop and desist orders, including that extensions have been given to the corporate, in line with an individual accustomed to the matter.

Different states which have began proceedings have solely set Coinbase deadlines to indicate trigger as to why its staking companies are usually not securities and nobody state is transferring to enforcement subsequent week, the particular person added.

Nevertheless it underscores that there’s lots at stake for Coinbase with staking. There are greater than 3.5mn US Coinbase clients with a staking reward programme account. Within the first quarter, turnover from the service was $74mn, about 10 per cent of complete group income.

It additionally varieties a part of the corporate’s broader “subscription and companies” income, which chief government Brian Armstrong sees as a gradual stream of revenue to protect in opposition to the unreliability of charges from buying and selling volumes.

“In a world the place Coinbase doesn’t provide staking, it is not going to be aggressive in opposition to those that do,” stated Ilan Solot, co-head of digital belongings at London-based monetary companies group Marex.

However this subject goes past solely an issue for Coinbase.

Staking clients’ tokens is on the coronary heart of the safety of networks similar to ethereum. The blockchain is verified by so-called validators chosen at random. These validators — both people or firms similar to Coinbase — stake tokens as a type of collateral in opposition to dangerous actors and are paid for it.

If one of many greater, extra dependable and clear validators runs into hassle with its staking product and has to withdraw, that will change the stability of financial energy.

It may focus the system in favour of fewer richer members as a result of the extra cash a miner owns, the extra mining energy it has. Or the hole will be stuffed by dangerous actors, doubtlessly corrupting it.

“Each centralised entity that runs into hassle with their staking programme is doubtlessly chipping away on the safety of the community . . . it could change into much less centralised,” Solot added.

What’s your tackle Coinbase’s run-in with American state regulators? As all the time, e mail me your ideas at scott.chipolina@ft.com.

Go to the FT Wilshire Digital Asset Index for round the clock updates on the crypto market, that includes knowledge on value, circulating worth and different key market metrics impacting business’s most generally traded cash, together with bitcoin and ether.

Weekly highlights:

-

Whereas with reference to state regulators, Nevada asked a courtroom to nominate a receiver for Prime Belief, one of many few “crypto-friendly” US monetary establishments with some regulatory approvals to function within the conventional US banking and funds system. The state alleges that the custodian used buyer funds to purchase cryptocurrencies after shedding entry to digital wallets containing tens of tens of millions of {dollars} in belongings.

-

The Nationwide Bureau for Counter Terror Financing of Israel announced this week it thwarted an operation involving digital belongings used to finance terror, headed by Hizbollah and the Iranian Quds Power. “This isn’t a simple job, which turns into much more complicated when digital currencies are concerned,” stated Israel’s defence minister Yoav Gallant.

-

Within the newest blow to Binance’s banking woes, Reuters reported that on-line funds service supplier Paysafe stated it might stop providing assist to Binance clients throughout the European Financial Space. The platform is now working with Binance to “terminate this service over the following few months”. Earlier this 12 months Paysafe stated it might wind down companies to Binance’s UK clients.

Soundbite of the week: Coinbase hits again on the SEC

As talked about, Coinbase’s response to the SEC was hefty and units up a head-on authorized conflict between it and the principle US markets regulator. One notable level is that Coinbase is arguing it violates the US Structure. It’s going to run and run.

“Even have been the SEC right that the belongings and companies it identifies are throughout the scope of its current regulatory authority, this motion should be dismissed on the impartial grounds that it violates Coinbase’s due course of rights and constitutes a rare abuse of course of.”

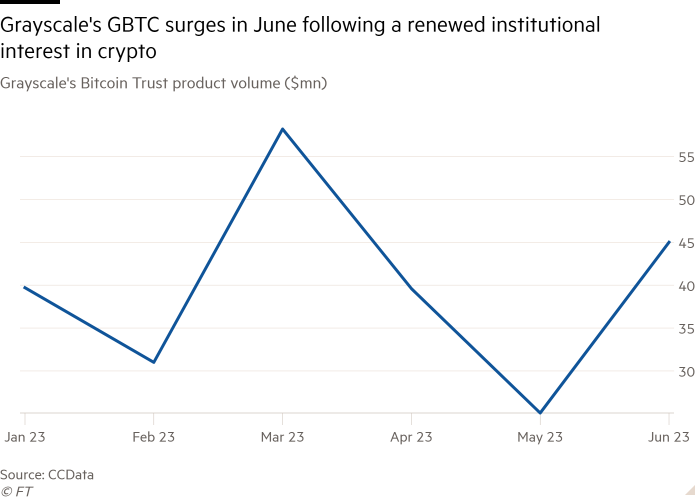

Knowledge mining: Grayscale surges amid institutional pleasure

Grayscale, supervisor of the world’s largest crypto fund, has had an excellent month.

The low cost of the $13.5bn Grayscale Bitcoin Belief (GBTC) to its web asset worth has narrowed sharply to a nine-month low of 29 per cent after BlackRock filed to listing a crypto ETF. The market value is now $19.55 versus an NAV of $27.65, in line with Bloomberg knowledge.

If the world’s largest asset supervisor succeeds, it may open the door to a flood of publicly traded spot bitcoin ETFs on the planet’s largest funding market.

Grayscale is suing the SEC for its refusal to permit it to transform GBTC into an ETF. If that modified the low cost would most likely disappear. Amid the joy quantity in GBTC has surged virtually 80 per cent in June.

Cryptofinance is edited by Philip Stafford. Please ship any ideas and suggestions to cryptofinance@ft.com.

[ad_2]

Source link