[ad_1]

Key Takeaways: Crypto Buying and selling for Novices

- Cryptocurrency is a kind of digital forex that may be freely traded between friends. Every cryptocurrency is traded on a public ledger, which makes it doable to confirm that crypto transactions are respectable.

- A crypto change is a platform that offers customers the instruments to purchase, promote and convert cryptocurrency.

- A crypto pockets holds the keys it is advisable entry your cryptocurrency. With out the keys, you possibly can’t entry your cash.

Cryptocurrency exploded into public consciousness with the meteoric rise of Bitcoin’s value in 2017. Regardless of changing into a family phrase, nevertheless, crypto hasn’t gotten any simpler to grasp. Whether or not you’re seeking to make investments or simply perceive the fundamentals when it comes up within the information, our crypto for dummies information is right here to assist.

Whether or not you prefer it or not, cryptocurrency is now related to your life. Dramatic collapses like the recent fall of FTX have repercussions within the wider financial system, and mainstream companies are leaping aboard the crypto practice at rising charges. A working information of crypto is an important asset in a contemporary financial system.

The crypto world is saturated with commerce speak and jargon, and it doesn’t assist that many buyers muddle their explanations on objective to sound smarter. Sweep all that apart and also you’ll discover that the foundational rules of cryptocurrency aren’t as advanced as they appear. You don’t want a lot tech savvy to understand them — you simply have to vary the best way you concentrate on cash.

Crypto for Dummies: Overview

We’ll begin this information with a primary overview of what cryptocurrencies are and the way they work, together with the alternative ways currencies achieve worth. We’ll additionally focus on exchanges, the assorted methods you may make cash from crypto and the way cryptocurrency wallets work.

A Transient Historical past of Crypto

Cryptocurrency has its roots within the monetary collapse of 2008, which revealed severe flaws in a banking system that relied on “too huge to fail” establishments. The primary to popularize each the idea of blockchain and its use as a banking ledger was “Satoshi Nakamoto,” an alias for a still-unknown particular person or group. “Nakamoto” launched Bitcoin as the primary cryptocurrency in 2009.

When the primary bitcoins have been mined, they have been barely price pennies. Now, due to the 2017 value increase, a single bitcoin goes for tens of 1000’s of {dollars}. Aside from Bitcoin, the largest contributions have come from Ethereum, which pioneered the usage of blockchain to confirm contracts and supply different decentralized companies.

Earlier than We Start: Crypto Fundamentals

The primary, most elementary factor to understand about crypto is that it’s principally the identical as another forex: a restricted useful resource you possibly can commerce for items or companies of equal worth. The cash itself has worth as a result of individuals agree it has worth. The U.S. greenback, for instance, is efficacious as a result of it’s utilized in commerce and backed by a acknowledged authorities.

The principle distinction with crypto is that it’s decentralized. In conventional non-crypto forex, generally known as fiat forex, an authority like a federal reserve or central financial institution verifies that transactions are respectable. Transactions with cryptocurrency are as a substitute verified by being entered in a public ledger generally known as a blockchain.

This grants crypto its largest benefit: It may be traded between two friends with none intermediaries being concerned. This doubles as its largest draw back, although: The dearth of an middleman means a cryptocurrency’s worth fluctuates much more wildly than that of a fiat forex.

What Are Cryptocurrencies?

By this level, we’ve realized {that a} cryptocurrency is a digital forex that may be traded from individual to individual with out approval from a centralized authority. On this part, we’ll unpack precisely how cryptocurrencies handle to work with out the assist buildings of conventional cash.

What Is Blockchain?

As cryptocurrencies use a blockchain rather than a government, blockchain is inseparable from crypto itself. In case you can perceive it, you’re already many of the method there.

A blockchain is a public ledger the place each transaction is seen. Once we say a cryptocurrency is “constructed on” a blockchain, we imply that any transactions utilizing that forex are entered into the ledger. As soon as a block exists, you possibly can’t change it; you possibly can solely add new blocks. For the reason that blockchain is distributed throughout many gadgets, no person might be reduce off from viewing it.

A blockchain is de facto only a high-tech model of an account ledger, the place all of the transactions are fully seen and no person can lose entry.

These two properties — being public and being distributed — make it doable to confirm transactions on the blockchain. A block should be verified earlier than it may be added to the blockchain. Verification offers crypto its worth, because it ensures that every crypto coin is a novel object that may’t be spent with out dropping it.

This additionally signifies that most crypto is not anonymous, since visibility is the entire objective of a blockchain. Your title won’t be hooked up to your crypto holdings, however your digital pockets has a pseudonymous identification that’s 100% seen. In case you’re frightened about having it traced again to you, you possibly can all the time use a VPN for crypto trading.

Yet one more vital be aware about blockchains: In a super world, they’d be completely distributed; in observe, few obtain complete equality. To make sure a cryptocurrency does its job, most of them require some form of administration construction, usually a decentralized autonomous group (DAO).

The bitcoin blockchain grants bitcoin worth as a result of each bitcoin transaction is seen to your complete public, to allow them to all be checked for legitimacy. That is the final precept behind each different cryptocurrency. Subsequent, let’s speak in regards to the two commonest ways in which verification can occur: mining and staking.

Mining Digital Foreign money

Let’s begin by discussing mining. As a result of it’s used by bitcoin (not the one cryptocurrency, however the very best identified and highest valued), it’s the higher identified methodology. Nevertheless, mining is definitely on the decline in crypto because of its heavy energy costs and comparative unreliability.

Though the time period “mining” means that miners are discovering cryptocurrency that already exists in a cache someplace, this impression is inaccurate. Crypto miners are literally being rewarded for including blocks to the blockchain by verifying transactions.

Right here’s the way it works. Every new block added to the blockchain is related to a novel quantity known as a hash, generated by making use of a math components to that block’s knowledge. Miners attempt to confirm the block by producing that very same distinctive hash with a sure variety of zeros in entrance of it. Whoever generates the hash with sufficient zeroes first provides the block to the chain.

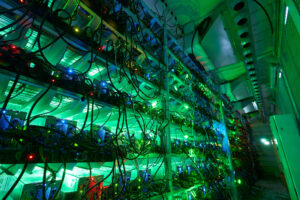

At this time, mining bitcoin takes unbelievable processing energy, normally drawn from huge farms like this one.

In change for making transactions doable, miners who reach including blocks to the chain are rewarded with crypto cash. In different phrases, the identical labor that makes it doable to commerce cryptocurrency can also be what places new cryptocurrency into circulation. Because of this mining is also referred to as the proof-of-work methodology.

Since there’s basically no strategy to hit the goal hash with out randomly making an attempt as many solutions as doable, crypto mining requires lots of processing energy — a lot that many concern it’s making a significant contribution to climate change; for instance, Bitcoin mining consumes extra power than the entire country of Argentina.

The staking methodology within the subsequent part, with its a lot decrease prices, has these days overtaken mining in reputation.

Staking Digital Foreign money

Crypto mining works as a result of it’s technically doable for anyone to be a validator, as long as they contribute processing energy (although in observe, most rewards at the moment are claimed by huge consortiums).

The proof-of-stake methodology chooses its validators otherwise. As a substitute of rewards going to whoever contributes probably the most energy, a cryptocurrency operating on proof-of-stake selects from amongst individuals who maintain that forex. The extra of the forex you could have, the extra possible you’re to be chosen as a validator.

Traders chosen as validators are rewarded with extra forex. Additionally they get a vote to find out whether or not a given transaction on the blockchain needs to be legitimized. If a easy majority (50%+1) validators vote “sure,” the transaction goes on the ledger.

Though mining got here first, staking is now nearly universally seen because the extra elegant validation methodology. Ethereum, arguably the second most well-known cryptocurrency after bitcoin, switched from proof-of-work (mining) to proof-of-stake in 2022.

Ethereum has extra validators than most proof-of-stake cryptocurrencies, giving it a extra decentralized type.

The principle downside to staking is that most individuals won’t ever maintain sufficient of the forex to have an opportunity of getting chosen. Nevertheless, many proof-of-stake cryptocurrencies assist minor staking investments, by which customers can lend their forex to larger buyers who’ve an opportunity to turn into validators. In return, the validators pay the customers again with a little bit of curiosity.

Crypto exchanges usually merely check with this observe as staking, but it surely’s extra correctly contributing your cash for different individuals to do the precise staking. In observe, it’s quite a bit like a high-yield financial savings account, as you quickly lose entry to your cash so as to make extra.

What Are Stablecoins?

Some digital currencies are generally known as stablecoins as a result of their costs aren’t presupposed to fluctuate like these of different cryptocurrencies. As a substitute, a stablecoin (in idea) has the identical worth as a chosen fiat forex, akin to Tether (USDT), which is all the time price the identical because the U.S. greenback.

Stablecoins type a helpful center floor between fiat and crypto, letting customers buy blockchain companies and make trades with out important volatility. Nevertheless, relying on how a stablecoin maintains its value, it might nonetheless collapse — the 2022 fall of TerraUSD is the very best identified instance.

Advantages of Utilizing Crypto Cash

By this time, you may moderately be asking what the purpose of all that is. What are you able to do with cryptocurrency which you can’t do with fiat forex?

As we’ve coated, the principle level of cryptocurrency is to finish transactions with out oversight. In case you have any motive to not belief a central financial institution, otherwise you disagree with its strategies, crypto permits you to bypass the establishment altogether. The dearth of a intermediary additionally signifies that transactions can course of rather more rapidly, usually in seconds.

For a lot of, nevertheless, cryptocurrency is much less about really spending it (the variety of locations you are able to do so is proscribed anyway), and extra about speculating on its value. Fast value fluctuations imply crypto cash can achieve worth rapidly, outpacing each inflation and the standard inventory market. Some early buyers turned millionaires virtually in a single day.

One last profit is that corruption in cryptocurrency is theoretically not possible, due to the completely open nature of blockchain expertise. Observe, nevertheless, that this solely applies to tampering with the ledger itself; even a safe pockets or change might be hacked, and fraud is comparatively widespread.

Drawbacks of Cryptocurrency

Cryptocurrency guarantees an thrilling monetary future, but it surely’s not with out its downsides. The most important factor to watch out for for those who commerce crypto is its excessive value volatility. Costs can surge, however they’ll collapse simply as rapidly. Since a crypto coin has no inherent worth, it’s usually thought of a bubble, liable to burst from just some days of dangerous information.

The opposite largest downside is that cryptocurrency is generally unregulated, since governments around the globe haven’t but caught as much as the trade. The ensuing “Wild West” ambiance has attracted crime and corruption, from the massive hack that destroyed Mt. Gox to the collapse of FTX under Sam Bankman-Fried.

What Are Exchanges?

Most individuals who maintain shares don’t purchase them on the buying and selling ground on the New York Inventory Trade. As a substitute, they belief middlemen to deal with their investments, selecting brokers and cash managers who know the system higher than they do. Most of those that need to decide their very own shares nonetheless select a service like Vanguard or Charles Schwab to make it simpler.

It’s the identical with cryptocurrency. You should purchase and promote crypto manually, but it surely takes lots of technical information and comes with only a few aspect advantages. It’s quite a bit simpler to make use of an change to purchase cryptocurrency, because it comes prepackaged with all of the instruments it is advisable commerce. Most exchanges supply different methods to make cash, just like the staking we mentioned within the final part.

The perfect identified exchanges, akin to Coinbase (as you’ll see in our Coinbase review) intention to supply user-friendly interfaces for starting merchants, paired with extra advanced spot buying and selling options for these with superior information. It’s nearly all the time free to arrange an account — exchanges make their cash by taking a share price from every transaction.

The precise quantity you’ll pay normally is dependent upon just a few components, akin to the quantity you maintain in your digital pockets, the quantity you commerce per day and whether or not you’re a “maker” or a “taker” (see the following part). Be sure you all the time perceive the price schedule earlier than placing any funds into an change.

Buying and selling on the Cryptocurrency Market

Once we discuss “buying and selling crypto,” we’re most frequently referring to one among three primary actions: utilizing fiat forex to buy cryptocurrency, promoting cryptocurrency for fiat forex, or buying and selling one cryptocurrency for one more.

Shopping for, Changing & Promoting Crypto

To purchase crypto, you conform to change a specific amount of fiat forex for a selected cryptocurrency. There are two methods to do that. You should purchase immediately on the present value, which makes you a taker, or place an order to purchase a specific amount of crypto as quickly because it reaches a specified value, by which case you’re a maker.

Makers usually get higher buying and selling charges, and are even paid by the change in some circumstances. To know why, do not forget that an change is a enterprise that is dependent upon retaining money available. In case you commit cash for a later buy, the change will get liquidity it might reinvest someplace else.

Buying and selling one cryptocurrency for one more is named changing crypto, and might usually be carried out instantaneously and with out charges. In case you can predict the place the value of a digital asset will go, you may make huge income this manner. Say you’ve transformed your Bitcoin into Ethereum — if Bitcoin drops or Ethereum rises, you possibly can enhance your BTC holdings with out paying a cent.

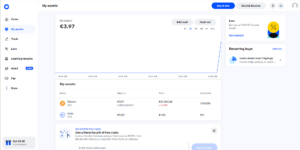

This pockets web page on Coinbase is an instance of a easy crypto buying and selling interface.

Lastly, you possibly can sell crypto in change for conventional forex, which most exchanges describe as a withdrawal. As we’ve defined, exchanges need to maintain as a lot liquidity as doable, so withdrawal charges might be fairly excessive to encourage you to go away your cash the place it’s.

Margin & Futures Buying and selling

When you’re extra comfy with the world of cryptocurrency, exchanges supply just a few higher-risk, higher-reward investments. For instance, there’s margin buying and selling, by which merchants borrow cash to purchase extra crypto without delay. You may make extra revenue this manner, however there’s additionally the potential to lose way over you began with.

There’s additionally futures buying and selling, which helps you to purchase and promote contracts to buy crypto on a future date. You possibly can quick a coin by promoting a futures contract, successfully promoting the cash earlier than you purchase them; if the value goes down, you’ll make a revenue on the acquisition and resale.

Some exchanges let customers mortgage out their cryptocurrency to others for margin buying and selling. In case you’re sitting on crypto funds and need to make them give you the results you want, this may be extra worthwhile than staking.

Investing in Cryptocurrencies

In case you’re nonetheless studying, you’d most likely prefer to understand how individuals most frequently make cash by way of cryptocurrency investing. The very first thing to know is that success is just not assured. Solely 28% of American crypto holders mentioned that they had ever offered a crypto asset for greater than they paid for it. Go in with a method, and be ready to chop your losses.

As with all types of asset buying and selling, your goal is to purchase low and promote excessive. The best method to do that is to foretell which coin will enhance in value, purchase that coin, maintain it till you assume the value is about to peak, then promote it off. Some merchants revenue by “shopping for the downswing” — shopping for a forex whose value is dropping, assuming an increase will come after the autumn.

Spot buying and selling, margin buying and selling and futures buying and selling are all variations on the purchase low/promote excessive goal. If you need a surer factor, you may make a good passive revenue by staking your cash or lending them out.

We don’t advocate making an attempt to make a revenue by way of mining. Not solely does it take a large quantity of processing energy to have an opportunity, however proof-of-work cryptocurrencies recurrently debase the worth of newly mined cash so as to management inflation.

Lastly, there are just a few methods to earn small quantities of crypto by way of giveaways or video games like Axie Infinity. In case you select this route, be extraordinarily cautious, as giveaways are a typical vector for scams.

Selecting a Crypto Trade

Earlier than trying into any change, be sure that it’s licensed to commerce in your nation. A number of exchanges akin to OKX (see our OKX review) have pulled out of the U.S. because of rising rules, and China banned cryptocurrency altogether in 2021.

Verify that the change helps the digital property you need to commerce — not all exchanges commerce in all cryptocurrencies. Search for low buying and selling charges, an easy-to-use interface and a robust file of securing customers’ digital property towards hackers.

What Are Crypto Wallets?

Identical to “mining” crypto is a euphemism for a extra advanced course of, a crypto wallet isn’t really a spot for storing cryptocurrency. Do not forget that cryptocurrency solely exists on its related blockchain expertise — really locking it away from others would defeat the aim.

A crypto pockets is extra like a password manager than an precise pockets. It shops the keys it is advisable show your crypto property belong to you. Together with your private and non-private keys, you possibly can lay declare to knowledge on the blockchain; for those who lose them, it’s possible you’ll as properly not have that cash in any respect.

Managing your credentials is a pockets’s most vital perform, however it might additionally work like a web based checking account, monitoring your balances and letting you make purchases and transfers. Some wallets act as gateways to exchanges; forex you purchase on the change goes into your pockets and can be utilized for future trades.

Protecting Crypto Property Secure

Crypto wallets are easy. Even simply writing your keys down on a bit of paper technically counts as one. A pockets that protects your keys from theft is one other matter. One possibility is a USB {hardware} pockets that incorporates your keys; solely a pc with the {hardware} pockets inserted can entry your cryptocurrency.

In case you begin buying and selling by way of an change, chances are high you’ll hold your crypto in a software program pockets as a substitute. These can observe your property and might’t be bodily stolen since they’re completely on-line — although they’re susceptible to hacking.

In different phrases, a software program pockets presents extra comfort, whereas a {hardware} pockets comes with better safety. We’ve put collectively a listing of the best crypto wallets in case you’re fascinated about discovering out extra.

Remaining Ideas: How Crypto Works

Cryptocurrency remains to be in its infancy. Though it’s already been by way of a number of boom-and-bust cycles, it stays stuffed with untapped potential. Is decentralized forex the way forward for cash, or will this all end up to only be a sideshow?

The one factor we will say for certain about crypto is that it’s not doable to disregard it. The extra you perceive about cryptocurrency, the higher you’ll be capable of resolve how a lot you need to contain it in your individual life. If you already know the dangers and have a transparent goal, buying and selling might be profitable and even enjoyable.

We hope this information has helped you get your head across the famously esoteric ideas underpinning cryptocurrency. Are there any topics you’re nonetheless misplaced on? Do you disagree with any of our claims, or assume we missed one thing vital? Tell us within the feedback, and thanks for studying!

FAQ: Crypto for Dummies

-

A cryptocurrency is a unit of cash that may be traded on a distributed community with out going by way of a financial institution or central authorities. A crypto “coin” is definitely a string of knowledge written on a public ledger generally known as a blockchain.

-

Coinbase has our favourite person interface for crypto buying and selling. Novices will discover it pleasant and useful.

-

Sure! Most exchanges have a minimal transaction worth, but it surely’s nearly all the time a lot decrease, within the $10 to $20 vary.

[ad_2]

Source link

![Crypto for Dummies 2023 [Explaining How Cryptocurrency Works]](https://www.blocpress.com/wp-content/uploads/2023/06/Crypto-for-Dummies-Explaining-How-Cryptocurrency-Works-for-Beginners-750x375.png)