[ad_1]

On-chain knowledge exhibits the Bitcoin trade netflow has registered a destructive spike lately, an indication which may be bullish for the value.

Bitcoin Alternate Netflow Has Plunged In Latest Days

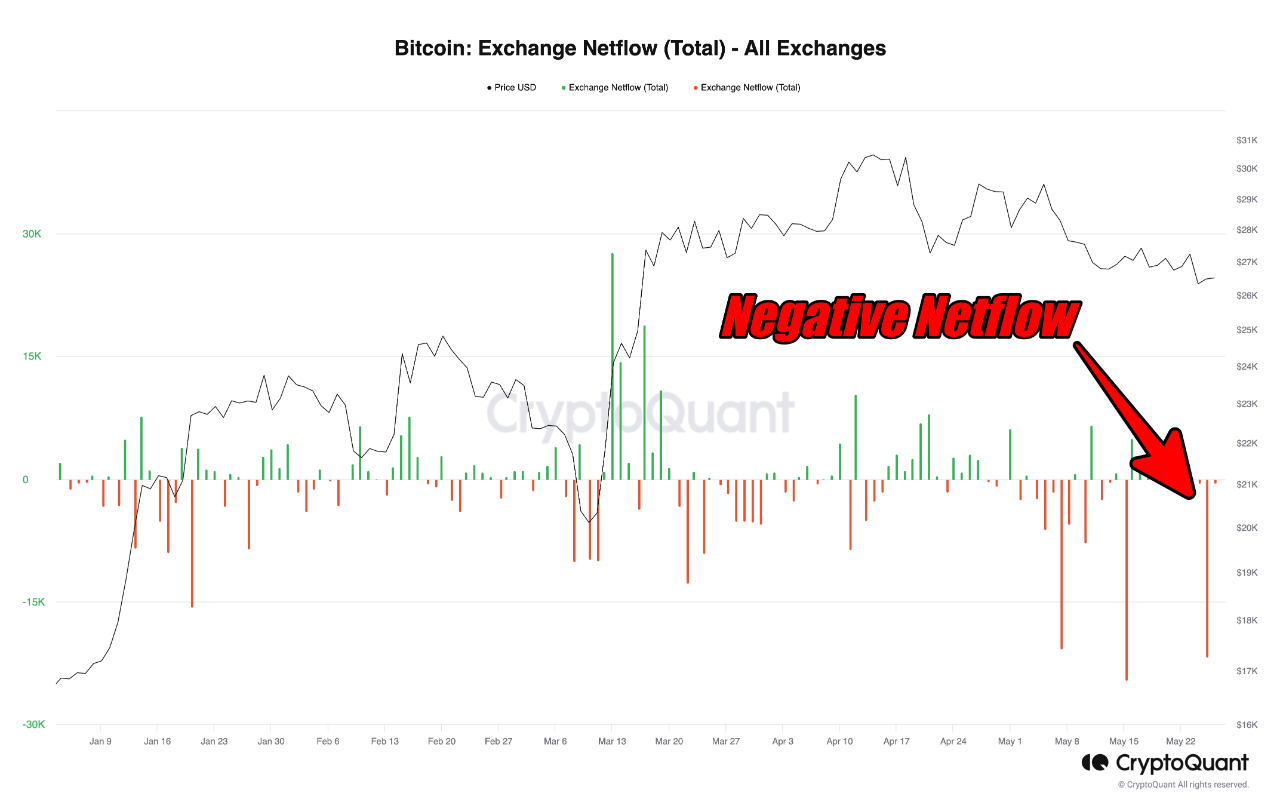

As identified by an analyst in a CryptoQuant post, a big destructive spike within the netflow befell simply yesterday. The “exchange netflow” is an indicator that measures the web quantity of Bitcoin that’s getting into into or exiting the wallets of all centralized exchanges. Its worth is of course calculated because the inflows minus the outflows.

When the worth of this metric is optimistic, it means a internet quantity of BTC is getting into the wallets of those platforms proper now. Since one of many foremost the explanation why buyers would deposit their cash to the exchanges is for selling-related functions, this type of pattern can have bearish implications for the asset’s worth.

However, destructive values of the indicator indicate that outflows are overwhelming the inflows at present. Such a pattern, when extended, generally is a signal of accumulation from the holders, and therefore, might be bullish for the value of the cryptocurrency.

Now, here’s a chart that exhibits the pattern within the Bitcoin trade netflow over the previous couple of months:

The worth of the metric appears to have been fairly destructive in current days | Supply: CryptoQuant

As proven within the above graph, the Bitcoin trade netflow noticed an enormous destructive spike lately. Which means that the buyers have withdrawn numerous cash from these platforms.

A few giant destructive spikes had been additionally noticed earlier within the month. The primary of those got here simply after the asset’s worth had slipped beneath the $28,000 stage, whereas the second got here when the coin was wobbling across the $27,000 mark.

Each of those spikes might have been indicators of some whales making an attempt to catch the underside in the course of the decline. The newest plunge within the indicator has additionally come after the cryptocurrency has plummeted; this time in direction of the $26,000 stage.

This new internet outflow spike is the second largest that the indicator has registered this yr, with solely the withdrawals in the course of the consolidation across the $27,000 stage being higher in scale.

Naturally, even when these outflows are an indication of shopping for stress available in the market, it’s unlikely that they’ll flip the value round on their very own; similar to how the earlier two spikes additionally failed.

Nevertheless, it’s a optimistic signal for the cryptocurrency nonetheless, because it exhibits that at the least some whales assume that it’s value shopping for the asset on the present costs. Whereas maybe not instantly, this may actually assist the value hit a backside ultimately.

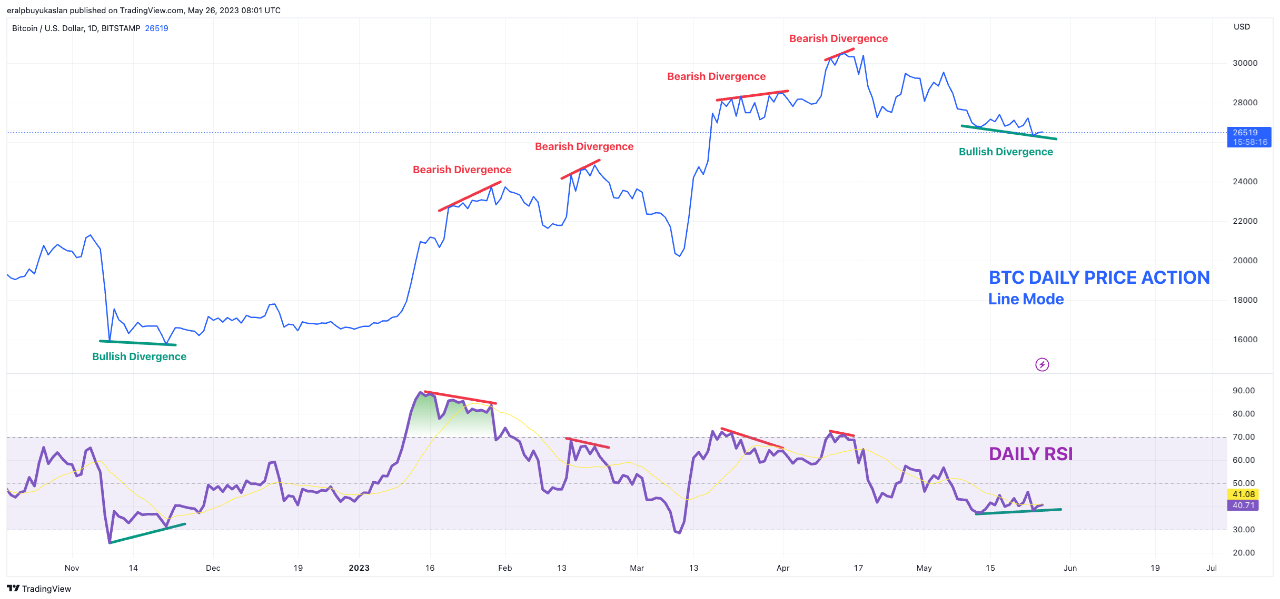

The quant has additionally famous that the day by day Relative Strength Index (RSI) of Bitcoin has additionally shaped a potential bullish divergence lately, which can even be one other issue to contemplate.

Appears to be like like the value and the RSI have gone reverse methods lately | Supply: CryptoQuant

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,800, up 1% within the final week.

BTC has been consolidating lately | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link