[ad_1]

On-chain information reveals the Bitcoin short-term holder price foundation has now risen to $25,300; right here’s what this tells us in regards to the market.

Bitcoin Brief-Time period Holder Price Foundation Has Gone Up Not too long ago

In response to information from the on-chain analytics agency Glassnode, the common acquisition worth of the short-term holders continues to method the spot worth. The related indicator right here is the “realized price,” a metric derived from the “realized cap.”

The realized worth is a capitalization mannequin for Bitcoin that places every coin’s “actual” worth within the circulating provide as the value at which it was final moved on the blockchain, slightly than the present spot worth as the traditional market cap does.

The realized worth is obtained when this cover is split by the full variety of cash in circulation. For the reason that realized cap accounted for the traders’ price foundation (the value at which they purchased their cash), the realized cap signifies the worth at which the common investor out there acquired their BTC.

The realized worth will also be outlined explicitly for under components of the market. Usually, BTC traders are divided into two major teams: the “short-term holders” (STHs) and the “long-term holders” (LTHs).

The STHs embody all traders holding onto their cash since lower than 155 days in the past, whereas the LTHs have these holding since greater than that threshold quantity.

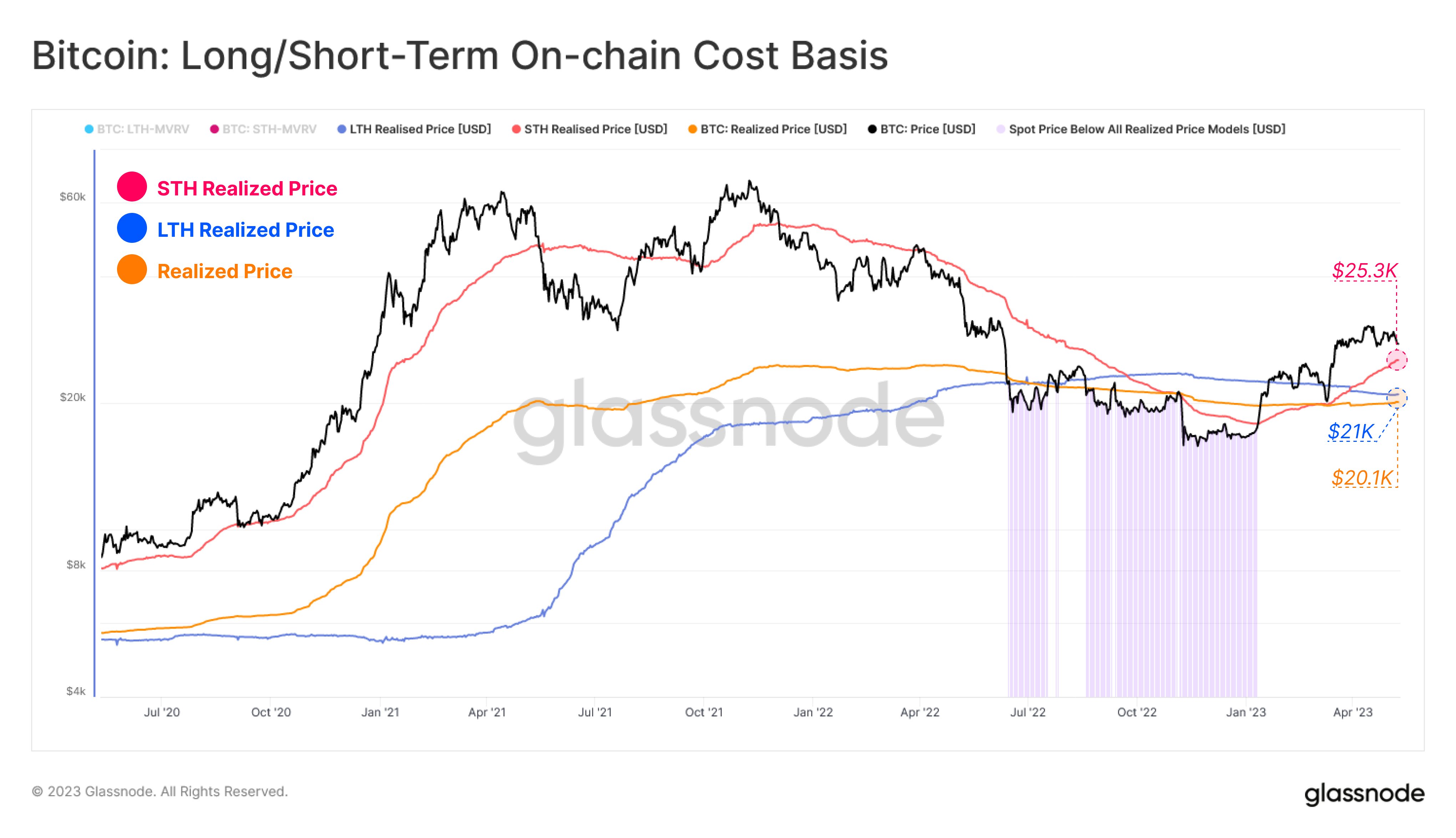

Now, here’s a chart that reveals the pattern within the Bitcoin realized worth for your complete market, in addition to the variations of the metric for the STHs and LTHs, over the previous few years:

The fee foundation of the totally different segments of the market | Supply: Glassnode on Twitter

As displayed within the above graph, the Bitcoin realized worth (for the full market) is round $20,100 presently, that means that the common investor purchased their cash at this worth.

The market’s realized worth has held historic significance for the asset, performing because the transition mark between the bear market lows and bullish durations all through the cycles. Usually, throughout bear markets, this stage has acted as resistance, whereas throughout bulls, it has supported the value.

This stage is unrelated to the spot worth as a result of it is a vital psychological level for traders. Because it’s the value they purchased at, holders would favor to promote at this worth throughout bear markets to keep away from losses.

In full-blown bull rallies, nonetheless, Bitcoin traders would see this stage as a preferable level to build up extra, thus explaining why it could act as assist in such durations as a substitute.

Equally, the price foundation of the STHs and LTHs has additionally acted as resistance and assist. The varied interactions of the STHs’ realized worth are most prominently seen through the 2021 bull run within the chart.

The STH realized worth has additionally elevated as the present rally has continued. That is regular conduct seen throughout uptrends within the worth, because the STHs embody solely the traders who purchased most lately. Since the latest spot costs can be going up in such durations, the price foundation of the group would additionally naturally go up as recent holders be part of them.

This stage is round $25,300, near the spot worth. It will likely be attention-grabbing to see how the spot worth might work together with this line if BTC observes some prolonged downtrend quickly. Such a retest can be a constructive signal if profitable, as this conduct would align with historic bull markets.

BTC Value

On the time of writing, Bitcoin is buying and selling round $28,200, down 1% within the final week.

BTC has surged at present | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link