[ad_1]

Ethereum has registered some decline not too long ago as on-chain knowledge reveals an elevated quantity of deposits in the direction of centralized exchanges.

Ethereum Trade Deposits Have Spiked Just lately

As identified by an analyst on Twitter, there are indicators of elevated short-term promoting stress within the ETH market in the meanwhile. The related indicator right here is the “Ethereum energetic deposits,” which measures the day by day whole variety of trade addresses which can be collaborating in some deposit exercise presently.

This indicator solely retains monitor of the distinctive variety of such addresses, that means that it solely counts an deal with as soon as even when it has been concerned in a number of deposit transactions in a single day.

The benefit of this limitation is that distinctive addresses are analogous to distinctive customers on the community, so this metric can inform us in regards to the variety of customers making deposits to those platforms.

When the worth of this indicator is excessive, it means a lot of trade addresses are observing deposits proper now. This means {that a} excessive quantity of customers are transferring their cash to those platforms presently.

Since one of many primary the reason why holders transfer their cash to the exchanges is for dumping-related functions, a excessive worth of this metric is usually a signal of a mass selloff available in the market.

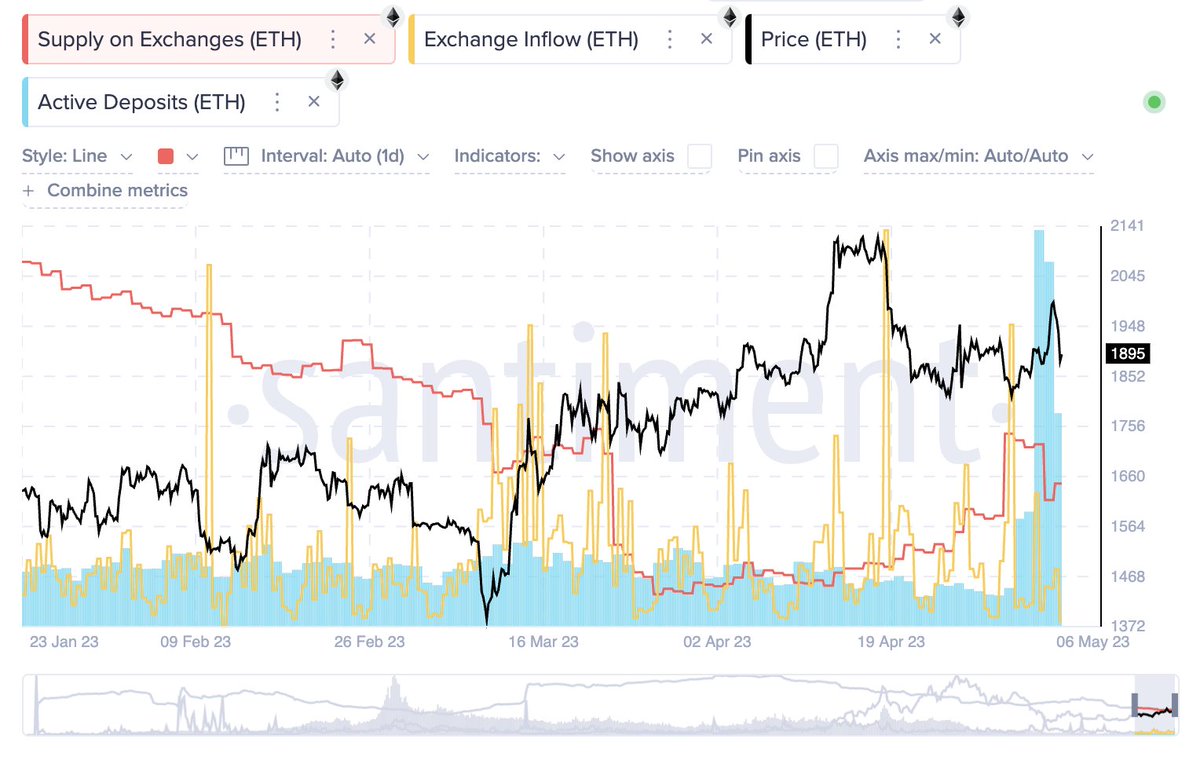

Now, here’s a chart that reveals the development within the Ethereum energetic deposits over the previous couple of months:

The worth of the metric appears to have been fairly excessive in latest days | Supply: Ali on Twitter

As proven within the above graph, the Ethereum energetic deposits metric surged to some fairly excessive values throughout the weekend. On the peak of this spike within the indicator, there have been greater than 20,000 trade addresses that have been collaborating in deposit exercise.

These newest values within the indicator have been considerably greater than the norm for the 12 months 2023 thus far, implying {that a} a lot larger quantity of customers have been making deposits not too long ago.

The latest peak worth has the truth is additionally been the best that the Ethereum energetic deposits indicator has been since November 2021, the month when ETH set its all-time excessive value.

Within the chart, knowledge for 2 different metrics, the supply on exchanges and the exchange inflow, can also be displayed. The previous of those measures the entire quantity of ETH sitting within the wallets of all exchanges, whereas the latter tracks the variety of cash being deposited into these platforms.

It appears like whereas there have been a lot of customers making deposits not too long ago, there has solely been a small trade influx spike. This is able to suggest that many of the deposits made haven’t truly concerned a switch of any considerable quantity of ETH, suggesting that the inflows have primarily been coming from retail buyers.

The availability on exchanges likewise hasn’t elevated after these deposits; it has quite gone down, implying that there have been a lot stronger withdrawals not too long ago.

Ethereum, nonetheless, nonetheless appears to have noticed a bearish impact from these mass deposits, as its value has fallen beneath the $1,900 stage. Given the dimensions of the deposits, although, it’s doable that this promoting stress was solely short-term, and thus, the drawdown could not go on for too lengthy.

ETH Value

On the time of writing, Ethereum is buying and selling round $1,800, down 2% within the final week.

ETH has gone down throughout the previous day | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.internet

[ad_2]

Source link