[ad_1]

Hello and welcome to the latest edition of the FT’s Cryptofinance newsletter. This week, we’re looking at the UK and crypto’s banking crisis.

The demise of crypto’s favourite American banks has slimmed the industry’s access to the traditional financial system, fuelling theories that crypto is being run out of town, at least in the US.

Fewer banks accepting crypto means fewer places for companies to park their customers’ assets. But this trend — dubbed “Operation Chokepoint” by a fevered few on social media — isn’t stopping at America’s borders. British banks are going cold on crypto, too.

NatWest and other large UK banks have imposed limits on how much money can flow to and from crypto exchanges. Citing a challenging regulatory environment, online payments provider Paysafe recently said it would wind down services to UK customers of Binance, the largest trading shop crypto has to offer.

Coupled with the wobble in America, the trend has set off alarm bells. Lobbying group CryptoUK this week wrote to the UK’s economic secretary Andrew Griffith expressing “deep concerns” about blanket bans and restrictions of transfers from UK banks to crypto asset platforms.

The group urged the government to “find a path forward” and consider facilitating meetings between banking and crypto C-suite heads.

One can see why they think it’s worth a shot. The UK government has been explicit about embracing crypto.

“I’m selling the UK as a place to set up shop, but if you can’t get banking support, what’s the point? Potential newcomers will just not bother coming here,” Ian Taylor, CryptoUK board advisor, told me over the phone.

Lisa Cameron, an MP who is the chair of the all-party parliamentary group for crypto, told me she raised crypto’s banking issue with Kevin Hollinrake, parliamentary under-secretary of state at the Department for Business and Trade.

“It’s counterintuitive to the UK’s crypto vision. De-banking the industry could undermine the UK remaining an international hub of fintech,” she said.

In my view, the more pressing issue is whether banks — in their aversion to risk — are actually doing more of a disservice to UK consumers.

The risk is that the business will just be carried out offshore, where it’s harder to track down money or executives. As we have seen in the past year, companies in offshore jurisdictions can still sting customers. FTX in the Bahamas and Terraform Labs in Singapore are prime examples.

The banks already do know-your-customer and anti-money-laundering checks for crypto companies in the UK. Authorities in Britain have not been explicit at all about the risks to banks in accepting crypto business, unlike in the US. So what has changed?

“It’s a moral hazard. It’s not good consumer protection,” said one industry professional who works in London. “The banks are not accepting that they play an important part in protecting people from fraud.”

But asking banks to embrace crypto remains a hard sell. A bank’s choice of its customer is a decision made by a private, commercially minded company.

“My concern is the hyperbole will, over time, be negative for crypto because it makes the industry look a little bit like it’s throwing its toys out the pram,” said one person who works in London’s crypto scene.

CryptoUK doesn’t help itself when its members generate their own regulatory controversies. One prime example is Binance, which the Financial Conduct Authority decided was incapable of being effectively regulated after the exchange failed to supply the agency with basic information.

CryptoUK said it “proactively engages” with members when negative feedback from regulators is received, and would offboard a member if issues “go unresolved.”

In any case, one individual familiar with Westminster’s approach to digital assets told me recently that the government was not concerned with being first on digital assets, nor was it swayed by any advantages afforded to a first mover.

Let someone make the mistakes first and then pick up the pieces, they said. So no matter how many turn out to fight in crypto’s corner in the halls of Westminster, it might all fall on deaf ears.

What’s your take on the UK’s crypto tug of war? Email me at scott.chipolina@ft.com.

Weekly highlights: US assault on crypto

-

Authorities in Montenegro arrested Do Kwon, co-founder and chief executive of Terraform Labs, the company behind the terraUSD and luna tokens whose collapses sparked last year’s epic crypto market crash. The country’s interior ministry said Kwon was arrested for using a forged passport from Costa Rica on his way to Dubai. To top it off Kwon was then indicted on criminal charges in the US late on Thursday. Read my story — together with colleagues Marton Dunai and Joe Miller — here.

-

The Securities and Exchange Commission sued crypto entrepreneur Justin Sun, whose companies include Tron and BitTorrent, as well as a host of celebrities for improperly touting crypto tokens.

-

The White House let rip at crypto too. In an annual economic report it said “crypto assets currently do not offer widespread economic benefits” and that much of the crypto activity was covered by existing regulations.

-

SushiSwap, a decentralised finance project, says it has been subpoenaed by the SEC. A social media post this week is looking to establish a defence fund to pay legal fees.

Soundbite of the week: Coinbase vs SEC

It was not a good week for Coinbase. The Securities and Exchange Commission told the Nasdaq-listed crypto exchange it was considering a potential enforcement action over possible securities laws violations. Coinbase said it covered its staking products, in which customers agree to lock up their tokens in other crypto projects, in return for a high yield.

Its shares fell 13 per cent on Thursday. Check out my story with Stefania Palma here. That led to a furious online pushback from the company, led by chief legal officer Paul Grewal. He said on Twitter:

“When Coinbase filed to go public in 2021, our S1 described our business in much detail, including 57 references to staking and details on our asset listing process. The SEC approved us to go public, knowing those details. Now they have changed their mind on what is allowed.”

One can sympathise to a degree; Coinbase has been offering these products openly for years and has other SEC licences.

But that SEC S1 ‘approval’ only applies to the accuracy of the disclosures. In the risk section of that filing Coinbase warned about legal uncertainty over several of its products. It even highlighted one in particular. “For example, there is regulatory uncertainty regarding the status of our staking activities under the US federal securities laws,” it said.

Maybe Coinbase’s management was taken aback by the SEC’s move but the lawyers who wrote the S1 could not have been surprised.

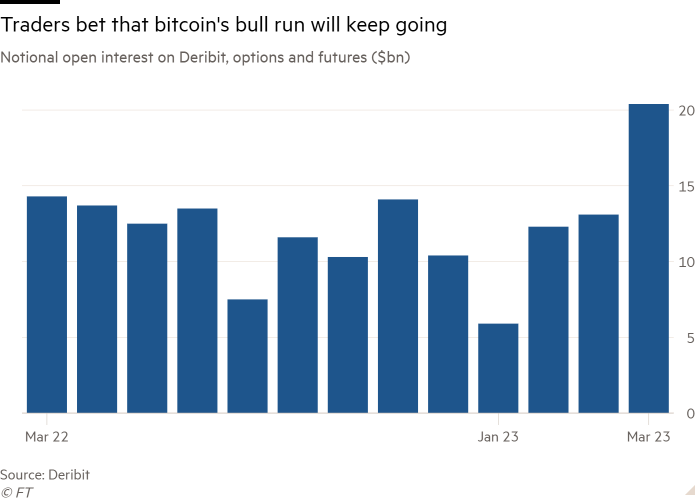

Data mining: Open interest on Deribit reaches all-time high

The world’s largest crypto options exchange isn’t Binance but a little-known exchange called Deribit. You might recall Deribit helped push Three Arrows Capital into liquidation, claiming the hedge fund had failed to repay it $80mn.

According to data provided by the exchange, open interest on the platform has exceeded $20bn this week for the first time. More than $18bn of positions are options on bitcoin and Ethereum. Options give investors the right but not the obligation to buy the coins by a set date in the future.

Most calls expire at the end of March and the majority of these contracts have a strike price of $30,000. That suggests crypto investors are optimistic, at least for the next week.

Cryptofinance is edited by Philip Stafford. Please send any thoughts and feedback to cryptofinance@ft.com.

Your comments are welcome.

[ad_2]

Source link