[ad_1]

One scoop to start: Longtime JPMorgan Chase boss Jamie Dimon will be interviewed under oath over his bank’s decision to retain the late sex offender Jeffrey Epstein as a client, said people familiar with the matter.

Welcome to Due Diligence, your briefing on dealmaking, private equity and corporate finance. This article is an on-site version of the newsletter. Sign up here to get the newsletter sent to your inbox every Tuesday to Friday. Get in touch with us anytime: Due.Diligence@ft.com

In today’s newsletter

The US indictment against SBF grows thicker

This week, Manhattan federal judge Lewis Kaplan approved a request by Sam Bankman-Fried’s lawyers at Cohen & Gresser to allow their client access to a list of “preapproved websites” as he awaits his fate on house arrest.

We’re honoured to be included on the list, among a handful of our esteemed competitors, as well as DoorDash and Uber Eats. We hope the FTX founder has been blessed with FT premium so he can access Due Diligence.

Sam, if you’re reading this, would you like to weigh in on prosecutors’ latest allegations that you bribed Chinese officials with $40mn in cryptocurrency? Email us: due.diligence@ft.com.

On Tuesday, US prosecutors accused SBF of sending a bribe to regain access to trading accounts that had been frozen by law enforcement in China. The accounts were linked to FTX’s sister company Alameda Research, the FT reported on Tuesday.

The bribery charge adds to the 12 criminal counts the FTX boss is already facing after his crypto exchange collapsed in November last year. SBF pleaded not guilty to eight charges placed against him in January.

According to the latest indictment, prosecutors allege that Bankman-Fried repeatedly tried to unfreeze the Alameda-linked accounts by hiring attorneys to lobby on the company’s behalf in China. Prosecutors say he used the personal information of several individuals that weren’t affiliated with FTX or Alameda in an attempt to transfer funds and get around the freeze orders put in place by Chinese authorities.

After months of failed attempts to unfreeze the accounts, the indictment claims, SBF directed the multimillion-dollar bribe sometime around November 2021.

At or around the time of the roughly $40mn payment, prosecutors allege, the accounts were unfrozen, prompting SBF to transfer additional tens of millions of dollars worth of cryptocurrencies. Alameda then used the unfrozen accounts to fund additional trading activity.

A spokesperson for SBF declined to comment.

The bribery accusations aren’t the only new details to emerge from the FTX saga this week.

Executives at Genesis, a major lender to Alameda, had privileged early access to issuances of new tokens backed by FTX, our colleagues Kadhim Shubber and Nikou Asgari revealed on Tuesday.

That meant they could invest in certain cryptocurrencies launched by SBF at a discounted rate before they were issued to the public, according to people familiar with the matter.

Those ties have since backfired for Genesis: the firm, which is undergoing its own bankruptcy proceedings, is FTX and Alameda’s biggest creditor and is still owed $226mn, according to US court records.

That figure could have been worse, since Alameda repaid some of its loans last year. Though authorities have accused SBF of repaying Alameda’s creditors with FTX funds without telling them the true source of the money.

As Genesis’ SoftBank-backed owner Digital Currency Group negotiates with its own creditors, its executives may now be wondering if their past crypto bargains were worth it.

Short seller accusations dampen the fun at games group Embracer

Over the past four years, Lars Wingefors has gone on a dealmaking spree that has transformed his little-known gaming company Embracer. The group’s assets span gaming studios across the globe, US comics publishers, board games such as Silicon Valley favourite Catan, and even intellectual property for the Lord of the Rings.

Wingefors’ dinner table pitch to entrepreneurs is a supportive home that leaves them free to pursue a creative vision, with no forced cost cuts or centralisation. He boasts that of 108 business owners that have entered the group, 106 remain.

But his unorthodox approach to integrating newly acquired businesses has drawn the attention of several short sellers, including Shadowfall, the investment firm run by Wirecard short seller Matt Earl, who believe the company amounts to less than the sum of its parts.

Embracer’s share price dropped by 13 per cent on Tuesday, to SKr43, after the FT’s Anna Gross and Dan McCrum reported on some of their concerns. The Swedish gaming group had also announced a delay to the completion of some hotly anticipated licensing deals the night before, which no doubt weighed on investor sentiment.

In particular, sceptical hedge fund managers point to the gulf between Embracer’s operating and “adjusted” profit figures. Embracer made a cumulative operating loss of SKr838mn ($81mn) over the last seven quarters, but after adjustments this turned into an operating profit of SKr9.9bn.

Costs investors are told to ignore are predominantly “earn-outs” paid to acquired business owners — either in cash or shares — if they remain in post for a certain duration, or if they reach certain milestones.

Investors argue the scale of the adjustments and size of the earn-outs are abnormal, and should raise questions about the real nature of the beast that lies beneath.

The company said it follows international accounting standards, provides adjusted profit metrics “to further increase the understanding of our business” and has “a solid balance sheet”. It added that personnel costs paid “to a handful of selling shareholders in addition to the market-based salary they earn should not be viewed as a long-term reasonable reimbursement”.

Bankers follow the money to the Middle East

The Gulf’s oil powers have long been courted for their ability to calm global oil markets and invest surplus hydrocarbon receipts abroad.

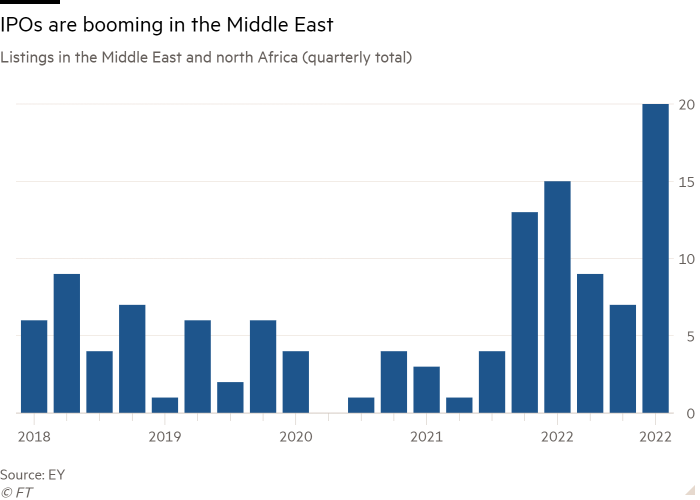

But there’s another reason luring bankers to the marble-paved walkways of Dubai’s financial centre: a growing pipeline of regional initial public offerings in recent years.

The IPO and private deals frenzy has been fuelled by a number of things, bankers told the FT’s Simeon Kerr, including financial regulatory reform, a privatisation push, greater political stability and recovering oil and gas prices.

The bumper $29bn IPO of energy giant Saudi Aramco in 2019 kick-started the trend, with other state-related enterprises across the Gulf following suit. Abu Dhabi’s national oil company has spun off various business units, and Dubai’s state utility went public last year.

EY says the 51 issuances across the wider region last year was a record, raising $22bn, a 179 per cent increase on 2021, with a healthy pipeline ahead.

Bankers hope that state-related IPOs will now be followed by other private-sector businesses. This month’s IPO of Al Ansari Financial Services, a Dubai-based exchange house, could presage other family-owned firms coming to market.

But there are also warning signs surrounding elements of the frenetic activity in Abu Dhabi, the UAE’s capital, where companies linked to the national security adviser, Sheikh Tahnoon bin Zayed al-Nahyan, have supercharged growth.

His International Holding Company and related firms account for about half the market capitalisation of the entire stock exchange.

With bankers left mystified about the apparent dissonance between these groups’ economic fundamentals and their valuations, analysts are concerned about transparency in this increasingly important market for foreign players.

Job moves

-

Diageo has named Debra Crew — who was recently appointed chief operating officer — as chief executive. She replaces Ivan Menezes, who’s stepping down after 10 years at the helm.

-

Robin Barr, the head of the family dynasty behind Scottish soft drink Irn-Bru, is leaving the board of the group that makes the beverage after 58 years.

-

Cellnex chair Bertrand Boudewijn Kan has stepped down after the mobile towers group became the target of a campaign by billionaire hedge fund manager Chris Hohn. He will be replaced by board member Anne Bouverot.

-

Three Goldman Sachs partners are leaving the firm amid a dealmaking slowdown, Bloomberg reports.

-

Liontrust non-executive directors Emma Howard Boyd and Quintin Price have quit over a row about the chair’s 12-year tenure on the board.

-

London-based financial communications firm Camarco has been acquired by advisory firm APCO Worldwide, for a price tag of about £20mn, according to a person familiar with the matter, resulting in more than 40 Camarco staff joining its new owner.

Smart reads

Flight risk The disappearance of China Renaissance dealmaker Bao Fan has placed a global spotlight on the potential fleeing of China’s wealthy entrepreneurs, the FT’s former chief financial correspondent Henny Sender writes.

The house always wins Stake.com is gambling’s newest power player, using celebrity partners such as Drake to pursue its ideal target: “a young, male sports enthusiast with a very high tolerance for risk”, the FT reports.

Postmortem One of Wall Street’s most lauded M&A whisperers, Michael Klein, has lost out on the deal of a lifetime at Credit Suisse. Bloomberg examines the fallout.

News round-up

Top ECB official claims CDS market ‘contaminates’ bank stocks and deposit flows (FT)

Big debt investors dealt blow in mattress maker bankruptcy ruling (FT)

Alibaba to split into six in radical overhaul (FT)

Apple launches ‘buy now, pay later’ service in the US (FT)

ECB approves UniCredit’s share buyback plan ahead of AGM (FT)

BP teams up with Abu Dhabi oil group in bid for Israel’s NewMed (FT)

German antitrust watchdog probes Microsoft’s market power (FT)

Activist investors smoke out South Korea’s undervalued companies (FT)

Recommended newsletters for you

[ad_2]

Source link