[ad_1]

agnormark

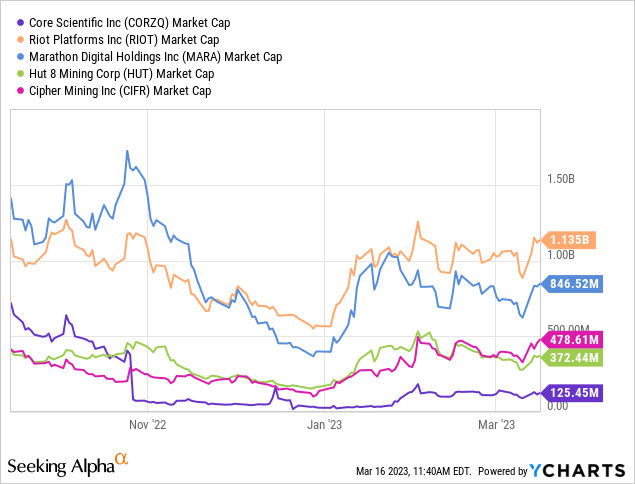

The quickest rising public Bitcoin (BTC-USD) miner by manufacturing capability is at present Cipher Mining (NASDAQ:CIFR). The corporate has shortly scaled a mining operation during the last a number of months and is now one of many leaders within the public Bitcoin mining house by a number of key metrics. Cipher Mining grew to become a public firm by means of a SPAC merger with Good Works Acquisition Corp again in 2021. On the time, the corporate had a valuation of $2 billion with plans to make use of money from the merger to develop out a Bitcoin mining operation.

Having now been 2 years because the SPAC merger was introduced and over a 12 months because it was accomplished, Cipher has grow to be the third largest Bitcoin miner by market cap – although with a 75% discount to the unique $2 billion merger announcement valuation. On this article, we’ll have a look at the manufacturing development, treasury technique, and level out some issues to keep watch over.

Manufacturing & Capability Steering

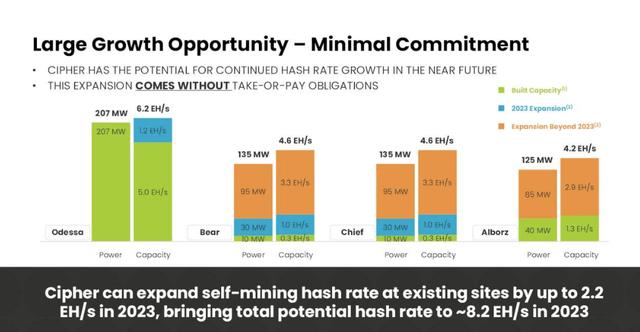

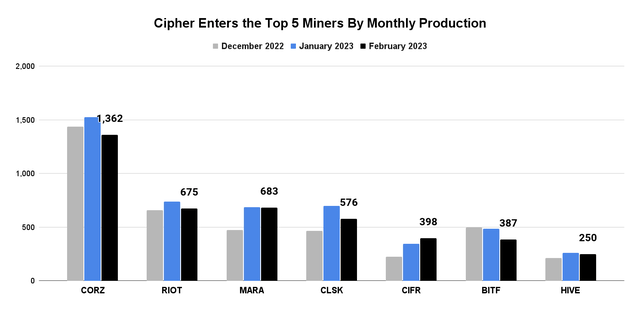

As talked about, Cipher Mining has in a short time scaled a mining operation over the previous few months. Capability on the finish of February was 5.2 EH/s. This speedy improve in mining capability since November has propelled Cipher into the highest 5 public miners by manufacturing capability as of final month:

BTC Manufacturing Development (Firm filings)

With 398 Bitcoin produced within the month of February, Cipher now produces extra Bitcoin every month than Bitfarms (BITF), HIVE Blockchain (HIVE), and Hut 8 Mining (HUT). Whereas EH/s development has been sturdy since getting the corporate’s Odessa website on-line, Cipher has guided a considerably conservative strategy to scaling from right here relative to what has been introduced on within the final 3 months.

Cipher anticipates a complete potential hash price of 8.2 EH/S this 12 months, which might come primarily from its Bear and Chief working websites. Within the earnings name earlier this week, CEO Tyler Web page gave perception into the strategic strategy going ahead and supplied rationale for why the corporate hasn’t jumped on sooner growth regardless of machine acquisition alternatives being accessible:

Nevertheless, given risky market situations, we need to be aware of not overextending ourselves. So we are going to proceed to judge growth in mild of market situations. This near-term alternative for development with sturdy built-in unit economics however with out operational spending commitments is one which few if any of our rivals have and exhibit Cipher’s continued strategy to search for low-risk alternatives.

A number of the alternatives the corporate says it has declined to maneuver on concerned credit score phrases that had been unfavorable and acquisitions of companies which have basic flaws.

Treasury Technique

One of many issues that I have a look at every month is the online change within the Bitcoin balances for every publicly traded miner. Whereas promoting down BTC positions is not at all times indicative of an organization that’s in hassle financially, I do view ‘stacking’ as a constructive signal. Within the occasion that BTC goes up considerably, the worth of the belongings the corporate has in treasury will improve as properly and people spikes in BTC worth can be utilized to opportunistically elevate additional cash with out diluting shareholders.

| BTC in Treasury | January 2023 | February 2023 | Mo/Mo |

|---|---|---|---|

| Cipher Mining | 424 | 465 | 9.7% |

| Riot Platforms (RIOT) | 6,978 | 7,058 | 1.1% |

| Bitfarms | 405 | 405 | 0.0% |

| Marathon Digital (MARA) | 11,418 | 11,392 | -0.2% |

| Hut 8 | 9,274 | 9,242 | -0.3% |

| HIVE Blockchain | 2,430 | 2,365 | -2.7% |

| Argo Blockchain (ARBK) | 115 | 101 | -12.2% |

| Bit Digital (BTBT) | 971 | 697 | -28.2% |

| CleanSpark (CLSK) | 301 | 100 | -66.8% |

Supply: Firm releases

In February, Cipher had the biggest proportion change in BTC HODL – growing practically 10% from January. The nominal improve was simply 40 Bitcoin, or about 10% of Cipher’s February manufacturing, which signifies a balanced strategy to BTC treasury as the corporate is promoting many of the month-to-month manufacturing to pay bills whereas holding some for worth improve optionality. This optionality is essential as a result of the corporate may doubtlessly have to lift money quickly and has a pair completely different levers it will possibly pull to usher in contemporary cash.

Dangers to Take into account

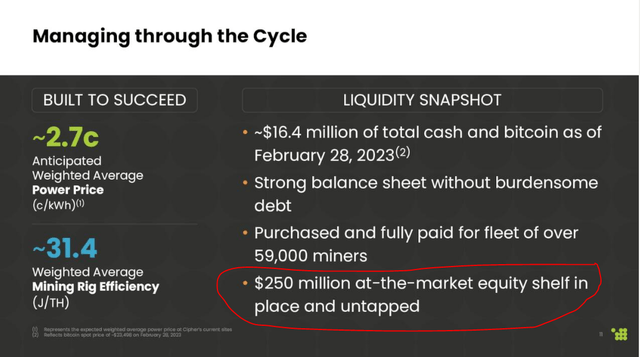

Within the firm’s earnings report from earlier this week, it disclosed a little bit beneath $12 million on money on the finish of December, although that determine has elevated to $16.4 million on the finish of February as Cipher has been ready to make use of BTC gross sales to fund operations. Within the occasion the corporate wants funding, which I view as possible if the worth of Bitcoin reverses decrease, there’s a $250 million shelf that Cipher has but to attract from:

Through the convention name, Web page was fairly clear that the shelf could be tapped if it made sense to take action from an operational growth perspective. The instance the CEO gave concerned the fast use of fairness providing money to scale capability at Odessa.

Nevertheless, the 2023 financial viability of Bitcoin mining continues to be up within the air and will depend on the worth of Bitcoin to a major diploma. If the worth of Bitcoin does certainly fall again down beneath the $20k space for a sustained time frame, Cipher could have to hit the shelf for opex given the $41.1 million complete working expenditure during the last half 12 months. Cipher’s SG&A expense was greater than six instances income in This fall-22 and CFO Ed Farrell indicated on the decision that the run price from the second half of 2022 may very well be an inexpensive expectation for 2023. This run price might be high quality at $25k BTC, it is a lot much less high quality at $20k BTC.

And this will get us to the bills. Cipher reported manufacturing prices of $5,143 in electrical energy per Bitcoin at its Alborz website and $6,293 in electrical energy per Bitcoin at its Bear and Chief websites. That is excellent in comparison with friends, however we do not have readability on what the electrical energy value is at Odessa and that is the place nearly all of the mining has taken place to date this 12 months:

| Website | BTC Mined YTD | Cipher Owns |

|---|---|---|

| Odessa | 770 | 770 |

| Alborz | 186 | 91 |

| Bear & Chief | 111 | 54 |

Supply: Cipher Mining

I feel it is also essential to say that Alborz, Bear, and Chief are joint ventures with WindHQ LLC and Cipher owns roughly half of the Bitcoins which have been mined at these websites 12 months so far. This implies 84% of Cipher’s Bitcoin that has been mined in 2023 has come from Odessa and that is the positioning that we do not but have electrical expense readability.

Abstract

Whereas I feel Cipher is fascinating, I am ready a bit earlier than I take into account opening a place. I am a bit involved by the corporate’s non-operating bills and I need to see what that appears like following 1 / 4 with operations which are extra reflective of present manufacturing ranges. There is no such thing as a doubt the electrical energy prices the corporate disclosed at Alborz, Bear, and Chief could be industry-leading however I nonetheless assume it is a little bit too early to be on this one. I’d solely be promoting CIFR shares in the event you assume the worth of Bitcoin is about to go down. Wanting that, Cipher inventory is a maintain.

[ad_2]

Source link