[ad_1]

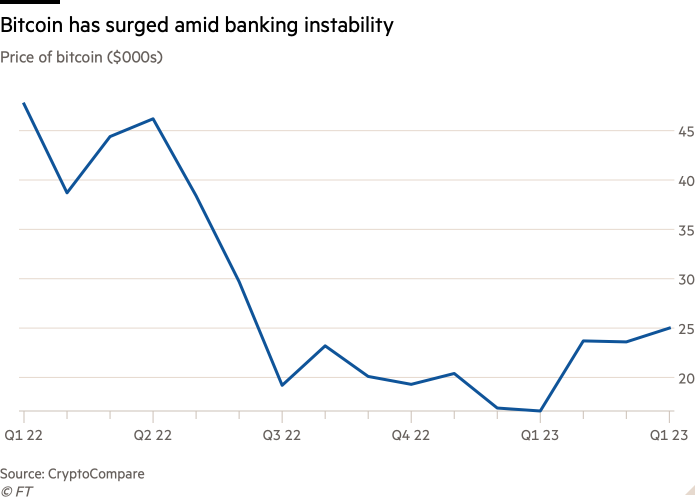

Bitcoin hit its highest stage in 9 months on Friday as crypto merchants shifted funds away from banks and warmed to quickly shifting rate of interest expectations.

The dollar-denominated value of the unique and largest crypto coin has surged greater than 30 per cent this week to greater than $27,000, its highest level because the onset of the disaster of confidence that engulfed the market final summer season. The second-largest token, ether, has risen a fifth in the identical interval.

Patrons have emerged after per week of acute turbulence for the world’s banking business on either side of the Atlantic as traders fret over the valuations of smaller banks’ bond portfolios and enterprise fashions.

The US authorities and enormous banks stepped in to regular the system whereas the Swiss central financial institution offered a $54bn emergency backstop for lender Credit score Suisse. The uncertainty has prompted hypothesis that the Federal Reserve and European Central Financial institution will pause their plans to lift rates of interest aggressively to curb lingering inflation.

For the previous 18 months the value of bitcoin, as soon as touted as a hedge towards inflation, has typically been correlated with conventional inventory indices such because the S&P 500 and the Nasdaq Composite, and delicate to merchants’ expectations on rates of interest.

Merchants level out that when traders have fears over crypto costs, they transfer funds into financial institution deposits and stablecoins. When there are issues over banks, they quickly transfer to buying tokens.

“Fears over the soundness of the banking system, together with declining actual rates of interest, creates an excellent setting for bitcoin to rebound as a result of it’s seen by some traders as a hedge towards systemic dangers,” stated Ilan Solot, co-head of digital belongings at London dealer Marex.

The market restoration has additionally been bolstered after reassurances from US authorities that deposits on the failed Silicon Valley Financial institution could be protected.

Circle, operator of the crypto market’s second largest stablecoin USDC, admitted it had $3.3bn trapped at SVB, triggering a short lived decline within the worth of the stablecoin to 88 cents.

Stablecoins act as a conduit between crypto and sovereign cash and are supposed to take care of their worth one-for-one towards the greenback always.

Regardless of a short-term restoration for digital belongings, turbulence within the banking sector casts doubt over the crypto business’s long-term footprint within the US.

Along with Silvergate and Signature, SVB was one in every of a tripartite of crypto-friendly banks that met their demise in current days. Their failures have sparked fears amongst business supporters that the US is de-banking the crypto business.

Republican congressman Tom Emmer on Wednesday wrote a letter to the Federal Deposit Insurance coverage Company, arguing that the regulator was purposely in search of to restrict the banking business’s publicity to crypto markets.

“Lots of people already perceive the business is rotating away from the US, so in some ways, America’s crypto clampdown has been priced in by the market,” Solot stated.

[ad_2]

Source link