[ad_1]

On-chain information exhibits the full variety of Bitcoin addresses has seen fast development not too long ago, an indication that adoption could also be accelerating.

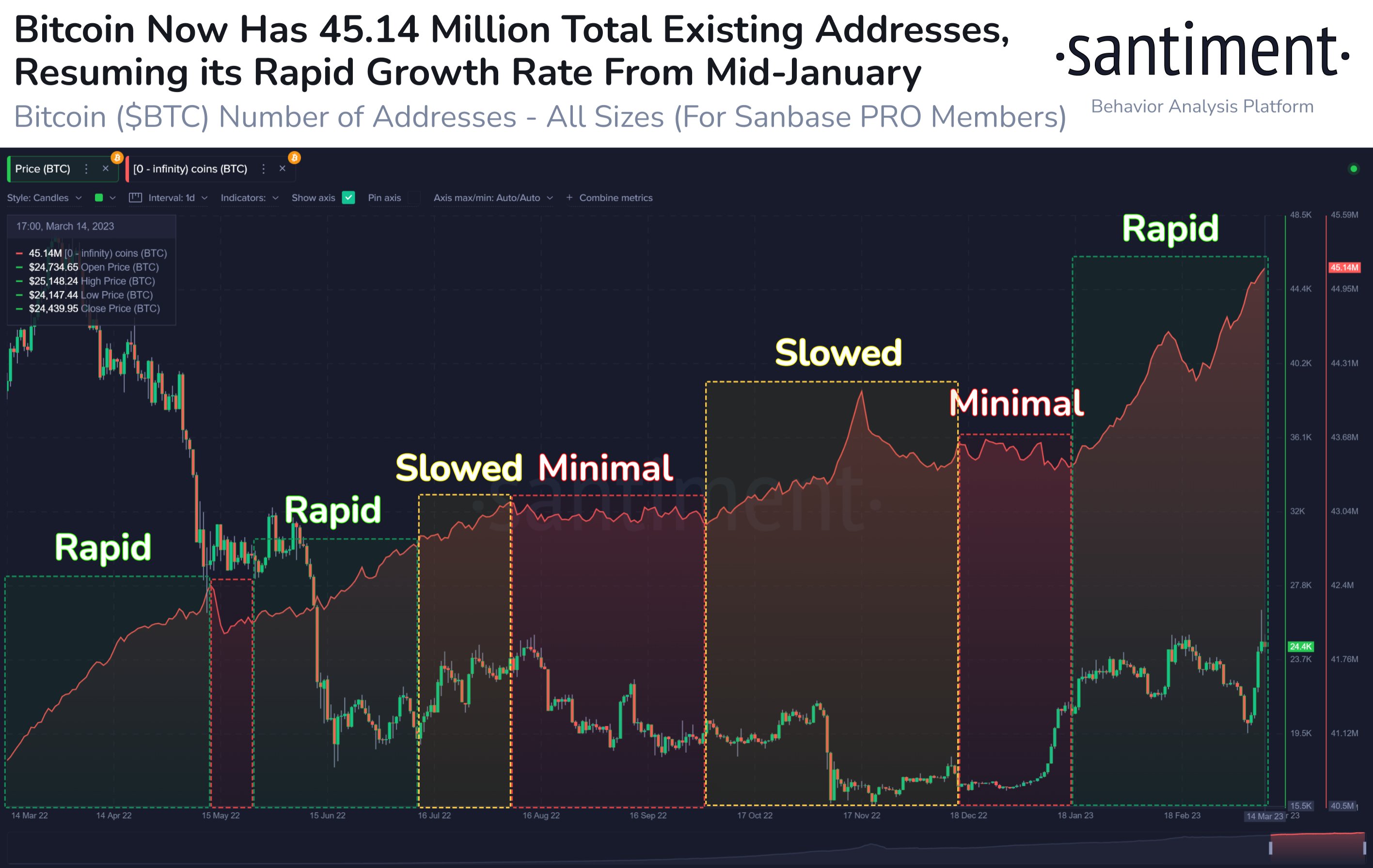

Bitcoin Complete Addresses Have Grown By 3.95% Throughout The Final Two Months

In keeping with information from the on-chain analytics agency Santiment, BTC now has a complete of 45.14 million addresses. The related indicator right here is the “BTC Supply Distribution,” which tells us which pockets teams out there embody what number of addresses proper now.

The pockets teams right here seek advice from cohorts divided primarily based on the full variety of cash they’re at the moment holding. As an illustration, the 1-10 cash group consists of all addresses which can be carrying a stability between 1 and 10 BTC in the meanwhile.

If the Bitcoin Provide Distribution metric is utilized to this group, then it could measure the full variety of such wallets out there which can be satisfying this situation.

Since within the present case, the amount of curiosity is the full variety of addresses throughout your complete community, no matter pockets quantity, Santiment has merely merged all the prevailing deal with cohorts to indicate their mixed Provide Distribution.

Here’s a chart that exhibits the pattern on this indicator over the previous 12 months:

Seems to be like the worth of this metric has quickly gone up in current days | Supply: Santiment on Twitter

As displayed within the above graph, the full variety of addresses holding between 0 and infinite BTC (that’s, a spread that covers wallets of all sizes out there) had been observing some sharp development round a 12 months in the past, when the bear market was solely simply setting in.

This implies that new addresses had been nonetheless being created at a fast tempo again then. At any time when this type of pattern is seen, it signifies that numerous new customers are presumably becoming a member of the community, and thus the adoption of the cryptocurrency is selecting up.

Nevertheless, when crashes like these triggered by the LUNA collapse and 3AC bankruptcy shook the market and a bearish transition occurred in full swing, the expansion slowed down and the indicator even encountered giant stretches of sideways motion.

Often, traders discover consolidating markets boring, so exercise slows down throughout bear markets when the worth is exhibiting such a pattern. Naturally, the community has a tough time attracting new customers in these situations, so the rise within the whole addresses additionally plateaus.

Quite the opposite, unstable strikes are thrilling to holders and thus, convey plenty of consideration to the blockchain, which finally ends up pulling in new customers to the cryptocurrency. An instance of that is clearly seen in the course of the FTX crash within the chart, the place the addresses abruptly jumped in a interval of in any other case gradual development.

With the most recent Bitcoin rally over the past couple of months, the indicator’s worth has as soon as once more began exhibiting a pointy rise, implying that plenty of new customers are being interested in the asset now.

On this interval alone, the full variety of addresses has grown by virtually 4%, a notable enhance in such a brief period of time. Extra adoption is usually a optimistic signal for any coin, because it supplies a sustainable base for long-term development.

BTC Value

On the time of writing, Bitcoin is buying and selling round $24,900, up 15% within the final week.

BTC has stumbled because the rise above $26,000 | Supply: BTCUSD on TradingView

Featured picture from André François McKenzie on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link