[ad_1]

Information from Glassnode has revealed that the Bitcoin provide is step by step dispersing from whales and exchanges to smaller palms with time.

Bitcoin Provide Is Slowly Exhibiting Dispersal In direction of Smaller Holders

In keeping with a brand new report revealed by the on-chain analytics agency Glassnode, buyers holding lower than 50 BTC have not too long ago absorbed probably the most vital quantity of cash.

One thing that BTC critics typically maintain up in opposition to the cryptocurrency is the distribution of the provision. They argue that the provision is closely concentrated round a number of whales, offering the existence of enormous wallets as proof.

To test whether or not this reality holds, Glassnode studied the provision distribution of the market by breaking down buyers into completely different cohorts. These holder teams are outlined by the analytics agency as follows: shrimp (<1 BTC), crab (1-10 BTC), octopus (10-50 BTC), fish (50-100 BTC), dolphin (100-500 BTC), shark (500-1,000 BTC), whale (1,000-5,000 BTC), and humpback (>5,000 BTC).

The provides held by exchanges and miners are additionally thought of for the classification. A related indicator right here is the “yearly absorption charges,” which measures the yearly change within the provides of the completely different cohorts as a proportion of the entire quantity of issued cash (that’s, the recent provide miners produce).

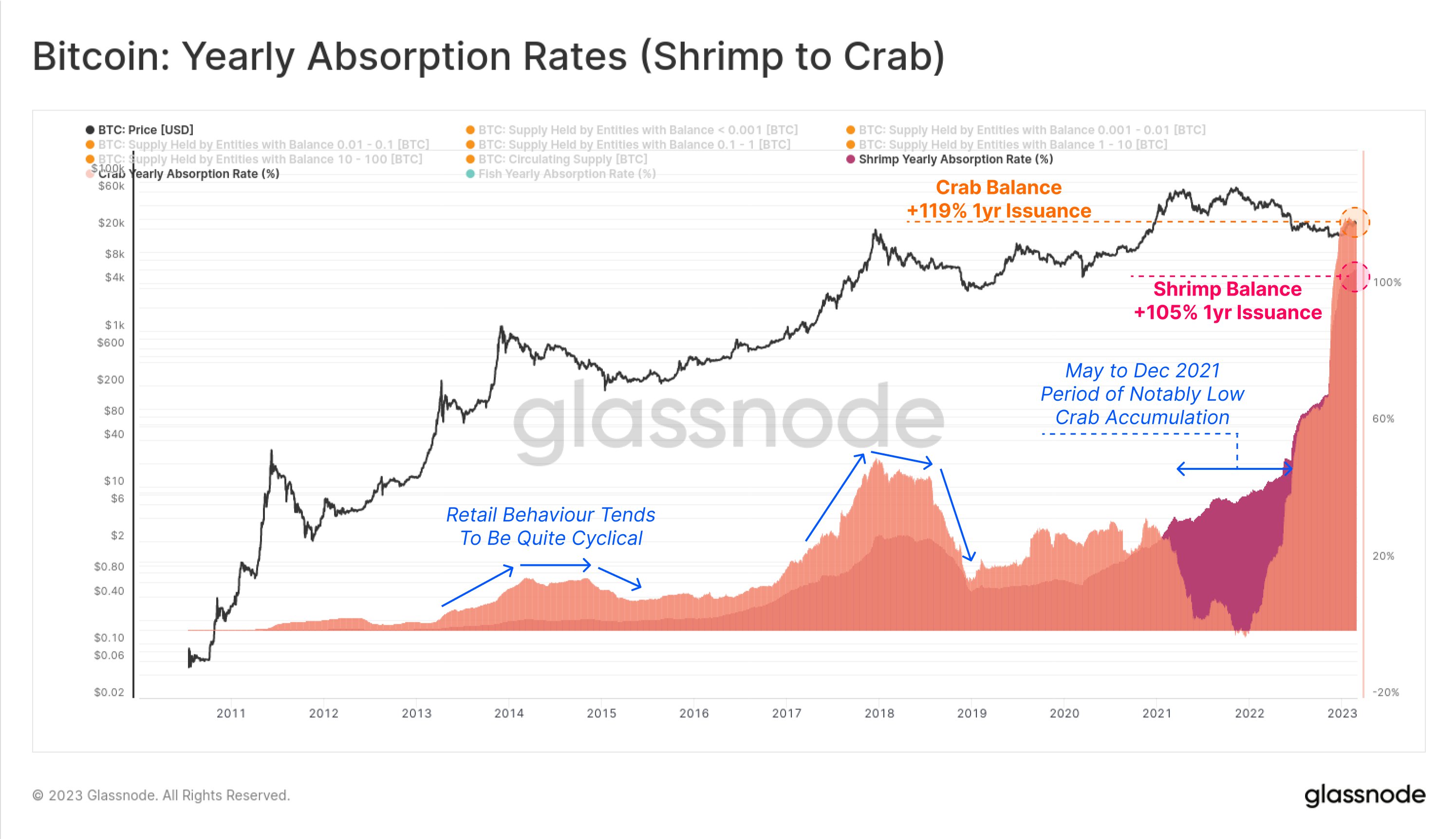

First, here’s a chart that reveals how the yearly absorption charges of shrimps and crabs have modified over the lifetime of the cryptocurrency:

Seems just like the metrics have proven excessive values in current days | Supply: Glassnode

As displayed within the above graph, the Bitcoin shrimps and crabs have not too long ago been observing all-time excessive absorption charges of about 105% and 119%, respectively.

Because of this the provision held by the shrimps has grown by 105% of what miners produced throughout the previous yr, whereas the crabs have added an much more vital proportion at 119%.

Even when the BTC miners launched 100% of what they mined the previous yr, these cohorts nonetheless have absorbed an additional provide. The place did these further cash come from? The absorption charges of the opposite cohorts would possibly maintain the reply to it.

The absorption charges of the sharks and whales | Supply: Glassnode

From the chart, it’s obvious that sharks have had a barely constructive yearly absorption charge not too long ago. Nonetheless, the whales have seen a damaging indicator worth, implying that this cohort has been distributing throughout the previous yr.

The mixed change within the provides of each these cohorts can be a internet damaging because the distribution of the whales far outweighs regardless of the sharks gathered throughout this era.

Information for the absorption charges of the exchanges additionally reveals damaging values, implying that these platforms have launched many cash into circulation.

The extremely damaging absorption charges proven by exchanges | Supply: Glassnode

The smaller Bitcoin entities have been choosing up the cash distributed by these cohorts. Apparently, whereas this shift within the provide has been excessive not too long ago, it’s a development that has held up all through the years.

Because the chart under highlights, the provision held by smaller entities (with lower than 50 BTC) has step by step gained dominance all through the cryptocurrency’s historical past.

The rise of the shrimps and different small buyers | Supply: Glassnode

Although the share of the whales could have been fairly vital in some unspecified time in the future, at the moment, their holdings have shrunk down to simply 34.4% of all the circulating provide, which, though nonetheless sizeable, is far lesser than the 62.7% across the time of the primary halving, the occasions that reduce downs BTC mining rewards in half, again in 2012.

The gradual provide shift additionally appears to be in direction of the smallest entities, that are the retail buyers. This can be a signal that cryptocurrency is turning into extra dispersed as adoption will increase.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $24,300, up 10% within the final week.

BTC observes a pullback | Supply: BTCUSD on TradingView

Featured picture from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link