[ad_1]

- BTC’s value jumps by nearly 10% within the final 24 hours.

- That is as a result of determination by U.S. regulators to guard all buyer deposits at failed Silicon Valley Financial institution (SIVB).

Following the decision by the U.S. Division of the Treasury, Federal Reserve, and Federal Deposit Insurance coverage Company (FDIC) to revive all buyer deposits at failed Silicon Valley Financial institution (SVB), Bitcoin’s [BTC] value rallied by nearly 10% within the final 24 hours.

On 11 March, BTC’s value suffered a big drop beneath $20,000 following a mass withdrawal of funds by clients of SVB.

On account of this, the California Division of Monetary Safety and Innovation shut down the financial institution on the identical day. This led to the de-pegging of varied stablecoins and different related cryptocurrencies.

Learn Bitcoin [BTC] Price Prediction 2023-24

Improved sentiments, nevertheless, returned to the market as Federal regulators, in a joint assertion on 12 March, introduced the approval of “actions enabling the FDIC to finish actions in a fashion that absolutely protects all depositors” on the failed financial institution.

Merchants flock to the BTC market

Exchanging palms at $22,422.56 at press time and with a 9% leap in value within the final 24 hours, BTC logged a corresponding hike in buying and selling quantity throughout the identical interval.

Per knowledge from CoinMarketCap, the coin’s buying and selling quantity was up by 40%. A leap in an asset’s buying and selling quantity with a value rally to indicate for it’s taken as a bullish signal that signifies improved constructive sentiment and continuation of the uptrend.

Knowledge from Santiment confirmed the constructive sentiment that lingered within the BTC market at press time. The coin’s weighted sentiment was a constructive 7.114% on the time of writing, suggesting that traders believed within the continued development of the asset’s value.

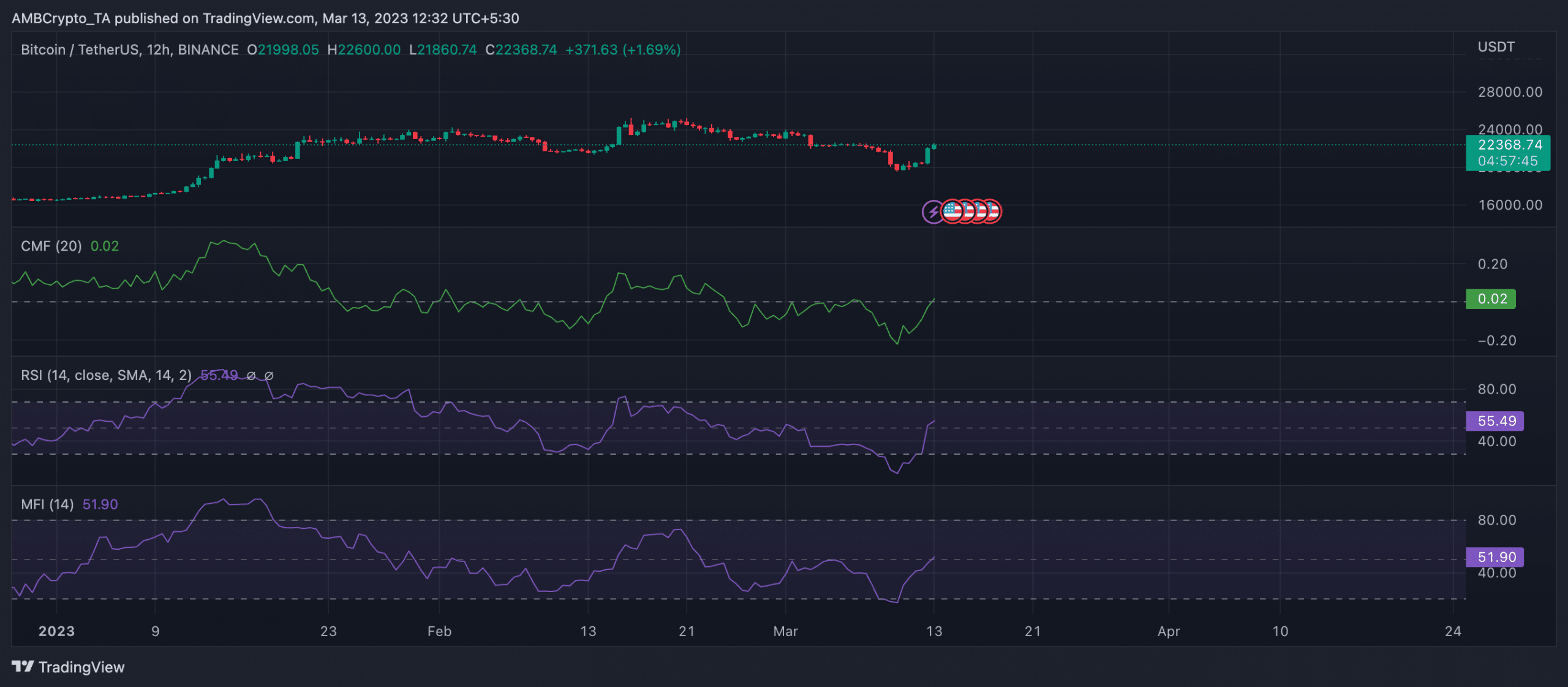

Additional, BTC’s value motion assessed on a 12-hour chart revealed a sample of rising coin accumulation. Key momentum indicators such because the Relative Energy Index (RSI) and the Cash Move Index (MFI) rested above their impartial strains in uptrend positions.

This steered that coin accumulation exceeded the distribution at press time. BTC’s RSI was 55.49, whereas its MFI was 51.90.

Likewise, its Chaikin Cash Move (CMF) reclaimed its spot on the constructive territory and posted a worth of 0.02 at press time. A constructive CMF worth is a bullish signal that hints at elevated liquidity wanted to drive up the worth of an asset.

Is your portfolio inexperienced? Take a look at the Bitcoin Profit Calculator

Be at alert

In the meantime, pseudonymous CryptoQuant analyst Crazzy Blockk assessed BTC’s Unrealized Revenue/Loss and located that the metric’s subsequent course would decide whether or not or not the BTC market would endure one other capitulation.

Relating to the Unrealized Revenue/Loss metric, a worth above zero signifies that the majority traders are in revenue, whereas a worth beneath zero implies a loss.

Within the present market, “after two heavy capitulation phases within the BTC market, the worth is testing stage 0 of this metric,” Crazzy Blockk famous.

In accordance with the analyst:

“If the bitcoin value can keep this stage and the profitability of bitcoins in holders’ pockets start to rise, the restoration part will occur.on this case, the bitcoin value may rise once more. If the online unrealized Revenue/Loss metric, primarily based on the holders’ actual worth, decreases repeatedly, there will likely be a chance of a 3rd capitulation part or one other heavy ache out there.”

[ad_2]

Source link